Sales Growth in an AmazonSupply World: New E-Commerce Revenue Models for B2B Wholesalers

(Second in a Series)

"Most managers starve the future to feed the present and obesely glorify the past . . ."i

|

|

Distribution Research Project |

|

What's this? Get a free Executive Summary on our 2013 Growth Research |

by Scott Benfield

E-commerce started in B2B supply chains in the late 1990s. For all intents and purposes, electronic marketing efforts remained the same through the Great Recession, with the primary function of e-commerce as a transaction portal for existing customers. Since the Recession, and as the economy rebuilds, there are new models that give the technology promise and that migrate away from usage as a low-cost transaction platform. In this second installment of our series, we review new models of revenue generation with e-commerce. While some of these models have their roots at the start of the New Millennium, they are becoming established with the caveat that the base of wholesalers that have an e-commerce capability is somewhere in the range of 25% to 35% of existing companies. Additionally, several of these models require partnering with outside content providers that offer “mega-content” and technology services.ii

New Models and Their Applications

New models of revenue through e-commerce largely follow a significant amount of trial and error by progressive wholesalers on the “bleeding edge” of technology and practice. As their experimentation becomes successful, other firms research their innovationiii and adopt the practice(s). Over time, the more successful ventures receive attention by the academic and consulting community and are researched, standardized and taught, eventually becoming mainstream.

Before we begin, it is important to establish definition of e-commerce as separate from strategies and tactics that increase growth. E-commerce, as a standalone, is nothing more than the ability to conduct commerce electronically; it is fundamentally a low-cost transaction platform. E-commerce, however, has several distinct advantages over pre-existing services where commerce was transacted including:

- The technology disaggregates the customer purchasing event from the selling event including outside and inside sales efforts.

- The technology is asynchronous where ordering can be done at any time convenient to the buyer.

- The technology can deliver price, availability and technical specs more quickly, more completely, and more efficiently to a much larger audience than any previous format.

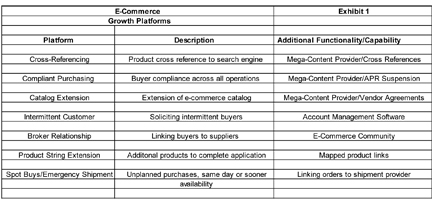

The important thing to remember is that e-commerce, as a standalone, is a low-cost transaction option and not a strategy. But it is an enabling technology and, when combined with other traditional sales and marketing efforts, can be used tactically and strategically. We have reviewed and cataloged seven separate revenue platforms for B2B supply chains using e-commerce. These revenue platforms are, for all intents and purposes, in their early or growth stages and we expect them to become more common in the future. The platforms are listed in Exhibit 1.

Cross-referencing has been a common means to promote the robust application of a product(s) in lieu of leading brands. The technique is often done by less well-known manufacturers that have better price point(s) versus a dominant competitor. In the e-commerce world, cross references can be linked to a search engine (Google) or a mega-content provider (WayPart.com) and the searches matched to a variety of suppliers. The search engine and its content magnify the cross-reference substitute of the wholesaler and often by a factor of 5X or more. The more complete and accurate the cross-reference, the better the chance a match is made to a prospective buyer. Often, cross-referencing is an efficient and effective means to land new customers from the web.

A close kin to cross-referencing is Compliant Purchasing whereby cross-references are used, within a defined search engine, to drive purchasing to approved vendors. An example of compliant purchasing is a Fortune-rated manufacturer with numerous facilities across North America. Purchasing for each facility is done by a local manager who has freedom over differing vendors. For a critical application, however, the corporate parent specifies a specific vendor (X). To ensure that vendor is purchased in all facilities, the parent organization requires purchasers go to a specific site (mega-content provider) that has most of the competitive substitutes for vendor (X). If a purchaser in a far-flung operation has the substitutes cross-referenced to vendor (X) their buying is driven to compliance by the use of a mega-content provider and cross-references to the approved vendor. Compliant purchasing is especially important for critical use parts and approved substitutes in continuous operations. However, manufacturers of approved parts may have to enlarge their area(s) of primary responsibility (APRs) for their distributor network to cover the customer’s operation(s).

The growth of compliant purchasing is due, in large part, to a category of e-commerce services called “mega-content” providers. These firms gather products, often specific to an industry, and offer the content for use, among other services, and on a fee basis. These firms may release part of the content to subscribers or participating firms may have to develop new product content; much depends on where the content comes from, the permission of the providers, and if it is in the public domain. Qualified “mega-content” providers will advise you of the ability to use content, where it comes from, and your ability to use it. We see “mega-content” providers as a growth area in B2B distribution and especially with independent distributors as they do not have the resources of the billion dollar players for e-commerce and e-business development.

