Winning or Losing in the B2B Omni-Channel: One Value Slice at a Time

by Scott Benfield

B2B Online sales are forecast to be approximately 25% of North American demand by 2025 or over $2 trillion in sales. Additionally, these sales grow annually at 8% per year or 3.5x traditional channel growth rates. These statistics are reasonably well accepted. One would expect that existing manufacturers and distributors serving B2B markets are aware and well-connected to the omni-channel. Our work and research, however, finds that nothing could be further from the truth; approximately 70% of manufacturing firms, and 90% of the distribution sector, are missing potential omni-channel partnerships with new and growing entrants in the B2B online sector that, according to research, represent sales totaling over $500 billion.1

The problems with the approach of most mature companies to the B2B omni-channel revolve around past market familiarity and momentum, “steamrolling” existing marketing supports, and lack of research and review of new channel configurations called “slices” of the value chain. In this blog, we will point out the explosive growth of the omni-channel, problems with traditional approaches for partnership, and what manufacturers and distributors need to do to grow their online sales with made-for-e-commerce entrants.

The New Online B2B Omni-Channel

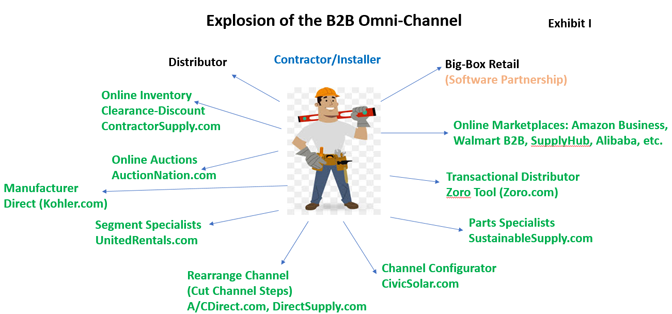

Before the advent of e-commerce, the B2B value chain has been dominated by three primary channels to market including: manufacturer direct for large, complex products, wholesale distribution for most products, and big-box retail for a slice of construction products (Home Depot, Lowes). These channel configurations were, largely, stable until B2B e-commerce began in the late 1990s. Until specialized software for a competitive (sales-assisted) online experience began to appear around the time of the Great Recession, there was limited change in the B2B sector. However, since the appearance of specialized B2B e-commerce software suite,2 B2B e-commerce has grown along with new supply chain models (pathways) to market. To illustrate the explosive growth of online-based alternative channel configurations, we’ve included Exhibit I for contractor-based sales.

In the Exhibit, we have listed traditional channels in black lettering for the Contractor/Installer. Traditional channel entrants were wholesaler-distributors and big-box stores. However, new channel entrants, in green lettering, began to appear along with the specialization of B2B online software 10 to 15 years ago. Today we find, in most B2B sectors, variations on these theme(s) of channel entrants depicted in the Exhibit (i.e. they are accurate for industrial, medical, institutional and a host of other channels). We’ve given titles to these channel entrants and define them and their value proposition(s) as follows:

- Online Marketplaces - The best known of omni-channel participants because of Amazon Business, marketplaces aggregate a broad array of products, primarily for “tail-spend” or the 20% of products that are 80% of the vendors. They tend to offer great search capabilities and superior availability of product.

- Transactional Distributors - Online entities that use technology to strip out costs from the full-service distributor model especially in sales and branch outlets. They then take the operating cost advantage to the market in a price decrease, often a 10% or more discount on most items.

- Parts Specialists - Sites that offer significant parts availability, often for specific industries. Parts specialists have great content, parts cross references, and often ship direct from the manufacturer.

- Channel Configurator - Online entities that rearrange channel functions, often by combining them or reducing channel steps. They upgrade technology to give more accurate recommendations, and push forward into the value chain to give a better experience than traditional channel entrants.

- Rearranging the Channel (Cutting Channel Steps) - Online firms that bypass or cut out channel entrants to simplify channel complexity and offer a better price.

- Segment Specialists - Firms that specialize in a unique segment with a detailed, in-depth offering that covers unique services along with products.

