How are your fundamentals?

by Howard Coleman

For many, 2020 was the worst year of our lifetimes. New vaccines will reach all of our arms soon (as of this writing, however, things are not moving fast). A slow vaccine rollout may put a dent in 2021. No one is absolutely sure.

The COVID-19 crisis has, as expected, jacked-up customer use of e-commerce. One day, we’ll look back at this period as one that accelerated e-commerce adoption, for good, and hopefully enhanced business for every company that truly possesses a functional e-commerce site.

Importantly, many companies have reviewed their business models and have found points of innovation and altered their way of doing business across their value streams. Others? Not so much when it comes to differentiating improvements in business processes, technology or organizational structure. But, there is still time.

| "Value is created by removing a significant limitation for the customer, in a way that was not possible before.” |

| — Dr. Eliyahu Goldratt |

In early May of 2020, I wrote an article called “Innovation Post COVID-19 - Is This the Time To Invest In Your Company’s Future?” The one thing we can count on is change but a lot of experts were discussing “what to do” at a 35,000 foot level, an aspirational level. In other words, lacking enough granular detail and not answering the question, “Where, in your company, should you focus on innovation?” Ultimately, you have to be able to explain change to your people.

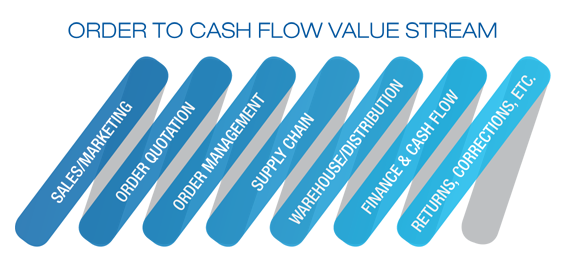

Within the value-stream summary depicted to the far right, there exist functionalities that become great targets for improvement through innovation.

Within the value-stream summary depicted to the far right, there exist functionalities that become great targets for improvement through innovation.

No list can be totally comprehensive because companies differ. But the best run and most agile organizations are asking some key questions and taking steps in the right direction.

So, here’s our take on it.

1) Business Model Assessment

In all the value stream steps, if you possess Key Performance Indicators (KPIs), you’ll already have a measure of the current state that will help you determine what to do next. If not, start thinking about the KPIs that may be most valuable to you. For a pretty comprehensive list; contact us.

Review the lifetime value of your customer and compare it to the customer acquisition/service cost within their respective channels.

Assess your sales channels and, if possible, shift resources to the best performing sectors.

Analyze customer segments and product and/or service offerings. If success on some segments have narrowed, that could mean a full court press to identify what business processes could mitigate the situation.

Of course, talk to your customers and prospects for concerns, challenges and priorities. Are there areas in which your products and/or solutions could further help the customer?

2) Financial check

Managing cash flow is always important, but right now it should take priority. Who knows what will happen, but your business needs to be in a positive position. So, calculate it under different scenarios. While prognosticators are all speculating on the shape of an upturn, it’s best to run multiple scenarios assuming that revenue shortfalls continue first half of the year, declines accelerate through-out the year, etc. Factor in seasonality and customer concentration.

Understand your operating expense run rate as it relates to your cash burn.

Tightly manage payables and receivables.

Yes, I understand your desire and need for high order fill-rates and the potential for continued supply chain disruptions, but get leaner on inventory, scrutinizing metrics like turnover, GMROI and fill rate.

3) Sales/demand forecasting and supply chain

Forecasting is hard even in normal times. In the current environment, it is particularly difficult.

Assess whether the use of re-order points and min/max, the conventional wisdom of inventory replenishment, is still relevant considering the limitations (variance) of sales/demand forecasting when most companies, to be honest, are typically swamped with safety stock.

Continuous flow inventory replenishment should finally gain traction and adoption versus those lumps of inventory that are typically ordered, forced by the conventional wisdom, and the inherent vulnerability to forecast variance during re-order cycles. Request our White Paper “The Business Intelligence & Supply Chain Management Challenge: Create Profit, Service Level & Working Capital Improvement” for an alternative view and to understand the real value of continuous flow.

4) Customer retention and acquisition

While it may be difficult, it is paramount that every company focuses on retaining and servicing existing customers. It may be your best source of revenue since you already have an existing relationship. New customer acquisition is trickier, but it is where low-cost and different marketing strategies can come into play.

Focus efforts on market segments that are essential or least impacted.

Reassess how you go to market. Focus on your value as a partner. Demonstrate how you can help or alleviate customer worry.

This crisis has generated a lot of creative thinking regarding changes to inside sales/counter sales responsibilities. Look at organizationally restructuring the responsibilities of handling order taking, providing customer service/order status and outside sales support. Have outside sales reps focus on developing new accounts, introducing new products and making more consultative sales calls, no longer just acting as order takers.

Reassess marketing and sales messages (your external branding) whether being delivered by sales, on your website, in direct mail, in virtual events, etc.

Email marketing, properly targeted, could be immensely effective.

5) Distribution centers and warehouses

Wholesale distribution should be moving toward a centralized distribution network, providing inventory reduction opportunity, better service levels and distribution cost reduction. There is no practical reason why these success factors always have to be in conflict with one another.

The last few years have seen the introduction of several new warehouse designs and material handling, storage concepts and technologies that save space by increasing product density and increasing product picking accessibility, resulting in increased speed-of-flow through your facilities.

Your B2B customers will have more expectations just like B2C does, expecting increasingly faster delivery. So, offer other product order delivery choices, including night-time/early morning (before 6:00 a.m.) delivery. Learn more about third-party (3PL) logistics, faster and customer convenient last-mile delivery options.

One of our recent podcasts shines a light on what other companies are thinking about and are doing. Visit: https://www.buzzsprout.com/921511/6237823.

Remember, it’s really all about reducing future costs of distribution, as your company grows.

6) Health and safety

Coming back to work, opening up more to customers and engaging with suppliers and other partners has a major impact on every part of your value stream.

Examine and work within city, county, state regulations and CDC guidance.

If you already haven’t done so, develop a recovery plan for your facilities that includes how closely teams will work together, cleaning and hygiene supplies, cleaning services and protective equipment under a post-COVID environment. At least for a time, normal will not return just because we got vaccinated.

Consider what travel restrictions will continue.

What’s your approach?

It’s an ambitious menu and, as noted earlier, not meant to be comprehensive. Your innovation efforts have to occur below the clouds, not at 35,000 feet. Although there is ambiguity and uncertainty about the future, your business must have clarity in its strategy, tactics and objectives.

In developing your playbook, develop a well-defined gap analysis describing the innovative leaps you’ll need to take to either catch up or take the lead from your competition. Of course, not every initiative will be equal in effort or ROI. Focus on making the customer the only thing that matters.

Your organization should have confidence that it has the capability to close these gaps – the points of differentiation – as quickly as possible, or can engage partners with the required expertise to guide and assist in the development of your specific roadmap.

Feel free to look here www.mcaassociates.com/competitive-advantage-assessment.html for assistance.

There is still time to invest in your company’s future. What will be in your playbook?

Howard Coleman is principal of MCA Associates, a management consulting firm that has worked with wholesale distribution and manufacturing companies since 1986 seeking operational excellence. Contact them at (203) 732-0603 or at hcoleman@mcassociates.com.

Howard Coleman is principal of MCA Associates, a management consulting firm that has worked with wholesale distribution and manufacturing companies since 1986 seeking operational excellence. Contact them at (203) 732-0603 or at hcoleman@mcassociates.com.

This article originally appeared in the March/April 2021 issue of Industrial Supply magazine. Copyright 2021, Direct Business Media.