Trials and Tribulations of Sales Growth in an AmazonSupply World

(First in a Series)

Why placing outside sellers in geographic roles won’t work all that well in the post-recession AmazonSupply economy and why wholesalers need a much broader understanding of how to grow a century old business platform.

|

|

Distribution Research Project |

|

What's this? Get a free Executive Summary on our 2013 Growth Research |

by Scott Benfield

Four years after the bottom of the Great Recession, the DJIA is beginning a climb back to pre-recession highs. The average’s rise is based on solid signals that the worst of the recession and its anemic recovery may be over. Economic news, from most fronts, is better than it has been in some time. Construction appears to be on an upswing and housing is, for the first time in many years, slated to be around the one million mark in new startsi. In normal times, the construction sector can drive 20% or more of the GDP and the housing market has been at a 50% of long-run average for much of the recession.

Construction is a massive sector and drives industries as diverse as textiles to steel. Distributors that sell to construction markets will benefit from overall market growth as well as those that sell to manufacturing.

The recovery, while offering relief to many sectors, will be trying for many in the distribution trade. Why? Our work since the Great Depression finds that the traditional model of distribution is in a slow, but protracted decline. Distributors that want to grow will need to expand their definition of growth and may need to redefine their business models.

A Reason to Change

In two different wholesaler sectors in the past six months, we’ve presented the evidence of decline of the traditional distribution model. The reactions have been mixed and, as expected, not without some consternation.

The evidence for a decline of traditional distribution follows recent research, much of it done outside the industry, and much of it pointing to outside entrants chipping away at markets covered by distributors. A compilation of the researchii can be found in our series “The Value Decade” including:

- Statistics from the Bureau of Economic Analysis and U.S. Census that show durable goods wholesale distributor sales declining as a percent of GDP from 20% to 14% during the period of 1995 to 2010

- No real improvement in labor costs as compared to revenues in the past two decades for the wholesale trade

- Negative free cash flow profile of -7% for the industry for 2011 and placing the wholesale trade 39th of 44 sectors of the U.S. economy

- Movement of construction and MRO contractors to suppliers with robust e-commerce models where 58% of respondents used hand-held devices to check price and availability

To add to this evidence, we received a copy of research done (October 2012) by the Boston Consulting Group on the effects of AmazonSupply compared to wholesale distribution, which shows a typical price differential of 25% lower prices on common distribution items when comparing Amazon to select distributorsiii.

Finally, in interviews with half a dozen Fortune-rated manufacturing companies regarding their wholesale distributor sales, all admit that their traditional wholesale markets are in decline versus other channelsiv. The research unequivocally points to significant changes in the dominance of wholesaling in B2B supply chains, and many of these changes are yet to reach their peak. The research, however, is symptomatic of change in distribution-dominated markets but it does not explain causality. The causes, we believe, are the result of globalization of manufacturing, development of the Internet as a transaction tool, and advanced cost-to-serve models that give supply chain entities a keen understanding of the costs of varying channel configurations. When combined, these events create a vastly different environment for distributors in the second decade of the New Millennium.

The Bundled Model and Inefficiency

For all intents and purposes, wholesalers operate a supply chain model that we refer to as a full-service or bundled service model. Referring to Exhibit 1, we use the illustration of the existing wholesaler business model as a bowling ball strategy. In essence, wholesale firms wrap products and services into a “bowling ball” and roll it out to score with as many customers as possible. The current income of the model typically allows for a 25% gross margin on sales and 2.5% before tax return on sales. The problem with the “bowling ball” strategy is that it doesn’t align service costs commensurate with the customers’ use or want of them. In modern-day cost-to-serve modelsv, it is common to find that 40% of customers or transactions drive 130% or so of operating profitsvi. This model of buy/sell supply transactions went unchallenged for close to 80 years until Amazon and other e-commerce-based firms began to appear in the mid 1990s.

Amazon and supply chain businesses we term as Transactional Distributors operate from a much lower cost base than traditional distribution including scant sales forces, limited customer service, no local branches and limited brick-and-mortar installations. These companies quickly build volume and establish best-in-quality-and-cost global supply chains. They typically can reduce prices 20% to 30% less than traditional full-service (bowling ball strategy) distribution and earn returns that are 2x to 3x greater than traditional wholesalers.

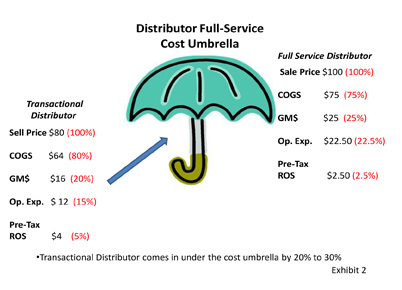

Many wholesalers doubt that their prices can be reduced, in the long run, by 20% to 30%, especially since they average a 2.5% return on sales. Exhibit 2 gives an example in what we typically find when traditional full-service distributors encounter a transactional competitor. The cost base of the full-service distributor creates a cost umbrella and the typical income statement, modeled on $100, is at the right of the umbrella. For every $100 sold, cost of goods are $75, margin dollars $25, operating expenses $22.50, and the pre-tax return on sales are $2.50 (2.5%).

