Distributor M&A:

The Work Behind the Numbers

Part 1

by Scott Benfield

Mergers and acquisitions for the gobal economy are at record levels as 2014 comes to a close. Current YTD M&A activity tops $3 trillion, with the market on a pre-recession pace.1 The $5 trillion in sales distribution sector is, perennially, a hotbed of activity as the overall market rises. As the DJIA sets a record, there are many distribution firms that sell once market multiples rise.

Our work in M&A has run the gamut from pre-acquisition preparation, due diligence, general advisement, to post-acquisition review and problem-solving. In representing both buyers and sellers and spending time site consulting in operations, we often have a different perspective on what makes a successful acquisition that goes beyond traditional financial analysis.

The Stuff You Don’t See

Balance sheets, income statements, and comparative analyses using these numbers are the first place most acquirers start. Once the numbers are scrubbed, they are rationalized with things called “gut and experience.” Our problem is that “gut and experience” are many times unquantified, usually overly optimistic, and where acquisitions get into trouble. It is too often the stuff you don’t see or the work behind the numbers that makes the critical difference between a run-of-the-mill and a really great acquisition. And, it’s common for “gut and experience” to atrophy; memory of past glory is substituted for the hard work of good analysis and current research.

The numbers behind the numbers take a great deal of experience and research within the industry; financial advisers, without solid, progressive and current operating experience and research need not apply. While well-meaning, financial types too often don’t know what they don’t know, but many can spin a convincing tale otherwise. Without being too gratuitous, we strongly advise any buyer without solid and current operating experience to get guidance from inside the industry on the stuff not found on the financial statements.

Where You Sit

Strategic buyers and financial buyers are monikers that define two different investors. As the storyline goes, strategic buyers are industry insiders who acquire for the longer term. Their interest is for growth strategy. Financial buyers seek an investment for a shorter-term; usually three to five years. They make money from lenders and the acquired and often have favorable tax treatment. Our experience with both sets of buyers finds the following:

- Financial buyers demand quick performance. How they get said performance is less of a concern, as they seldom supply management. Their income is made from load fees to lenders (2% is standard), management fees, a share of the profits (often 20%), and favorable treatment on capital gains.

- Strategic buyers are typically distributors from the industry or industrial companies that have acquisitive experience. They fold the acquisition into existing operations, sell their products through the acquired entity, or offer the acquisition access to a larger market. They make money by acquiring new lines, new territories and new customers. They also typically reduce capacity in the “middle” of the organization including operations, IT, and associated personnel.

- Financial buyers, when they fail, often do so in a big way. They miss the things strategic buyers understand, including the probability that a major vendor will pull a line, the effect of poor inventory management and how easily it can get out of whack. They also commonly miss the fact that customers, especially in the B2B environment, can’t operate without a high level of trust in services like processing credits, having good technical support, or good online content.

- Strategic buyers under-perform in that they overestimate their ability to transfer an acquisition to their culture or they overestimate the attributes of their culture to add value to an acquisition. We’ve seen strategic buyers overload their operations with acquisitions and burn up profits from poor processes. We’ve also seen them overestimate their expertise in acquiring companies and improving core profit processes like pricing and purchasing. Strategic buyers can easily slip into poor returns over the long haul in that they underestimate managing the size and complexity of numerous acquired cultures. This is especially telling when they don’t have a strong operating platform and support culture before they start acquiring.

The estimation of acquisitive prowess is slanted on whether the buyer is financial or strategic. The probability of future success, from past efforts, depends on where the acquirer sits and, if gone unexamined, what they sit on.

Not all Value Streams are the Same

Value, while being defined by the customer, is mostly added by the distribution firm and represented vendors in one dominant way. The traditional value of box in-box out (BIBO) distribution is the ability of the firm to aggregate different parts and pieces for a common application while making more margin dollars than fulfillment cost on any individual transaction. But the BIBO platform is aging and costly. There are simply too many brick and mortar locations and sellers trying to differentiate commodity products. Outside entrants, exemplified by AmazonSupply, don’t have loads of brick and mortar locations and sellers. They use technology to rework the value proposition and take cost out; traditional distributors should take note.

To counteract the declining value in the BIBO platform, some distributors have moved further into the value chain with assemblies and services. However, having assemblies and services does not ensure differentiated value. Many assemblies and services are old value streams with heavy competition. They yield, nominally, better profits than BIBO offerings but are not differentiators. Value streams that provide higher shareholder returns are in creating and perpetuating products and services that the customer needs and few competitors can match. They represent organic growth; an area where many wholesalers are in decline. But the higher yielding value streams need knowledge and process to come to fruition. For the best acquisitions, acquisitive firms should look for evidence of value creation through process.

AGILE, Stage-Gate and Value

The highest return value stream are in taking existing resources and designing products and services the customer needs and where there are less desirable substitutes.2 Visually, the higher value returns are depicted in Exhibit 1. In the exhibit, quadrants 1-4 are listed as higher to lower value returns.

Exhibit 1

For instance, New Products/Services to Existing Customers are the highest value returns, followed by Existing Products/Services to New Customers. Existing Products/Services to Existing Customers are a low value return.

