Channel Conflict, E-Style

by Scott Benfield

Looming Channel Conflict in the B2B Durable Goods Distribution Sector

Channel relationships between manufacturers and distributors are a perennial subject. When the relationships go bad, profits for both parties can suffer for a long period. It takes years to develop and harvest operating income from fragmented vertical markets with tens of thousands of end-user customers. There are some 50 vertical markets in the $2.5 trillion durable goods wholesale sector. Each wholesaler has hundreds, if not thousands, of active accounts. Luckily, for much of the past decade, durable goods channels have been rather docile. Outside of the growth of private brands, largely from China, distributors and manufacturers have had little to spar about. This is likely to change, however, as our research points to an impending conflict regarding the digitization of end-user transactions.

Channel relationships between manufacturers and distributors are a perennial subject. When the relationships go bad, profits for both parties can suffer for a long period. It takes years to develop and harvest operating income from fragmented vertical markets with tens of thousands of end-user customers. There are some 50 vertical markets in the $2.5 trillion durable goods wholesale sector. Each wholesaler has hundreds, if not thousands, of active accounts. Luckily, for much of the past decade, durable goods channels have been rather docile. Outside of the growth of private brands, largely from China, distributors and manufacturers have had little to spar about. This is likely to change, however, as our research points to an impending conflict regarding the digitization of end-user transactions.

The Evidence

In our sponsored research on distributor and distributor customer e-commerce1, we found that only a handful of distributors participate to any large extent in the MRO e-commerce space. Furthermore, the forecasts for e-purchases are growth faster than the sector, which portends that wholesalers that are accomplished in e-commerce will take share from those that are not.

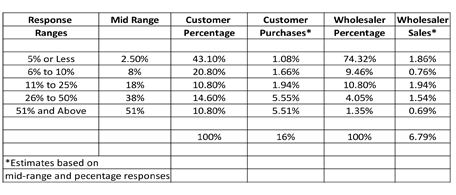

In Exhibit 1, we asked both wholesalers and their customers how much of their current sales and purchases they transacted via e-commerce. The percentage scale was the same for both audiences. For instance, 43% of customers purchase 5% or less via e-commerce, where 74% of wholesalers sell 5% or less online. We estimated the total Wholesaler Sales and Customer Purchase volume by using a product of the mid-range of responses and the percentage of respondents. Reviewing the last three Response Ranges starting at 11%, we find that 16.2% of wholesalers sell approximately 60% of online demand. Customer responses support this, as the distribution of purchases is weighted heavier as response ranges increase, with 36% of customers buying up to 75% of online demand. The weighted averages, using mid-range responses, are that wholesalers sell 7% or so of their demand online and customers purchase 16% of their demand online. For all intents and purposes, we find that 20% of wholesalers sell 80% of the online demand of the wholesale channel or the sales distribution is a Pareto. In addition, much of the difference between wholesale sales and customer purchases online of 9% (16%-7%) is likely attributed to entrants into the distribution space that are not counted as traditional distributors.

Customer vs. Wholesaler Responses to amount of

purchases or sales transacted via e-commerce (Exhibit 1)

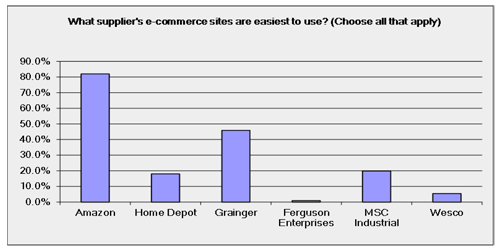

As further validation, we asked end-users which websites were easiest to use. Our intent was to find out, based on customer focus groups, which site features were most attractive. During the focus groups, we found end-users gravitating to non-traditional sites including Home Depot and AmazonSupply and we included them in the qualitative research. Of 160 end-user respondents, 80% answered the question resulting in Exhibit 2.

