Will the Soft Landing Come This Year?

|

| istockphoto.com |

Economists are divided on whether the economy can be cooled without a recession, but industry execs are optimistic about growth in the second half of 2024.

by Joanne Costin

“The recession didn’t materialize and 2023 ended up to be a pretty good year for most distributors that I’ve talked to,” said Hoplin.

“Stability is the word we’re hearing,” said Ann Arnott, executive vice president and chief executive officer of the Power Transmission Distributors Association. “There seems to be an acknowledgement that the “new normal” we were all anticipating post-COVID is here – whether it’s supply chain, inventory, or workforce management.”

Manufacturing, while down from the prior year, ended up being more resilient than anticipated in 2023.

“The best way to describe 2023 is ‘sluggish but stable,’” said Timothy R. Fiore, CPSM, C.P.M., and chairman of ISM’s “Manufacturing Report on Business,” which tracks Manufacturing PMI. “As we moved through the year, it became clear that there would likely not be a contraction under 45 (considered a danger zone) let alone a dreaded 43 (serious recession concern).”

Chris Chidzik, chief economist for the Association for Manufacturing Technology (AMT) attributes some of the resilience in manufacturing to reshoring and public investments in sectors through legislation such as the CHIPS and Science Act of 2022, the Inflation Reduction Act of 2022, and the Infrastructure Investment and Jobs Act.

“While some parts of the manufacturing economy have slowed because of rising prices, interest rate sensitivity or other headwinds, there continues to be a strong base of manufacturing from industries that reshored during the COVID shutdowns as well as those that are benefiting from recent government investment,” said Chidzik.

GROWTH IN 2024

According to Fiore, the manufacturing PMI tends to signal what the overall economy will do. It currently stands at 48.4%, 0.6 percentage points below the November’s reading of 49%. “Our analysis indicates that manufacturing has experienced a soft landing. Absent any outside unplanned influence, we should see growth in 2024,” he said.

|

A soft landing occurs when a central bank—such as the Federal Reserve Bank in the U.S., successfully reduces inflation and cools a hot economy without setting off a recession. Inflation currently stands at 4%, down from a high of 9.1% in June 2022.

Hoplin says NAW members also anticipate a soft landing. “Many of our members are expecting 2024 to be a relatively flat year, with a high side of 5% growth,” he said.

A manufacturing survey conducted by ISM in December reveals more positive expectations for 2024. Fifty-eight percent of respondents expect revenues to be greater in 2024 than in 2023. The panel of purchasing and supply executives expects a 5.6% net increase in overall revenues for 2024, compared to a 0.9% increase reported for 2023. Fifteen of the 18 manufacturing industries expect revenue improvement in 2024.

“Manufacturing’s purchasing and supply executives expect to see overall growth in 2024,” said Fiore. “They are optimistic about overall business prospects for the first half of 2024 and more excited about faster growth in the second half.”

Chidzik believes recent government investment will prove to be a large benefit to many industrial sectors. “Some of the first projects have already begun to be announced and many more will be announced and funded in the first few months of 2024,” he says. U.S. manufacturing construction spending is at a current level of $206.84 billion, up 71.17% from one year ago.

Profit margin expectations are on the upswing as well. Nearly a third (32%) of those on the manufacturing panel expect an increase in profits through May of 2024, compared to 17% who expect a decline. The share of respondents who currently forecast the second half of 2024 to be better than the first half is 45%, while 14% expect it to be worse. An additional 41% of purchasers expect no change.

|

RECESSION WORRIES REMAIN

Some economists don’t agree with the soft-landing outlook. The National Association for Business Economics (NABE) Outlook in December found that 24% of economists surveyed see a recession as more likely than not the next 12 months.

“Panelists anticipate further slowing in core inflation – excluding food and energy costs – but doubt it will reach the Federal Reserve Board’s 2% target before year-end 2024,” said NABE Outlook Survey Chair Mervin Jebaraj in a press release. Jebaraj is also director, Center for Business and Economic Research at the University of Arkansas. “More than two-thirds expect the target will be reached in 2025 or later. Still, more than 80% of panelists believe interest-rate cuts will begin in 2024, with most expecting cuts to start in the second or third quarter of 2024.”