The driving force for value is creation of new products and services. The evidence and efficiency of new products and services is enhanced by process. There are two processes that govern product/service development: 1) Stage-Gate and 2) AGILE. Stage-Gate is an over two-decade-old process that has good success in any number of B2B companies. AGILE is a newer process. Its advantage over Stage-Gate is speed and quick failure if a new product or service is not viable. If there is no demonstration of new product and services sales, and no demonstrable evidence of a process approach, it is highly unlikely that the firm has new, higher return value streams with any consistency and impact to earnings.

Sellers and Selling

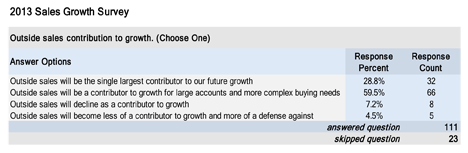

Most distribution is heavy on inside and outside sellers. The approach to these positions is well-established. Sellers are paid on margin dollars and have geographic territories that are commonly “one size fits all.” Our research finds that future growth will require wholesalers to have alternate sales force structures. Exhibit 2 is from a 2013/14 wholesaler growth survey. When asked about outside sales, some 60% of respondents selected the response “Outside sales will be a contributor to growth for large accounts and more complex buying needs.”

Exhibit 2

Many wholesalers have special sales force configurations for large customers. Solution selling, challenger sales, and consultative selling are the common monikers. Our review of many of these processes finds that, too often, efforts fall short to drive organic growth. There are limited supporting processes and process definition(s) that link to predictable growth from these efforts. They are often little more than slogans with limited substance. For specialized sales configurations and efforts, the wholesaler needs to demonstrate process that is replicable and links to new sales of products and services to existing customers. Without a correlation between an alternative sales configuration and growth, especially at larger customers, there is little reason these efforts contribute to value above and beyond existing efforts.

Technology and E-Commerce

Another clue to the higher yield value streams is the distributor’s use of technology. If the distributor has a top notch e-commerce effort with full content, over 100,000 SKUs, and uses PIM or MDM technology in managing product content, then there are likely higher value income streams.

The use of e-commerce allows the firm to reduce sales and logistic costs for commodities while giving customers the chance to secure information from full content. The higher the content SKUs, the better off the firm is. Our review of high SKU count content firms finds that they are growing at a minimum of 2x the GDP of 2.5%, whereas distributors with smaller content show only slight growth. In short, customers are moving purchases to distributors that have both rich content and a large number of online SKUs.3

It’s important to note that distributors, in order to develop large pools of quality content, have to have PIM/MDM (Product Information Management, Master Data Management) software. These software management packages, started in the early days of e-commerce, allow for codification of common product data fields and their storage and management. The ideal scenario is for firms to have product data flow from the manufacturer to the distributor’s ERP and CMS (Content Management Systems) without manual intervention. This ensures the quality of the content. Our research finds that most distributors over $1 billion in sales have PIM/MDM software, while smaller firms don’t.

The over $1 billion firms have over 100,000 full-content SKUs and their organic growth is taking share from lesser firms. Buyers of distribution firms should look for state-of-the-art e-commerce models with PIM/MDM software as well as solid sales growth in e-commerce sales. Our research finds that wholesalers have, on average, 11% of sales in e-commerce. Leading firms should be 2x to 3x this number.

Caveats and Closing

Just because a firm creates and generates higher return value streams does not mean they capture the value well or invest the profits. Top firms have good pricing practice and demonstrate plowback in new service/new product development. Too often, we find where privately held firms generate above average profits and capture the value in pricing. However, because of numerous generational shareholders, they don’t invest in new value streams. Over time, their value to buyers will diminish as shareholders under-invest profits and prefer rich dividends.

Beyond financial statement analysis, the demonstration of value is found in successful new product/new service development. There are valid processes for this development and these can be verified along with sales of new offerings. Investment in e-commerce with substantial SKU content is also a modern-day signal of better than average value creation.

While the investment horizon and objective can differ between strategic and financial buyers, superior value is generated through new products and services and investment in technology. These efforts are beyond the financial statements, but their success signals organic growth or delivering ongoing new offerings that differentiates them from the competition and translates into higher yields for the shareholder.

Benfield Consulting is a B2B supply chain firm specializing in the distribution sector. The firm engages in M&A advisory work for buyers and sellers and can be seen at www.benfieldconsulting.com. Scott Benfield, Principal, has done work for leading private equity firms, strategic buyers, and helping firms prepare for sale. He can be reached at (630) 428-9311 or scott@benfieldconsulting.com.

Benfield Consulting is a B2B supply chain firm specializing in the distribution sector. The firm engages in M&A advisory work for buyers and sellers and can be seen at www.benfieldconsulting.com. Scott Benfield, Principal, has done work for leading private equity firms, strategic buyers, and helping firms prepare for sale. He can be reached at (630) 428-9311 or scott@benfieldconsulting.com.

1 Strauss, G. “Mergers and acquisitions stay on a torrid pace.” USA Today, Nov. 17, 2014

2 Koller, T., Huyett, B., Dobbs, R. Value: The Four Cornerstones of Corporate Finance, Wiley, 2010.

3 Benfield, S. “Big Data, or Not?” Industrial Supply Newsletter, White Paper, October 2014