Ecommerce in industrial distribution: The maturity divide

A data-driven analysis of digital commerce performance from the Distribution Strategy Group

It won’t surprise anybody that distributors are selling more online each year. But two results from our recent survey of 320 industrial distributors may come as a surprise — and point the way forward for distributors lagging behind online.

The first surprise is that it’s people, not digital marketing channels like search or email, that are most effective in driving sales to distributor e-commerce sites.

The second is that product data is crucial for online success.

Taken together, those two results underscore that winning in e-commerce isn’t just about investing in technology. It’s also about adopting policies, including compensation policies, that incent employees to encourage customers to buy online.

The other big takeaway from this survey is this: Companies that are doing ecommerce well are lengthening their lead on competitors who aren’t. With customers, especially younger buyers, increasingly buying online, those falling behind will inevitably lose market share.

A closer look at the survey data shows what distinguishes the leaders from the laggards in e-commerce today and can help distribution executives focus on the digital strategies that will work for their businesses.

E-commerce Growth Is Real—but Uneven

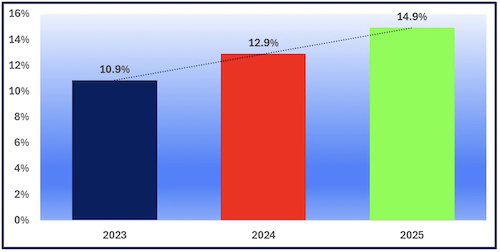

An effective digital strategy is crucial because distributors derive a growing portion of their revenue online, as Distribution Strategy Group’s annual survey shows. On average, respondents expected that e-commerce would account for 14.9% of their revenue in 2025, compared to 12.9% in 2024 and 10.9% in 2023.

|

| Figure 1: Ecommerce Revenue as Percentage of Total Sales, 2023-2025 |

That increase is a big deal. With U.S. wholesalers and distributors selling more than $8 trillion each year, a shift of four percentage points would suggest more than $300 billion in sales shifting to e-commerce from offline channels in just two years.

In reality, the shift is likely not that great. Distributors that take our surveys tend to be more digitally engaged than those that do not, and the survey no doubt overstates e-commerce adoption across all industrial distributors.

That said, it’s clear that distributors are selling more online. What’s more, that growth is increasingly concentrated at the top.

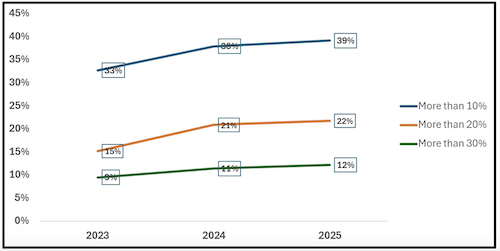

Distributors reporting more than 30% e-commerce penetration grew from 9% of survey respondents in 2023 to 12% in 2025. Even more telling, their percentage of revenue from ecommerce shot up from an average of 33% in 2023 to 39% in 2025. E-commerce growth was much slower for the other distributors responding to the survey.

|

| Figure 2: Percentage of Distributors Exceeding Ecommerce Penetration Thresholds, 2023-2025 |

The growth of this high-penetration group suggests the market is bifurcating between digital leaders who keep advancing capabilities and capturing market share, and laggards who struggle to develop the foundational capabilities required for competitive digital commerce.

Why Industrial Distribution Faces a Higher Bar

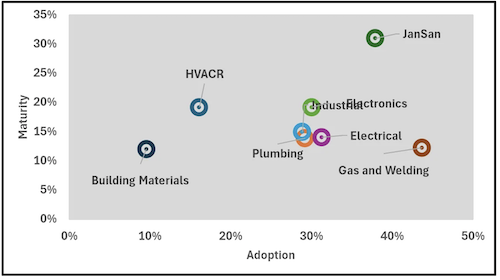

It’s important to note that this was a survey of industrial distributors, a category of companies that face special challenges in selling online. Unlike electrical, plumbing, or building materials distribution—where products are often standardized—industrial distributors manage vast catalogs of highly technical products.

A typical industrial distributor may carry 50,000 to 300,000 active SKUs, many requiring detailed specifications, engineering drawings, safety documentation, compliance certifications, and application guidance. Buying decisions are often tied to customer-specific pricing, delivery schedules, consignment arrangements, and long-standing service relationships.

