The Digital Transformation

By Scott Benfield

The call for e-commerce growth in industrial distribution markets is out. Our customer surveys find that nine out of 10 distributor customers say they will increasingly move purchases online at the rate of a 10% increase per year. Today, for the North American MRO sector, with estimated sales of $150 billion, approximately 20% of the purchases ($30 billion) are online. However, the distribution of wholesalers that participate in online transactions is skewed; 80% of the online transactions are performed by 20% of the wholesalers. We don’t expect this imbalance to last, however, most wholesalers have significant investment in software to catch up.

Technology costs for e-commerce upgrades on what we term Second Generation systems runs around $2 million. As detailed in Industrial Supply’s July/August issue, the technology build-out is part of the Digital Strategy and includes PIM (product information management), B2B e-commerce transaction platform, procurement punch-out, and faceted search software. The modern online customer experience expects the capabilities yielded by these software modules. It is very difficult to provide a quality online experience without them.

Investment in a modern-day Digital Strategy can be daunting, both financially and managerially. We expect software costs to come down as more distributors engage the newer offerings. We also expect that some wholesalers, that don’t want to make the investment, realize it is time to sell the firm. Hence, consolidation will proceed at a healthy pace as firms simply do not want to capitalize a modern e-commerce platform.

The Digital Strategy or digital assets of the firm are important to driving customers to online ordering. However, there are plenty of examples in the wholesale sector where investment in a modern digital strategy has taken place but online sales proceed at a snail’s pace. Why? The firm didn’t correctly align the existing processes with the Digital Strategy. In essence, operations, sales, marketing and financial functions all remained the same. The e-commerce effort was stuck on top of existing operating procedures like a cherry on top of an ice cream sundae. Predictably, the e-commerce effort under these circumstances is deemed a failure and, too often, executive management blames the technology and not themselves for a poorly designed Digital Transformation.

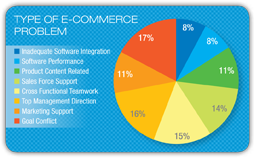

Where the Transformation Goes Wrong E-commerce problems can vary widely. In Exhibit 1, we grouped problems across eight separate areas from software performance to goal conflict. In the exhibit (multiple responses permitted) we asked wholesalers what were the most nagging problem areas in their e-commerce efforts. Areas related to the Digital Strategy (software and IT) are software integration, software performance and product content. The responses range from 8% to 11%. When compared to the issues from Digital Transformation (managerial direction, marketing, sales force support, etc.) we found the percentages ranged from 11% to 17% of respondents. The overall weighted numeric average finds that over 70% of e-commerce problems are related to the Digital Transformation and not the Digital Strategy.

E-commerce problems can vary widely. In Exhibit 1, we grouped problems across eight separate areas from software performance to goal conflict. In the exhibit (multiple responses permitted) we asked wholesalers what were the most nagging problem areas in their e-commerce efforts. Areas related to the Digital Strategy (software and IT) are software integration, software performance and product content. The responses range from 8% to 11%. When compared to the issues from Digital Transformation (managerial direction, marketing, sales force support, etc.) we found the percentages ranged from 11% to 17% of respondents. The overall weighted numeric average finds that over 70% of e-commerce problems are related to the Digital Transformation and not the Digital Strategy.

Our field work finds that distributors tend to worry more about the Digital Strategy (software, integration, product content) than about existing processes and policies surrounding the use of the technology once it is built out. The managerial focus and problem solving revolves around getting the software up and running. This focus is justified by the capital spend on software and related capabilities that can run into seven figures.

The concentration of managerial time and effort on the Digital Strategy is not, however, where most of the long run problems with e-commerce occur.

Existing processes and their adoption to the Digital Strategy are the overriding cause of poor online sales. The gross assumption is that since the existing processes have been in place and the firm has been successful, they can be easily transferred to ensure a successful e-commerce effort. Our post-mortem field work of e-commerce in distribution markets supports the research in that existing processes are where seven out of 10 major implementation issues exist. The reality is counter-intuitive to most distributors and especially to executive management. The paradox needs examination before millions more are spent on the Digital Strategy, only to see the investment(s) fail.