A unique and growing service of the “mega-content” provider is Catalog Extension. Most distributors have, in B2B markets, thousands to tens of thousands of items in stock and which are typically digital content on the proprietary e-commerce site. However, stocked items are often a small part of what a distributor can sell, which includes non-stock items which may or may not have been sold by the firm before. Also, many vendors have items which distributors can transact but they have little to no experience with. However, the willingness of the distributor to advertise, transact and carry credit for the item is of value, and progressive manufacturers are waking up to the fact that giving permission for distributors to advertise and sell fuller inventory over the Internet makes sense. The use of expanded product content via a “mega-content” provider is the core of catalog extension and it is not unusual for distributors to expand their product content 3x to 5x or more over typical stock or “regular” items. In the world of e-commerce, the trend is toward more products which have a probability of drawing more users and completing the order on the first pass. Catalog extension is a viable and modern means toward these goals.

The partnering with outside content providers, in distributed markets, is nascent. Our work and research suggest the trend and usage of cross-referencing, compliant purchasing and catalog extension will grow at a brisk pace. Other growth models for e-commerce, while making use of “mega-content” sites, are more the domain of a distributor’s proprietary efforts and we discuss them in the ending section.

Proprietary E-Commerce Growth Platforms

Distributors with proprietary e-commerce efforts are, too often, pressed as to how to drive revenue with the technology. Our research finds that of the 25% to 35% of distributors with e-commerce efforts, over half have not demonstrated a sustained revenue platform and singularly rely on the technology as a low-cost ordering portal. There are four basic means of driving revenue through a proprietary site, including intermittent customer solicitation, the broker relationship, product string extension(s), and spot buys with emergency shipping.

Intermittent customers are accounts which purchase infrequently. They are often non-core users of a distributor’s products and have limited applications for the products carried. Our work in restructuring distributor sales effortsiv finds that, over a three year period, 90% of intermittent, small accounts fail to rise above an activity breakeven where margin dollars are greater than service costs. Yet, we still find where sellers and their sales managers stuff territories with these accounts “hoping” that they will drive revenue and margin dollars over the activity breakeven. Allocating these accounts to a sales territory is almost always a mistake. They simply don’t have the volume to make it worth an investment in a face-to-face call. What they do need is a platform where they can see the breadth of products and a qualified inside seller when they have questions. Using the e-commerce portfolio, it is possible and profitable to send outbound communications to these accounts, on products or technologies they have ordered in the past and with a link to a qualified inside seller or product specialist. Often we’ve seen where these buyers don’t know the full breadth of the products carried by a distributor and their transaction size and yearly volume can increase simply by encouraging them to browse the online catalog or linking them with products that are often used with those they have purchased.

The direct cost of an outside seller is somewhere north of $100 per call while solicitation via e-commerce can be measured in coinage. Intermittent buyers can purchase significant amounts, from time to time (read every other year or so), but keeping the relationship fresh and meaningful can’t be done by an outside sales effort. Hence, using e-commerce, associated products, and inside sales links can serve to keep the distributor in front of these customers when the need to order does arise.

The Broker Relationship is an often misunderstood and financially underestimated growth platform. Brokering, as the term implies, means a relationship where an outside

agent links buyer and seller and gets paid a percentage or fee for the transaction. For instance, if Account 123 is searching for Zebra Widgets and finds they are listed on Big Distributor’s site, they will proceed to add the widgets to a shopping cart for purchase. However, Big Distributor doesn’t stock Zebra Widgets as they are not core products. Instead, Big Distributor is engaged in a community of distributors of which several stock Zebra Widgets. Big Distributor offers to broker the order for Account 123, and sends the request to the stocking distributor. The financial transaction takes places between Big Distributor and Account 123 and behind the scenes between the stocking distributor and Big Distributor. Big Distributor doesn’t physically handle the Zebra Widget, they launder the transaction, carry the credit, and connect buyer and seller with ordering information. The payoff for Big Distributor is that brokering, if done right, is extremely profitable. How? Brokering fees can be a few percentage points or a flat fee. The cost to transact the order, via e-commerce and assume credit risk is minimal. For instance, if the brokering fee is 5% of order value and a flat $2 for an order origination, a $100 order would net Big Distributor $7. The financial leverage on the brokered transaction is immense, as a $7 fee may only cost 50 cents in service costs. Hence the transaction ROI is ($6.50/$.50) or around 1300%!