That complexity helps explain why industrial e-commerce adoption has historically lagged other distribution sectors.

|

| Figure 3: Ecommerce Adoption versus Maturity by Distribution Sector |

At the same time, it highlights why industrial distributors that do sell effectively online have an edge on competitors.

What do e-commerce leaders among industrial distributors do differently? A look at the survey data reveals differences in goals, strategy and performance.

Efficiency, Not Volume, Separates Leaders

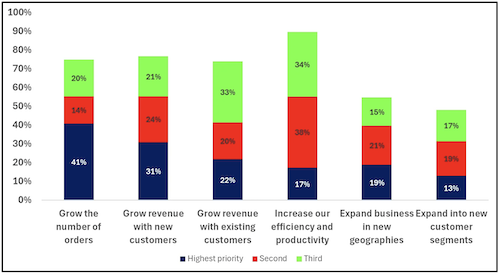

Industrial distributors demonstrate clear hierarchies in both financial and operational priorities driving e-commerce investment decisions. Asked about their top ecommerce financial objective, the largest number (41%) chose growing order volume. But the data shows that volume alone does not produce strong outcomes.

|

| Figure 4: Ecommerce Financial Priority Rankings by Importance Level |

Distributors that prioritize efficiency and productivity—ranked highest by 34% of respondents—consistently outperform peers on customer experience and satisfaction.

Among those distributors, 89% report high satisfaction with ease of use and overall customer experience, compared with an industry average of 57%.

|

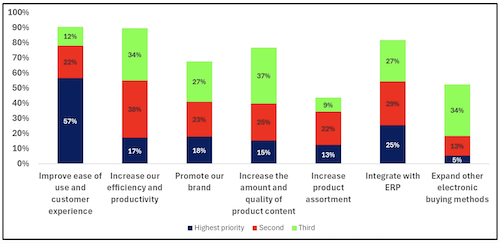

| Figure 5: Ecommerce Operational Priority Rankings by Importance Level |

That 32-point gap underscores a central finding: In industrial distribution, customer adoption follows operational reliability. Buyers will not self-serve if digital transactions introduce friction, errors, or uncertainty.

Product Data: The Primary Constraint

No factor correlates more strongly with e-commerce performance than product data quality.

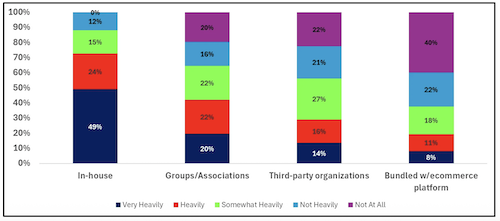

Three quarters (73%) of high-performing distributors rely heavily on in-house product data management, compared with 49% overall. Distributors with 90% or greater product data completeness report ecommerce ROI satisfaction rates 37 percentage points higher than those with less than 50% completeness.

|

| Figure 6: Product Data Source Reliance Levels by Data Management Approach |

That reflects rising customer expectations that they will be able to find the product information they seek. Five years ago, distributors could succeed with strong data on top-selling items and thinner coverage elsewhere. Today, customers expect complete, accurate, and current data across much broader portions of the catalogue, including dozens of attributes per product, along with images and documentation.

Incomplete or outdated data pushes customers back to phone calls and emails, increases order errors, and limits advanced capabilities such as guided selling, recommendations, and automated replenishment. Product data is no longer a supporting asset — it is the foundation of scalable digital commerce.

Integration Drives ROI

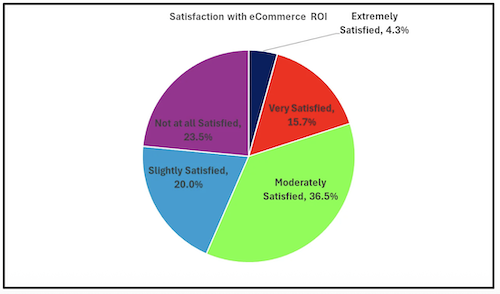

ERP integration is another major factor in digital success.

Among distributors with full ERP integration, 71% report high satisfaction with e-commerce ROI, compared with 35% among those with limited integration.

|

| Figure 7: Satisfaction with Ecommerce Return on Investment |

Real-time pricing, inventory visibility, and order status are essential for e-commerce success. That requires a smooth flow of real-time data between website and ERP.

Leading distributors have moved most routine orders into straight-through processing, lowering labor costs while improving speed and accuracy. Laggards remain stuck in hybrid workflows that increase costs and deliver inconsistent customer experiences.