End-User responses on sites that are easy to use. Exhibit 2

To our surprise, Amazon and Home Depot scored reasonably well and better than several core industry wholesalers. To be fair, the core respondents were in the manufacturing and institutional MRO sector, a $130 billion North American market. However, firms such as Wesco (Electrical) and Ferguson (PHCP) sell plenty of goods into the MRO space but their online recognition is low compared to non-traditional firms such as Amazon and Home Depot. Grainger and MSC scored well, as expected, but not nearly as high as Amazon. Grainger reports selling approximately a third of its demand via e-commerce and recent interviews with MSC executives2 disclose roughly half of all sales are conducted on the web.

The takeaway is that seasoned MRO buyers don’t necessarily need seasoned, traditional distributors for their indirect items. They are happy to buy from non-traditional firms that are new to the space and/or have easy to navigate web-commerce sites. We took the responses and available information to forecast the growth of online demand in the MRO sector.

In the Year 2025, Will Traditional Wholesaling Thrive?

For end customers, we asked a series of questions about the e-commerce space five years hence as it related to their wholesale suppliers. Two of the highest probability scores went to the statements:

- Wholesalers who have one-stop shop sites with easy to use product search and price comparisons will secure more of their customer’s business (89%)

- Wholesalers who invest in e-commerce and e-business will win more of their customers’ business in the future (81%)

We forecasted demand of the $130+ billion North American MRO sector as it concerned digital commerce to 2020. Because of the nature of the sector that comprises dozens of product/markets, we consider it to be a fair forecaster of durable goods distribution at large. We used current estimates of demand at 16% of current purchases online, 2% to 3% per year migration of Millennials into the workspace replacing Gen Y and Boomers (they have a higher propensity to purchase online), a 2.5% annual GDP growth, a 3% organic growth exhibited by firms dominant in e-commerce, and a 5% to 10% growth in the acceptance of e-commerce. The result, by 2020, is that 30% to 40% of MRO purchases are forecast to be consummated online.

Where the final online rate of commerce in the MRO sector is in five years is anyone’s guess. With 16% of demand online today, a third or more of demand ordered online by 2020 is not out of the question. Because of this, we see significant channel issues and potential for channel conflict of major proportions in durable goods markets. Why? With 251,000 wholesaler establishments3 and tens of thousands of manufacturers, the relationships and processes to get to market between vendor and wholesaler are immense and complex. For these manufacturers to move their relationships to 20% of the wholesalers that participate in the online migration will create conflict including:

- Vendors offer more lucrative policies including better pricing and lower cost services to those who participate online as they grow sales and increase purchases faster than traditional wholesalers

- There will be a concentration of channel power for the firms that succeed online, which allows them to get more concessions from vendors. The vendors will not offer the same concessions to traditional firms in slow-growth channels.

- A potential loss of the number of vendors is likely. As online growth distributors take share, second or third tier vendors will lose, as their distribution outlets lose sales.

The upshot of the growth of the online sector, at the expense of traditional distribution, is that pricing and service policies will favor the growth channel. Also, because of the concentration of power in the online sector, there will be a potential loss of vendors in durable goods markets. Wholesalers that do not compete in the online space will be at an increasing disadvantage, as their leverage over top vendors declines as their market presence fades.

Supporting institutions including co-operatives and independent representatives will not come away unscathed. Co-operatives and buying groups, long a standard for keeping small and mid-sized wholesalers competitive on the buy-side, will be hard pressed to demand ongoing discounts as member performance fades. And independent manufacturer’s representatives will face more consolidation as the buying power of the channel moves to the select group of firms that dominate the online space.

The effect of technology and its ability to take cost out of myriad channel relationships is a competitive advantage in the history of supply chains. Technological winners, in number, are less than losers as touch points are taken out of the chain, improving quality and reducing cost. Moving the rail head to Dallas killed the cattle drives in less than two decades (1860s-1880s). The combustion engine and interstate highway system greatly reduced the need for railroad transport and rail passenger traffic was significantly reduced from the 1940s to the 1960s. Finally, e-mail has been driving down postal volume since 2002, with first class volume down 40% in the past 12+ years.4 All these supply chain disruptions were initiated by technology and all reduced touch points, improved quality, and reduced cost. History of these events shows that existing supply chain service providers knew the technological changes were present and prescient. However, a surprising number failed to adapt. The time from peak to decline took around two decades. Top ranking e-commerce models in distribution started their development in the past decade. If supply chain history repeats itself, wholesale distributors that do not adapt to digital commerce will begin a precipitous slide in the second decade of the technology.