Brokering via e-commerce offers some of the best returns available in distribution but there needs to be a community of distributors that have linked content and agree to broker via member companies. Also, a “mega-content” provider can help immensely in developing brokering relationships, as member companies can agree to brokering arrangements between each other. We believe broker relationships will become more common as distributors find ways to create communities and agree to content “sharing” or offering links for unique products. Broker relationships can benefit vendors and those who enhance their digital capabilities, by helping wholesalers with digital files that can be easily uploaded with links to technical specs. Vendors that offer these services will find sales increases. Vendors can also drive sales by working with wholesalers on product strings.

The use of Product String technology in distributor e-commerce is in its infancy but the reasoning is well known. Distributors exist in large measure because they bundle differing products to complete an application. As distribution consolidates across sectors, the idea that an individual inside seller has the product knowledge to complete an increasing array of applications is obsolete. To increase the likelihood of bundled sales, IT departments with sales and marketing develop associations between products based on prior bundles and their probabilities. An example of a product string is with Amazon printed media where associations are made between readers of one subject to a similar subject. (i.e. a history reader of Founding Fathers would be interested in history on the Revolution or Federalist Papers.)

Product strings in the B2B world, however, are more complex and more critical than in the B2C space. Application associations need to be carefully planned and tested; significant work goes into their creation. Once developed and tested, the association logic is placed into the e-commerce software and the buyer gets immediate updates on additional product(s) they are likely to need for an application. (A buyer of drills needs bits, deburring tools, chargers, etc.) Manufacturers can help with product strings by giving insight into additional products that would go into the application including parts and accessories. Product strings are akin to the follow-up question in the sales call regarding additional items, but it is done automatically and often with greater accuracy than the face-to-face sales call. Product strings are mostly effective with in-stock items similar to our final e-commerce growth platform.

Spot buys/emergency shipment items are needed to solve an immediate problem. The issue with spot-buys, in days past, is that they required the user to stop work, drive to the nearest counter, and hope the item was in stock. Today, items can be checked for price, availability and proximity to the user using hand-held devices. There are several wholesalers that have created mobile apps for this purpose. Too, the spot buy doesn’t have to be picked up at the counter. There are today, in most reasonably sized metropolitan areas, emergency shippers that will deliver the item(s) the same day and often within a few hours. E-commerce can be made to enhance performance where the variables of time, place, availability and distance are involved. The emergency need transaction requires support from the wholesaler including immediate pulling, packing, and notification of a quick-ship option but the results, from a customer satisfaction and loyalty perspective, can be worth it. The use of e-commerce to enhance and even replace the function of the city counter is real and our forecast is for technology of e-commerce and advanced logistics to reduce the number of physical facilities. In a recent webinar, we called this trend “Losing With Local”v and there are several large and prominent wholesalers that have reduced their branch complement while organic sales have continued to prosper.

E-commerce has moved from a transaction portal to a means of driving top-line revenues. Far too many distributors dismiss the technology and stick with the tried-and-true model of belly-to-belly seller to account model replete with local branches. Over time, we see the tried-and-true losing out to more efficient and effective uses of capital and technology. While there will always be a need for sellers and branches, their functions will change significantly. Today, we no longer believe that features and benefit selling and much of consultative selling (at least at a basic level) is effective. We see a real need for redefinition of the sales effort and brick and mortar locations as e-commerce and associated technologies can be developed which supplant these efforts at a lower cost and with greater accuracy. The seven revenue platforms are a start but are likely being re-defined as this article is written; the leading wholesalers of tomorrow are busy finding new, less-costly and more accurate means to solicit and consummate the sale.

Scott Benfield is a consultant to manufacturers and distributors in B2B supply chains. He is the author of six books on marketing, sales, and operations subjects and is currently researching growth in wholesale markets. He has done work for North America’s largest wholesalers and manufacturers along with significant numbers of mid-market firms. Scott can be reached at scott@benfieldconsulting.com or (630) 428-9311. His site is www.benfieldconsulting.com.

i - Paraphrased quote by Burton Richter, Nobel prize winning physicist at Stanford.

ii - See WayPart at www.waypart.com for an example of a “Mega-Content” provider.

iii - Drucker, P. “Innovation and Entrepreneurship,” Harper and Row, 1984, p. 50.

iv - Benfield, S., Vurva, R. “Restructuring the Distribution Sales Effort,” 2006, Brown Publishing, p. 51.

v - Benfield, S., Lombardo, B. “Developing Distributor Partnerships in the New Normal,” found at: http://www.industrialsupplymagazine.com/pages/IS-Video-Library---Developing-Distributor-Partnerships-in-the-New-Normal.php