Sticker shock

By Scott Benfield

Research on the MRO channel served by distributors finds that 80 percent of online sales are transacted by 20 percent of the firms. Furthermore, online sales continues to climb. Our forecast is that 20 percent of the $130 billion in sales sector, or $26 billion, is slated to be purchased online in 2015; up $5 billion from 2014. The imbalance of firms that succeed at online growth and those that don’t is based on two distinct factors:

- Successful distributors make a digital transformation by amending sales, marketing and operating practices to benefit from e-commerce.

- Successful distributors have purchased and implemented second-generation software for an advanced customer experience.

In this article, we’ll review the software used by distributors that are winning the battle for the online sale and the barriers to its successful adoption.

The Second Generation

E-commerce for distributors began in the late 1990s, often with self-programmed systems that were, in large measure, based on B2C functionality. These systems could transact basic stock sales, provide simple information regarding the order, and represented 20,000 to 40,000 SKUs on average. Their search capabilities were driven by keyword search and customers had to enter the order twice, once on the distributor’s site and again into their purchasing system.

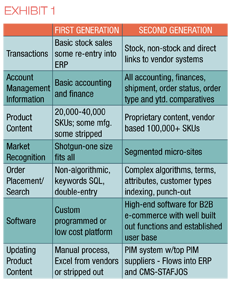

We call these systems First Generation, and they dominate the distributor online presence with approximately two-thirds of distributors having these systems in place. The problem with these systems is that, today, they are mostly obsolete. Technology has taken a substantial leap forward in the past five years with specialized software. Our work and research finds that leading firms use software made for specific functions and often specialized for B2B transactions. In Exhibit 1, we list the differences between First- and Second-Generation E-Commerce systems including:

- PIM or Product Information Software that manages product attributes and sets the stage for process management of vendor information to the ERP and CMS (content management) systems. PIM systems give users successful build-out of current product content of “big” SKU counts into the six and seven figures.

- Procurement Punch Out or software that eliminates double entry of the customer order and helps manage the procurement process.

- Search software that moves beyond keyword search including attribute, function, category, application and additional product and market based search options.

- Transaction software for e-commerce made specifically for B2B transactions and additional functionality needed by the B2B buyer.

The new age software programs began development, for all intents and purposes, in the late 1990s or early years of the new millennium. They often started in the B2C sector and developed expertise in the B2B sector. Today, research from organizations including Forrester and Gartner evaluate B2B e-commerce software and recent rankings for top performing PIM and e-commerce transaction software are available online. More important than rankings are the growing number of distributors that have purchased and used specialized software for their e-commerce efforts. The build-out of a full e-commerce software suite is known as the digital strategy. The digital strategy must be accompanied by full process review of existing functions and how to take advantage of the software. This migration to new digital capabilities is known as the digital transformation, and typically includes changes to the sales force, vendor management, pricing, and fulfillment processes among others. Firms that have a current e-commerce software suite and successfully navigate the digital transformation are winning big; they represent the 20 percent of firms that sell 80 percent of the online demand.

The new age software programs began development, for all intents and purposes, in the late 1990s or early years of the new millennium. They often started in the B2C sector and developed expertise in the B2B sector. Today, research from organizations including Forrester and Gartner evaluate B2B e-commerce software and recent rankings for top performing PIM and e-commerce transaction software are available online. More important than rankings are the growing number of distributors that have purchased and used specialized software for their e-commerce efforts. The build-out of a full e-commerce software suite is known as the digital strategy. The digital strategy must be accompanied by full process review of existing functions and how to take advantage of the software. This migration to new digital capabilities is known as the digital transformation, and typically includes changes to the sales force, vendor management, pricing, and fulfillment processes among others. Firms that have a current e-commerce software suite and successfully navigate the digital transformation are winning big; they represent the 20 percent of firms that sell 80 percent of the online demand.

You Get What You Pay For; and You Pay A Lot

With e-commerce firms winning big in distribution, we wondered why so few wholesalers haven’t upgraded their software to second-generation offerings. Many distributors, as previously noted, simply have not made a successful digital transformation. Without knowing how to amend existing processes to take advantage of the software, a software upgrade is wasted money. However, this puts first-generation software distributors at a disadvantage. As customers migrate to online buying, their expectations are driven by the latest and best sites—usually second-generation offerings. Today, some two-thirds of distributors with first-generation systems, bit-by-bit, lose to wholesalers with more modern day systems. The difference in the ease of using the new technology, its reliability, and finding what you want is a “night and day” difference. Customers who leave first-generation e-commerce offerings have experienced repeated frustrations including: not finding what they want due to poor search or low SKU count, inability to track orders or get an accurate delivery time, inconsistent pricing, or inaccurate/non-available product specifications. Online buyers are dependent on their supplier’s system for accuracy, ease of use, and current information. Repeated gaps in these variables usually sends them to the competitor’s site.