Laundering Transaction versus a Strategic Change

In our recent survey of MRO/industrial distributors and their customers, most distributor executives view e-commerce as a tactical change. Usage of the technology is expected to reduce existing costs, make processes less cumbersome for the distributor and customer, and allow the customer to self-service. The direction is toward greater efficiencies which, while straightforward and intuitive, is a limited view of the scope and power of the technology and is where the Digital Transformation problems are seeded.

The focus on efficiencies are a focus on transactions done more efficiently from the existing base of operations. In many instances, efficiencies for one part of the channel (distributors) become more work for another part of the channel (customers). If the technology is not Second Generation, we find where customers would often be better off calling the order in to sales than attempting to place it online. First Generation technology has a plethora of problems in order quality including inaccurate content, limited content, poor search, inaccurate or non-existent pricing, hidden fees, misleading shipping dates and inaccurate inventory levels, among others. These order problems are the reason that we see a demand by customers for the most current technology, which some two-thirds of distributors do not have, and which will drive a sizable software build-out in the next five years. But these problems can be largely solved by Second Generation technology used by 20% of wholesalers that consummate 80% of the online sales. Therefore, technology or the Digital Strategy is workable—it has been successfully done and is thriving for many firms.

The understanding of strategic changes to the marketplace, in the eyes of the customer, are often generational and where Digital Transformation problems are rooted. In years prior to e-commerce, the distribution firm commanded the attention of the customer. Distributors were the place where knowledge of product, vendor sourcing, pricing and availability were available on a reasonably timely basis. As products matured and distribution consolidated, the hold of the distributor on the value elements of product, place and price were strengthened. The advent of e-commerce and the greater change in digitization of information, changed the basic value component of most distribution industries. Product information, availability and pricing could be accessed online and at one’s convenience. The combination of advanced logistics and inventory consolidation to larger warehouses meant less of a need for the brick and mortar of the local branch. Furthermore, for commodities, sales support was successfully unbundled from the product, hence the rise of non-traditional distribution models where customers could order at a low price without the over-burdened cost of sales support spread across their transaction(s).

E-commerce and the larger digitization of durable goods markets meant that the distribution firm, with the local branch experts, had more competition than ever, including new entrants and manufacturers selling direct. The changes wrought by the technology are strategic which, by definition, are large in scope and not tactical. And tactical thinking regarding efficiencies in existing processes is where most distributor executives and managers place e-commerce. Hence, the cognitive dissonance regarding e-commerce is the way in which distributor leaders view their value proposition in a digitized future.

E-commerce and the digitization of the supply chain changes core value elements of product knowledge, service support, pricing competitiveness and inventory availability. Customers want the information as they did in the past but the means, speed and ease at which they access it has changed from a primarily human to digital process. Mastering the digital processes means changing the core value elements of the firm; investing in new ways to add value while de-investing in others. This, more than anything else, is the root of the problem in the Digital Transformation; it is a strategic change that finds success in changing the infrastructure commensurate with market and generational changes.

Much change will need to accompany the Digital Transformation. Sales, operations, branch location, marketing and performance measures will all undergo changes to ease into successful digital commerce. We will cover the more prominent changes and their pitfalls in our next article.

Scott Benfield is a consultant for the B2B supply chain in the areas of mergers and acquisitions, operating performance improvement, and digital marketing. He can be reached at (630) 428-9311 or scott@benfieldconsulting.com. His site is www.benfieldconsulting.com.

Scott Benfield is a consultant for the B2B supply chain in the areas of mergers and acquisitions, operating performance improvement, and digital marketing. He can be reached at (630) 428-9311 or scott@benfieldconsulting.com. His site is www.benfieldconsulting.com.

This article originally appeared in the Sept./Oct. 2015 issue of Industrial Supply magazine. Copyright 2015, Direct Business Media.