At the left is a representative income statement of a transactional distributor. The sales price has been reduced to $80 and the cost of goods are $64 or 80% of sales. The reduced material cost is hinged on our research that transactional distributors have global supply chains and private label items averaging 30% less in cost than branded items. In Exhibit 2, half of the cost of goods are modeled as being private label items. In addition to sourcing cost advantages, transactional distributors have cost advantages in their service platform. These include targeting low-cost transaction types including stock sales of A and B items and direct shipments and discounting by transaction size (in dollars) which further leverages operating costs. Most transactional distributors have few outside sellers and limited customer service. Outside and inside sales costs are the largest single cost differential(s) for traditional distributors versus low-cost models. They are often 50% or more of the traditional distributor’s operating expenses. Knowledgeable sales reps were a necessity in the pre-Internet/pre-ecommerce days of B2B channels as they translated the products, pricing and services to the customer. Today, however, with the use of e-catalogs, e-commerce and solicitation strategies via the Internet, an order that is handled by a full sales complement is a luxury that end customers may elect not to pay for.

Redeploying the Sales Effort

Traditional wholesale distribution is a culture dominated by the sales rep. Our work in helping traditional distributors come to terms with low-cost models of distribution includes getting management to understand that the sales effort must be focused in new and different ways to unequivocally add value or the parent firm will suffer.

Most wholesalers have predictable and simple formulas for allocating the outside sales effort. Territories are comprised of a group of accounts within a geography that limits “windshield time” and maximizes “face-to-face time.” Compensation is typically done on the pool of territory margin dollars with the seller getting some portion of income in the form of salary and bonus or salary and commission. The problems with geographic territories and margin dollar compensation, in the here and now, are numerous including:

Customers can search price and availability on the Internet 24/7 and often from dozens of suppliers. This means pricing will be compressed with the ability to fund sellers less than it was before the days of e-commerce. Hence, transactional distributors do well in the new environment.

Margin dollars, as a singular metric, have little to do with how much the territory contributes to operating profit. Only when margin dollars are paired with their fulfillment costs can a distributor tell if the account and territory contribute to operating profit. It is becoming common knowledge that only 40% of transactions and accounts contribute to operating profit while the rest have a miserably low or negative profit return.

Geographic-only allocations are unspecific and drive efficiencies for salary and expenses. The allocation has little to do with unique customer needs or the ability of the seller, hence the differentiation of geographically allocated territories is poor and the ability of the wholesaler to maximize income and demonstrate value through the sales effort is low.

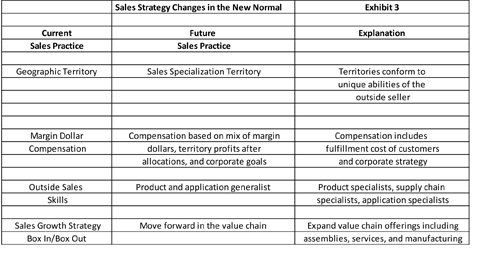

If the outside sales effort survives, it will have a very different configuration including the allocation of the sales effort, and sellers will be used in ways that, today, are seldom considered. In Exhibit 3, the current sales practice is listed and is compared to its replacement in the Future Sales Practice column. Explanations are given for each common practice.

Geographic territories will move to territories geared toward specialization. We see specializations conforming to a change in sales skills including product specialists, supply chain specialists and application specialists. The explicit goal of each specialist is to work very closely with customers to reduce redundant costs in the customer’s sphere of operations. Cost reduction can be achieved in supply chain, factory floor or new product related areas. Many wholesalers argue that they do many of these things today, however, our consulting work with distributor outside sellers finds that the vast majority are still generalists and have geographic territories. In the future, we believe that generalists will be greatly reduced and many accounts where revenues aren’t large enough or who don’t value sales specialists will opt for a transactional service platform.

As the role of sellers moves from generalist to specialization through consultation or enterprise selling, the sales strategy of the firm will change also.

In the last entry under the Sales Practice columns, the sales growth strategy moves from a box in/box out offering surrounded by commodity services to an expanded role where the wholesaler moves further into the value chain. Several wholesalers have made or are making this transition, including developing assembly operations, buying or creating unique services for their products, and even manufacturing products for unique customer needs. We will introduce these new areas of growth in our second part of the “Sales Growth” series.

Scott Benfield is a consultant to B2B distributors and manufacturers in the areas of marketing, sales, operations and strategy. His firm is located in Chicago and its offerings can be seen at www.benfieldconsulting.com. Scott can be reached at (630) 428-9311 or scott@benfieldconsulting.com.

i) McBride, B. “Calculated Risk Blog,” 2013 Housing Forecast, at www.caculatedriskblog.com, December 2012.

ii) Benfield, S. “The Value Decade, New Operating Rules for Durable Goods Distributors,” Industrial Supply magazine , September/October 2012.

iii) Hohner, D. “Amazon and Wholesalers,” research and presentation by the Boston Consulting Group, October 2012.

iv) Benfield Consulting research for Fortune rated firms in the industries of: Power Tools, Industrial Fasteners, Plumbing Supplies, Paper, and Janitorial Supplies. (2010-2012)

v) Benfield, S. “Follow the Value Streams,” White Paper, Nov. 2011 at benfieldconsulting.com. “Modern Day” cost allocations refer to standards established by Robert Kaplan of the Harvard Business School-2003-2007.

vi) Byrnes, J. Islands of Profit in a Sea of Red Ink, Penguin 2010, and Benfield, S. “Building Value: DrivingWholesaler Returns Through Strategic and Tactical Investment, Bencon Press, 2012.

Great article. Hopefully associations like ISA will take these facts to heart and develop programs/processes that will help the traditional distributor change his business model.