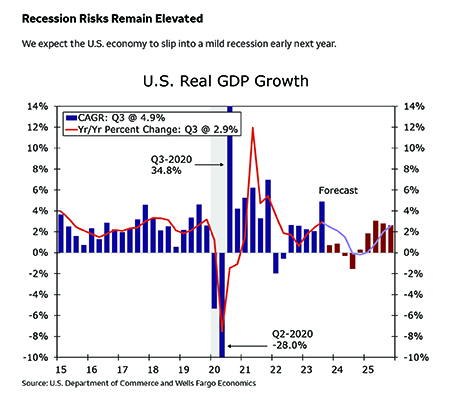

Jay Bryson, managing director and chief economist for Wells Fargo’s Corporate and Investment Bank is one of the economists who believes the outlook remains cloudy due to an elevated risk of recession. “We’re still forecasting a mild contraction in GDP by the middle of next year,” said Bryson during a recent webinar. “What we’re more certain of at this point is that growth will be quite slow next year, particularly under this environment of higher rates in the near term.”

WHAT TO LOOK OUT FOR IN 2024 AND BEYOND

Higher prices, longer lead times

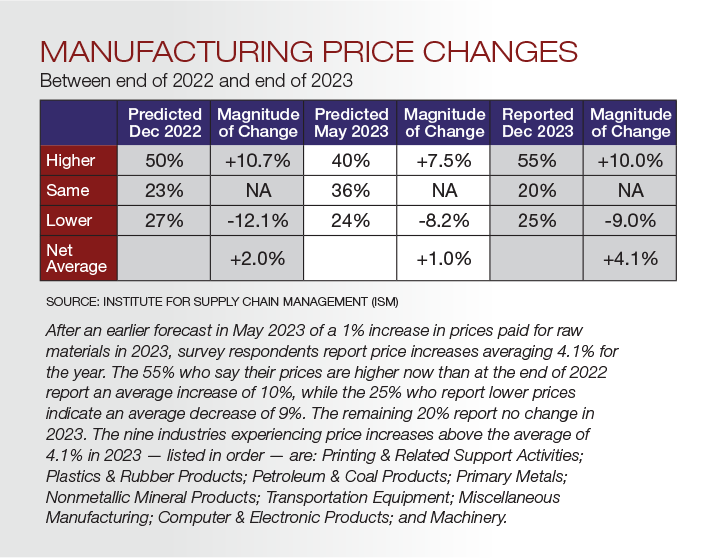

According to Fiore, buyers in manufacturing will be forced to accept long lead times and higher prices in order to keep goods flowing to their factories. Industrial distributors and their customers will be impacted as well.

“This is a direct result of a soft landing as a hard landing would have driven us to lower prices and shorter lead times,” he said. Forty-nine percent of purchasing and supply executives expect the prices they pay to increase in the first five months of 2024 by an average of 7.2%, while 22% anticipate decreases averaging 6%. Including the 29% who expect no change in prices, respondents expect a net average overall price increase of 3.2% before the end of May 2024. Nearly 7 in 10 executives (69%) expect to be able to pass the price increases along to customers.

Distributors need to be mindful of stocking levels as buyers continue to insist on short lead times while distributors want to work off inventory. “Carrying too much inventory represents liquidity risk if the economy declines faster,” said Fiore. “Based on our forecast and the PMI performance over the last quarter, we believe that we are at the trough, so further, significant economic declines are not likely.”

Materials shortages and energy spikes

Chidzik at AMT believes materials shortages and sudden spikes in the price of energy remain a threat for the industrial sector in 2024. “No matter if a disruption comes from geopolitical conflicts, trade disputes, demand from other countries, or environmental factors, the availability and affordability of the inputs to production are critical to the industrial sector in 2024,” he said.