The new software and personnel to manage the online offering are anything but inexpensive. The costs are all over the map. However, based on our work with wholesalers in e-commerce, the following costs, including integration, are indicative of what one would expect to pay:

- E-Commerce transaction software $500,000 to $1MM first year or more with recurring licensing fees of $100,000 or more

- PIM software: $200,000 to $1MM including integration and ongoing consulting fees from the software provider

- Search Software: $300,000 to $750,000 for a fully designed, robust search engine

- Procurement punch out: This is, more and more, part of the e-commerce transaction software but separately can run $100,000 or more.

Most digital strategies take several years to complete but it is not uncommon for the software, and new employees to manage it, to cost $750,000 to upwards of $2MM for several years running until the capability is built-out. We use a factor of 40 percent of the average first several years’ software costs as a minimum annuity for internal personnel to manage the e-commerce suite.

Many wholesalers, when they hear these estimates, balk—and big time. There are many software vendors that say they can do what the highest ranked products can do for a fraction of the cost. Our experience with the low-cost offerings is not good—they typically can’t handle the volume of demands from customers and vendors for product, search, pricing and order tracking changes that the best products can. Hence, we tend to recommend, research and follow those vendors used by distributors that are succeeding in e-commerce.

Finding the Funds

Most wholesalers aren’t about to shell out the capital for e-commerce that runs into the millions. There are many reasons including private, family-owned firms that are often risk-averse and with high dividend shareholder expectations, past experiences with the technology that have not come to fruition, sales growth without the technology, etc. Our research, however, points to several reasons that wholesalers should consider when dismissing the need for a second-generation online digital strategy including:

- Customers will increasingly use e-commerce to purchase, review products and move business to those wholesalers with modern-day online capabilities. Currently, we estimate 20 percent or so of MRO purchases are done online and this will rise to between 30 percent and 40 percent by 2020.

- E-Commerce allows the firm to reduce operating costs and remain more competitive. Supply chain success is a history of adding value by reducing costs and passing the savings on to the customer. Enhancing productivity for the customer is a must in mature markets. Firms that can’t do this are non-competitive and lose business.

- E-Commerce allows the firm to reach new or potential customers at significantly less cost and easier than the personal sales call.

- In our work for distributors that are considering second-generation technologies, we recommend the following events for funding:

- Work with vendors to offset the cost of building out the content. Many vendors have co-op or marketing funds which can be put to work to help product content and the cost of e-commerce. Their future is directly tied to that of their distributors’ ability to embrace current day technology.

- Carefully review pricing for incremental gain. Nothing is as efficient and quick to round up needed funds than pricing; small gains can often garner big results.

- Rework the budget to find monies for the tech build-out; leave no stone unturned.

- Begin to rework the sales force to get cost out. One of the biggest areas of return on investment in e-commerce is the long term reduction in sales cost. This is an often unpopular answer, however, predictions from Forrester are that, because of the technology, there will be one million fewer sellers in B2B sales by 2020.

We often find that, when these events are reviewed, there are significant funds to develop a second-generation offering.

Facing the Future

The need for distributors to engage new technology and develop it quickly should not be underestimated. Customers in B2B markets will, more and more, search and buy online. Those who are content with personal selling, customer service reps taking

phone or e-mail orders, and using manufacturer links for product information will, sooner rather than later, lose business. Delay is imprudent at best.

Scott Benfield is a consultant for the B2B supply chain in the areas of mergers and acquisitions, operating performance improvement, and digital marketing. He can be reached at (630) 428-9311 or scott@benfieldconsulting.com. His site is www.benfieldconsulting.com.

Scott Benfield is a consultant for the B2B supply chain in the areas of mergers and acquisitions, operating performance improvement, and digital marketing. He can be reached at (630) 428-9311 or scott@benfieldconsulting.com. His site is www.benfieldconsulting.com.

This article originally appeared in the July/August 2015 issue of Industrial Supply magazine. Copyright 2015, Direct Business Media.