- Manufacturer Direct - Manufacturers that sell direct online that originally sold to channel intermediaries. Research finds that approximately 30% of manufacturers sell online today and this is growing.

- Online Auctions - Auctions of products through an online portal that matches manufacturers and distributors with buyers who give price and quantity requirements for the best online price.

- Inventory Clearance - Firms that offer overstocks, buyouts, returns in good condition, etc., online and at a highly discounted price.

Again, we find where these slices of the online value chain are found in most of the discrete B2B product-market sectors but they are woefully under-marketed to by manufacturers and full-service distributors.

Unravelling the reasons why existing firms don’t sufficiently explore and market to the expanding omni-channel finds any number of reasons that are cultural or steeped in misconceptions about the omni-channel itself. We cover this in the next section.

Relearning the Omni-Channel

Channels of commerce are firms or collection of firms that get the product to the customer from the original manufacturer. Channels are composed of firms that manufacture and handle the product or include firms that transfer the information about the product. In some products, such as software, the channels can be online without any physical product, especially as cloud-based applications flourish. The vast majority of the B2B economy involves physical products that were originally held by manufacturers that sold them to a group of distributors across North America. The value added by distributors was aggregation of products, from differing manufacturers, that solved an application issue. The economics were sufficient that order gross margin dollars exceeded order fulfillment costs for most transactions and distributors eked out a slim profit of 3% or so of revenues before tax.

The dominance of wholesale distribution grew as the North American industrial base grew. Today, North American distribution, both durable and non-durable goods, at the distributor level is an approximately $7 trillion sales entity of the economy. In the 1990s, with the advent and growing usage of activity costing, it was discovered that the typical distributor had 40% of accounts that did not cover their fulfillment costs. Often these accounts were transaction-intensive and price-sensitive; they had lots of small revenue orders with low gross margin percentages. The upshot is that traditional wholesale distribution had a significant portion of accounts that were unprofitable and the result was management, more often than not, increased account prices.

From the 1970s forward, the field of B2B channel management formed in industrial markets and involved manufacturers, distributor, and dealer-based channels. The knowledge and management of channels soon became a part of graduate business school curriculums and numerous leading industrial firms hired channel managers. Channel management was found to be profitable and grew within industrial firms, with the knowledge spreading to other sectors. Today, original channel knowledge and thinking is predicated on the work and research from a generation ago. This approach is not without merit as the predominant channels are still manufacturer-distributor-end user, manufacturer-distributor-dealer, or manufacturer-distributor-retailer. But channels and their supply chains follow technology, as it is supply chain functions, aided by technology, that reduce cost, improve accuracy, and drive efficiencies, often through the roof. Ergo, with the advent of e-commerce, channels began a slow, but significant change in their complexity, economics, and management needs.

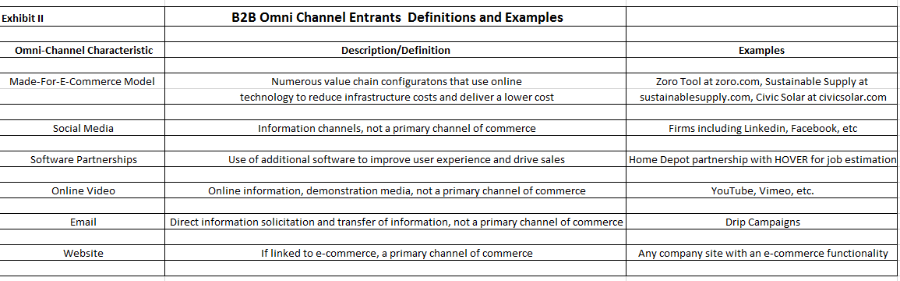

By the mid 2000s, e-commerce software had specialized for the B2B sector including the addition of PIM, Punch-Out, and Faceted Search software. Following the software, the movement of B2B transactions online began in earnest as well as the proliferation of alternative made-for-e-commerce firms. These firms used online technology to change the economics of supply chains, usage of online partnerships, and alternative structures to go to market. When discussing new age channels, we refer to Exhibit II for an overview.

