Take Time and Cost Out of Your Inventory and Supply Chain

Exploit the Constraints of Forecasting!

by Howard Coleman

Do you feel that your current inventory and supply chain business processes are not delivering their appropriate contribution to your operational excellence objectives? Do you want to leverage your supply chain and move it to the next level because you are no longer satisfied with just incremental improvement? Are you looking for ways to unlock capital? Regardless of your specific motivation, I expect that you understand that excellence in inventory and supply chain management drives value; that fundamental flow of materials, product and information from suppliers, through your company to its customers. And that supply chain is not just about warehouses, forklifts and trucks.

Do you feel that your current inventory and supply chain business processes are not delivering their appropriate contribution to your operational excellence objectives? Do you want to leverage your supply chain and move it to the next level because you are no longer satisfied with just incremental improvement? Are you looking for ways to unlock capital? Regardless of your specific motivation, I expect that you understand that excellence in inventory and supply chain management drives value; that fundamental flow of materials, product and information from suppliers, through your company to its customers. And that supply chain is not just about warehouses, forklifts and trucks.

I’d like to describe to you a more radical approach – a strategy – a change in thinking successfully adopted by companies both within the distribution and manufacturing sectors. Maybe I would even call it an alternative to those approaches that have been worked to death for years; squeezing costs and assets.

What I want to address here is a more elegant solution to the “how much of what, where and when” questions.

Don’t Be Chained To Old Thinking - Make Distribution Lean

So to begin, I need to tell you that I’ve developed a few serious concerns about companies accepting incremental improvement.

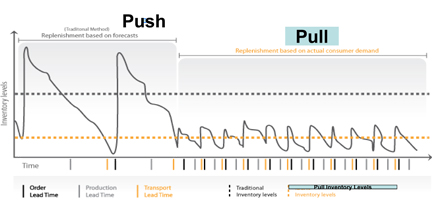

First, there is the confusion that is sometimes created by “experts” who seem to be stuck in the “push world.” Push world? Yes, it’s those folks still stuck in the '90s, or earlier (the ROP/EOQ and Min-Max world), who continue to suggest that “better forecasting” (i.e.; more accurate forecasting) and warmed over inventory management concepts are still the key to best practice in wholesale distribution inventory and supply chain management. What they commonly advocate is generating a replenishment order (purchase order, stock transfer, etc.) based on forecast and a calculation of when product will be needed in the future (based on inventory balance, lead-time and safety factors, etc.) and then push that product downstream, from suppliers, through DCs to all of your branch locations.

Secondly, what seems to be a desire to maintain the status quo – optimize the old rules, remain prisoners of and chained to their own thinking – rejecting what appears to be counter intuitive, or contrary to mainstream thinking. Just maybe it’s a disturbing lack of open mindedness to new concepts in the distribution inventory and supply chain management playbook, new concepts which are receiving wider acceptance in the distribution world, whether wholesale-distribution, retailing or manufacturing (they distribute too!).

Some would say if we could only develop better forecasting algorithms (or better use the ones we have) to make intelligent decisions, then we have the answer to “the right quantity of the right item, to the right location, at the right time” (a tough nut to crack under any circumstances!). Right? Wrong!

Have you ever measured your forecast accuracy? Many companies haven’t and yet many complain about accuracy. Frankly, I rarely see any better than 70% to 80% accuracy (that’s 20% to 30% error). In response, companies try to improve their systems and processes for forecasting and inventory replenishment planning, sometimes at the expense of execution and management. Some spend a lot of time and money on it. Most have pretty extensive enterprise resource planning systems in place to translate forecasts into product distribution plans – from suppliers to the distribution center and across all branches (sometimes even direct from the supplier to the branch) – all the while attempting to optimize transportation costs, customer service, warehouse capacity, inventory dollars and turns, etc. So why do we still hear complaints about forecasts, misallocation of product and, very importantly, why do so many wholesale distributors still achieve mediocre inventory turns? If in fact, we can agree at some level that forecasting is a constraint, then why not attempt to exploit that constraint?

You know, many manufacturers have been lean advocates a lot longer than most wholesale distributors. Historically, most manufacturers customarily focused on push-based planning to initiate their production orders as a way to reduce their set-up costs, total labor and capacity constraints. Many have made a 180 degree turn in the conventional wisdom to something called “pull," that is, planning and execution based on “actual consumption of product or material.” In other words, they drive the execution of production, its movement and product positioning based on downstream consumption (some call it the customer’s “buy signal” or just simply “actual demand”). They’ve established “target inventory” as a means to buffer uncertainty. They have focused on the bottlenecks to optimize their inventory drivers and modified those drivers where necessary. In wholesale-distribution, we seem to hear little conversation about this because distribution planning has historically been one of forecast-based push.

Unfortunately, forecast-based push systems ask us to forget that we always have excess inventory. In other words, the inventory we call safety stock – the inventory we don’t often choose to “see” or acknowledge – the inventory we plan just to offset the variation inherent in most forecasts.