For the past 25 or so years, mergers in the distribution space have reduced cost and combined vendor purchases but further consolidation of the old model is a losing proposition unless there is a concurrent effort to have online performance perfected. We expect the host of private equity firms, that compete for larger distribution firms along with their capital lenders, to take note and shy away from distributors without a healthy and growing online presence.

Divergent Interests, or Not?

Manufacturers and their distributors have long endured contention in their relationships. The firms are extremely different in their financial makeup and this drives different objectives. Manufacturers assume significant fixed costs in plant, property and equipment and seek to maximize production runs of high contribution products. Distribution is a thin margin, small increment step cost or variable cost enterprise. Wholesale distributors seek to drive down asset investment along with supporting service expenses—seemingly daily. However, manufacturers and distributors have learned to work together to consummate the end-user sale. Like the grizzled tom cat and big yellow dog in the suburban household, everyone gets along when each party stays out of one another’s food bowl. Given the potential and likely substantial change in existing channels, however, manufacturer and distributor have much to lose if the current dominance of digital commerce by a few firms grows at the expense of traditional firms.

Following is a list of suggestions for both parties to consider as online sales grow.

- Within vertical markets, distributors and their vendors should come together to assess the size of the problem and propose solutions. Customer research is highly recommended.

- Manufacturers should consider being more liberal in the use of the estimated $24 billion of market development funds (co-op) and let distributors use them for software and personnel key to the online space.

- Both parties will need to wrestle with common nomenclature and taxonomy for products. Without standards to standardize vendor data, the ability to provide consistent content is limited. Robust, large SKU count, and current product content in e-commerce is the heart of a successful online presence.

- Industry bodies along with co-operatives and other influencers, may be best to consider developing a shared software and content management platform for all members. This is being tried in at least one vertical market we know of and shows promise.

- Distributors should develop alliances and quickly begin to study best practices of the leading online firms including what they do and how they do it.

- Courses for distributors through associations and buying groups should be pushed to the forefront. Care should be taken to differentiate the best in B2B e-commerce from B2C. There are notable differences and many B2C conventions don’t work all that well in the industrial relationship.

- Forget surveying only wholesalers about their e-commerce activity, there is a 7.5 out of 10 chance any wholesale-only survey will find sales of 5% or less in e-commerce to be the norm. Survey customers on their e-commerce purchases and where and why they buy online.

We don’t expect wholesalers to close up shop en masse because of a slow start in e-commerce. We do expect that wholesalers and their vendors that don’t keep up investment in the technology (ies) and knowledge to compete online will consistently lose sales over the next decade. The resultant channel conflicts from a loss or slow-down in sales will rise as e-commerce grows and current channel members don’t succeed in the technology. Today, our research says some three quarters of existing wholesalers don’t do all that well online. There is much to do and precious little time to do it.

Scott Benfield is a consultant for B2B channels. He has authored six books on distribution supply chains and numerous research projects on change issues. He can be reached at (630) 428-9311 or scott@benfieldconsulting.com.

Benfield, S. “E-Commerce: Current Practice and Future Predictions in the B2B Wholesale Sector,” Bencon Publishing, 2015 at www.benfieldconsulting.com, homepage.

Demery, P. “Q2 Web Sales Rise Sharply at MSC Industrial Supply,” April 2014, Internet Retailer.

Bureau of Labor and Statistics, BLS.GOV, Merchant Wholesalers, NAICS 423 Durable Goods, on 2/20/15.

First class mail volume was 103,000+ pieces in 2000 and stands at 65,000+ pieces by 2013, First Class Volume history at USPS.com.