Labor shortages and labor unions

While labor issues have eased a little, 59% of manufacturing firms surveyed for ISM’s “December 2023 Semiannual Economic Forecast” report having difficulty finding workers (down from 77% in December 2022).

“Not every task or activity can be replaced by technology,” said PTDA’s Arnott. “And technology is also a challenge as it becomes more complex and innovative, requiring significant investments both financially but also (again) in a workforce that understands and can support efforts in automation and artificial intelligence.”

Strengthened unions are another threat to distributors. According to Hoplin, the White House, and the National Labor Relations Board, unions are all attempting to change rules and regulations to make it easier to establish unions. “I think it’s going to be a major challenge to fight off unionization of the distribution workforce,” he said.

Scope 3 emissions tracking

Hoplin also cautions distributors about the potential threat of a new Securities and Exchange Commission rule around Scope 3 emissions that will require all publicly-traded companies to track and report certain types of emissions. “Publicly traded companies are going to only want to do business with companies that are easily able to track and report all of this,” said Hoplin. NAW has engaged with the SEC and plans to litigate if needed to stop or slow down this effort.

Tax increases

Distributors who aren’t a Ccorporation (C-corp) are facing a potential tax increase in 2025. While tax cuts implemented in 2017 were permanent for C-corps, everyone else may be looking at an increase if the government doesn’t proactively extend or make permanent the tax decreases. According to Hoplin, 2024 will be the year to start fighting for an extension or permanent decrease and/or planning for a tax increase.

IMPROVING DISTRIBUTOR PERFORMANCE

With no shortage of headwinds facing distributors in 2024, we asked industrial leaders what inherent advantages distributors could put to work.

“The amount of data distributors own, combined with the ever-expanding list of technologies and ways to use that data, gives them a huge advantage,” advised Hoplin.

“With an AI platform, you suddenly have much more clarity on what strategic choices you should be making, such as what types of customers you should be going after and what approaches work best,” he added. “The days of companies collecting orders and processing everything by hand are behind us. Most companies are moving in the direction of utilizing technology to get ahead of the curve.”

A Q4-23 survey of NetPlus Alliance distributor members supports this, with 56% of respondents planning to invest in operational improvements to increase productivity in 2024.

Arnott believes the broad perspective, creativity, and curiosity of industrial distributors is an inherent advantage. “What works at one customer’s facility may translate to another customer’s facility or process. Distributors can leverage not just the products they provide but support and service to choose the right product for the right process, driving costs lower and improving bottom lines.”

MAKE THE MOST OF A SOFT LANDING

If a soft landing is upon us, Fiore advises distributors to be ready to grow and gain market share, especially as we enter the second quarter of 2024. He believes we’re in the trough and that further monetary policy actions will be minimal. “Having products available at fair prices will support manufacturers’ desire for lower lead times and win over their customers,” he said.

With geopolitical tensions, as well as natural disasters increasing around the world, industrial distributors need to continue to think about building resilience in their supply chain. “Many companies are de-risking their supply chains by working to onshore and reshore critical materials that they’re sourcing from around the globe,” said Hoplin.

It’s also very likely that some sectors of industrial supply will be slower to recover than others.

“When facing the prospect of industry-specific slowdowns (or rolling recession), it is important to use the data most applicable to your business to track your performance and anticipate changing customer demand,” said Chidzik at AMT. He recommends reaching out to various trade associations like AMT to get the data you need to make the best business decisions.

History suggests that an economic soft landing is extremely difficult to achieve. While most economists and distribution leaders are optimistic, it’s important for distributors to keep focused on inflation, interest rates, employment, and other market threats as 2024 unfolds.

Joanne Costin is an award-winning business journalist and content writer with expertise in a wide range of industries. By delving into the trends, data, and insight from industry leaders, Costin helps readers navigate current business environments.

This article originally appeared in the January/February 2024 issue of Industrial Supply magazine. Copyright 2024, Direct Business Media.