Contrary to much of the literature on B2B markets, we do not regard social media, online video, email, or extranets as direct or primary channels unless they are linked to a shopping cart. We regard them as information, solicitation or product demonstration channels and an important part of online marketing. The focus on social media, online video, etc., as a channel, similar to direct channels, is a big part of the definitional problem. Existing distributors and manufacturers have missed made-for-online entrants with differing value configurations since the definitions of the omni-channel errantly included information and solicitation technologies as channels of equal value and strategic importance in the supply chain.

Exhibit II reviews different omni-channel characteristics, their definition and examples. The first row is dedicated to the new made-for-internet channel models from Exhibit I. Again, we find these value configurations in most verticals and they are growing. Most of these firms streamline the channel over traditional distributor/dealer networks and translate the channel savings into a better price for the customer. We’ve listed social media, online video, and email as primarily information or solicitation channels and don’t consider them direct channel members unless they are connected to a shopping cart. We’ve also listed software partnerships in the second row. These are partnerships between a channel entrant and software that gives an advantage to the end customer. An example is Home Depot’s partnership with HOVER, a cell-phone app that lets contractors determine job site material needs from a cell phone photo.

To understand possible direct and new value “slice” channels in one’s marketplace, we suggest online surveys of customers and potential customers and where they buy online. Research, especially open-ended questions, can often identify where new channel entrants exist. We also recommend simply reviewing online search engines for products of competitors and where one can buy them online. The problem in marketing to new channel entrants is also one of historic practice of going to market with old-style channels, which we cover in the next section.

“Steamrolling” Digital Channel Partners

Past channel configurations, with distributors, dealers and other intermediaries, meant that these firms often covered all customer types in a defined geographic market area. This is opposed to new made-for-e-commerce channel entrants that market to a defined application base and drive their model across as much geography they can reasonably serve. Channel marketing supports, for yesterday’s members, tend to be varied, broad and expensive. Most include full (outside and inside) sales complements, multiple branch locations, and a variety of vendor funded events that average 7% of cost of goods.3

These channel supports, being expensive, are exactly those that made-for-e-commerce entrants bypass with technology and new supply chain configurations. For instance, transactional distributors typically don’t have much of a sales effort and few branches. They take the infrastructure cost advantage to market often at prices that are 10% or more lower than full-service distributors. Ergo, the infrastructure cost disadvantage of traditional supply chain manufacturers and distributors is prohibitive to online buyers looking at the great price/limited service offered by transactional competitors. We’ve witnessed traditional channel members’ efforts attempting to partner with new age e-commerce entrants and they, typically, are based on a full-service platform with the result that their prices are too expensive for the new channel member.

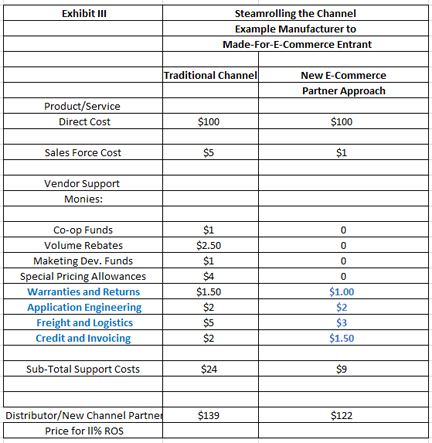

For instance, if a manufacturer whose operating expenses are 30% of sales tries to partner with a transactional distributor whose operating costs are 10% of sales, the partnership opportunity falls apart with the first offering; it’s too expensive. Transactional distributors don’t need a full channel support package and they can’t pass the cost down the channel to the economic buyer. We call approaching new age channel partners with a full-service offering “steamrolling” the channel. To successfully sell made-for-e-commerce channel partners, manufacturers and distributors need to use only the services that are required and price the deal on the reduced service or incremental support offering.