Adoption Remains Sales-Led

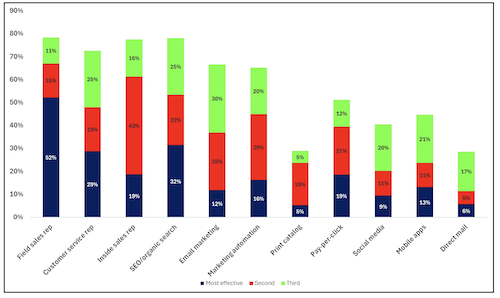

One notable insight from the survey is that, despite years of digital marketing investment, ecommerce adoption in industrial distribution remains fundamentally relationship-driven.

Field sales representatives are cited as the most effective driver of e-commerce adoption by 52% of distributors, followed by customer service and inside sales teams. Digital channels such as SEO and email play supporting roles but rarely lead adoption on their own.

|

| Figure 8: Marketing Channel Effectiveness Rankings for Driving Ecommerce Demand |

For industrial supplies distributors, the implication is clear: E-commerce does not replace the sales force. It works when sales teams actively position digital channels as the default for routine, repeat, and replenishment transactions—freeing time for higher-value technical and consultative work.

The Maturity Divide

Top-performing industrial distributors demonstrate consistent patterns: They typically achieve ecommerce penetration exceeding 20% of total revenue, report high satisfaction with ROI outcomes (65%+ extremely or very satisfied), and maintain product data completeness above 90% of SKU base.

An analysis of the survey data shows there are four distinct levels of digital maturity among industrial distributors:

- Foundational maturity (≈25%): Basic e-commerce presence, limited ERP integration, product data completeness below 50%, and e-commerce revenue under 8% of total sales. ROI satisfaction is low, and manual intervention remains common.

- Developing maturity (≈40%): Functional platforms with partial integration and 50–75% product data completeness. Digital revenue typically ranges from 8–15%, with moderate ROI satisfaction.

- Advanced maturity (≈25%): Comprehensive integration, 75–90% product data completeness, and 15–25% of revenue transacted digitally. Straight-through processing is common for routine orders.

- Leading maturity (≈10%): Best-in-class capabilities, more than 90% product data completeness, full ERP integration, and over 25% of total revenue flowing through e-commerce. ROI satisfaction exceeds 65%.

There are reasons why many distributors struggle to gain traction in ecommerce—and reasons for optimism about their ability to catch up.

Democratization Is Expanding the Field

Here’s the good news: E-commerce is more accessible than ever to companies of all sizes.

Platform costs have fallen sharply while functionality has improved. The number of viable e-commerce platforms serving industrial distributors has expanded from a handful a decade ago to dozens today. At the same time, distributor organizations have gained experience in selling online. Many digital leaders are now on their second or third implementation, with clearer expectations and stronger execution discipline.

As a result, e-commerce success is no longer limited to the largest distributors. Smaller and mid-sized firms increasingly have access to the tools and know-how required to compete — provided they invest in the fundamentals.

Distributors that have fallen behind can make up ground — and quickly, if they make the necessary investments.

What This Means for Industrial Supplies Distributors

The research points to several conclusions:

- The maturity gap is widening, not narrowing.

- Foundational investments matter more than features.

- Middle-tier distributors face growing urgency as leaders push beyond 25–30% digital revenue share.

- Sales alignment remains critical to adoption.

- E-commerce is increasingly accessible—but execution still determines outcomes.

- E-commerce in industrial distribution is no longer an experiment. It is a competitive operating model. And the distributors that treat it that way are pulling decisively ahead.

Methodology

This research analyzes survey data collected from 320 industrial distributors between June and October 2025. The survey instrument consisted of multiple-choice questions, priority ranking exercises, and numeric response fields covering e-commerce strategic priorities, operational capabilities, technology infrastructure, marketing effectiveness, financial performance, and satisfaction metrics. Survey distribution occurred through industry association partnerships with NAHAD, NAED, and CIPH, Distribution Strategy Group's proprietary distributor contact database, and targeted outreach to industrial distributor executives. Respondents represent diverse industrial segments including fasteners, bearings, power transmission, cutting tools, safety equipment, fluid power, material handling, and MRO supplies. Analysis employs descriptive statistics, cross-tabulation, and correlation analysis to identify patterns.