An example can be seen in Exhibit III where we take a manufacturer selling a Transactional Channel entrant. In the Exhibit, we depict a manufacturer selling a traditional full-service distributor versus the offering necessary to sell a new channel entrant. In the first column, the product direct costs (material, labor, overhead) are $100 with additional supports costs of full sales effort, vendor support monies, and required services. Required services are those that cannot be removed from the channel as they are prerequisite for a buy/sell relationship. In the example, the manufacturer has a goal of 11% ROS and total channel support costs of $24, making the price to the traditional distributor $139. For the made-for-e-commerce distributor, the support services of sales and vendor support monies have been reduced including reduction in warranty and credit services as the product line is truncated. The result, for an 11% ROS for the made-for-e-commerce channel partner is a price of $122. In short, the traditional full-service distributor would get a $139 price and the transactional distributor a $122 price. While full-service distributors chafe at this analysis, it is a growing part of the economics of online channels. This type of channel function analysis can help manufacturers and distributors successfully partner with new age channel entrants. The key to remember is that new age firms often don’t need or want traditional vendor monies, full sales support, and other services are often reduced in cost as they are automated or for truncated product lines. The functional cost analysis is the best means we know to reduce the chance the potential partner is steamrolled by the cost of a full-service offering. We recommend diagramming the service provided by the made-for-e-commerce channel member and how it differs in support needs from a full-service channel offering. Once channel support services are diagrammed and cost estimates done, a more competitive price can be offered.

Finally, we often hear from distributors that new channel entrants compete against full-service offerings; the statement is not inaccurate. Hence distributors don’t and can’t offer products and services to new channel entrants. Our view, however, is that full-service distributors are missing an excellent opportunity to partner with new channel entrants as they often solicit price sensitive or small activity negative customers (those the full-service distributor has forgone) or they have a need of distributor offerings including breadth of product, advanced product knowledge, value added services of logistics, storage, and private label items. Also, these firms can use inventory back-up when their products are out of stock.

Armed with a functional cost analysis from Exhibit III, research of the online customer, and an open mind, distributor executives will find that many of the channel configurations from Exhibit I can become channel partners. The upshot is that we believe sales growth for distributors will increasingly come from partnerships with alternative value chain configurations and new tools including UX/CX research and functional cost analytics/supply chain economics will be needed to profitably secure these relationships.

Developing New Channel Partnerships

New online B2B channel entrants are expected to grow as B2B e-commerce grows. The B2B Omni-Channel, today, is largely underestimated and unsolicited by existing manufacturers and distributors for partner opportunities. This is a result of poor definition of the B2B Omni-Channel, lack of research of customer online buying choices, and steamrolling the channel with a full-service platform. Once these problem approaches are understood, significant sales await in channel partnerships that, today, total over $500 billion in sales and grow over three times faster than traditional channels.

Scott Benfield is a consultant for manufacturers and distributors in B2B channels. He has been quoted in Forbes and The Financial Times. He can be reached at Scott@BenfieldConsulting.com or (630) 428-9311. His firm, Benfield Consulting, is a member of Digital Channel Advisors, a group of consultants who help mature firms move online.

Scott Benfield is a consultant for manufacturers and distributors in B2B channels. He has been quoted in Forbes and The Financial Times. He can be reached at Scott@BenfieldConsulting.com or (630) 428-9311. His firm, Benfield Consulting, is a member of Digital Channel Advisors, a group of consultants who help mature firms move online.

1 Bughin, J, van Zeebroeck, N., The Best Response to Digital Disruption, MIT Sloan Management Review, 2017 at: (https://sloanreview.mit.edu/article/the-right-response-to-digital-disruption/)

2 Benfield, S., The Top Five Reasons B2B E-Commerce Efforts Fall Short, Section III, LinkedIn Blog, 2019, at: https://www.linkedin.com/pulse/top-5-reasons-b2b-e-commerce-efforts-fall-short-scott-benfield/

3 Benfield, S. Vendor Funds Management, A New Discipline for Distributors, Linkedin Blog, 2019, at: https://www.linkedin.com/pulse/vendor-funds-management-new-discipline-distributors-scott-benfield/