Why Does Lean Pull-Based Planning & Execution Deliver Results?

I often say that inventory is the least optimized distribution resource in terms of undervaluing its costs or penalties. We forecast and plan by SKU. We have DCs and branch warehouses to house inventory. We have purchasing and supply chain managers and their staff(s). We have physical inventories and cycle counting to ensure accuracy. And we have special sales sometimes to clear out excess inventory. Often, these costs are not considered; rather carrying costs are generally limited to the cost of capital, insurance and maybe some factor for obsolescence and/or shrinkage. Computed in this customary way, they rarely add up to a trade-off of inventory versus transportation or other costs.

This rationalizing of inventory costs was an issue for many manufacturers also. The “lean ones” found they could have it both ways, with lower production rates, excellent customer service and low inventory. Again, they challenged the conventional wisdom that said we must have sufficient inventory to optimize transportation and meet customer demands.

The break in conventional wisdom for some manufacturers came through lean thinking approaches to reducing their production batch sizes and production cycle times. It led to more frequent resupply to their whole supply chain. I believe this type of lean thinking can do the same in distribution! In reality, only the terminology is different in distribution; order quantities and replenishment frequency interval now replace what manufacturers call batch sizes and production cycle times, respectively.

Pull processes and the placement of target inventory/buffer inventory are real and new answers for distribution. But, of course, any transformation requires some changes in thinking, especially when process change is involved,

So, here are some basic “pull concepts”:

- Forecast accuracy and stability can be improved through aggregation of demand across warehouses. In other words, use the DC level forecast for planning and concentrate buffer inventory at the DC aggregation point. The variation in demand at the DC is typically less than at the branches.

- One of the most radical departures from existing norms, and a critical transition, is to pull inventory back from branches. I know, it’s scary, isn’t it? No, not all the inventory! Again, keep in mind that forecast variance is highest at the branches. It’s just a statistical truth! Strategic inventory positioning, therefore, becomes paramount. So why not move some of that safety stock to the DC, where it can best protect the whole distribution network?

- Inventory levels should be a function of replenishment time and frequency. Focus on reducing the lead time and increasing the frequency of replenishment – the resupply (those are the inventory drivers!) – not just safety stock factors. As the frequency increases, the more you will be driven by actual demand. Put another way, “pull” initiates replenishments closer to the actual quantities that were actually sold and shipped to customers, minimizing the poor decisions surrounding inventory allocation.

- Allow “pull” to create a replenishment stream – a continuous flow – of inventory to stocking locations (from supplier to DC, from DC to branches). Increasing the frequency of replenishment increases the speed and velocity of the supply chain. In other words, it increases through-put!

- See the chart below. I happen to think “it’s worth a thousand words.”

- Planning can continue to be based on forecasts, while execution will be driven by an actual demand-driven model.

- Target inventory, let’s call it buffer inventory, is not some reorder point or min/max calculation (Refer to the whitepaper offered below for how it’s calculated). In other words, it’s not used to trigger replenishments, but rather it’s meant to be monitored. The target/buffer inventories can be dynamically adjusted to accommodate real-life situations such as product introductions and ramp-up, trending, seasonality considerations, etc. The figure below shows, as an example, the target/buffer inventory broken into three zones (red, yellow, green). The real intent here is to monitor demand variation and buffer inventory penetration, not necessarily the inventory level. What results is more of a replenishment monitoring mechanism focused on visibility to the health of the system.

- For any one distribution network, obviously there may be no one single answer – it’s dependent on your particular distribution network, geography, and even the level of external supplier collaboration you may have been able to develop. But it doesn’t absolve us of the need to apply some lean principles, break down the bottlenecks, the constraints, and not ignore the inventory drivers – not be so forecast driven.

A Call to Action:

It’s time to move away from the old Gordon Graham “Distribution for The '90s” inventory management methods – the addiction to inventory – the total reliance on forecast accuracy, and the mediocre inventory turns that typically result, and that wholesale-distributors, for too long, seem to have accepted.

“Pull” brings the concept of “total cost of ownership” to the forefront. Now, if your reaction to all of this is a concern about transportation costs or maybe even labor costs, then do a cost analysis. Using the paradigms above, I’m confident that you will find a trade-off point (a total cost approach) that provides better results than what you’ve obtained previously. Trust me, it won’t be easy work; your own mindset will have to change first and you will have some issues, maybe, with some employees and/or suppliers who need to think differently too (that’s a topic for another time!).

So, no one is really saying don’t forecast. Start with a forecast, particularly for longer-term and overall business planning, but be wise about committing to strategic inventory positioning and replenishment, recognizing the inherent inaccuracy of forecasts and the diminishing returns of spending more time and dollars on it just for some small incremental improvement. Use pull-based replenishment execution to exploit the constraint!

As is always the case with newer solutions, the focus is on a change in thinking – policy, procedure, measurement, and ultimately on behavior. So this is not about some technology project. Rather, it’s about a business improvement project.

For a complimentary copy of our recent white paper which more fully describes this radical change in thinking, please e-mail me at: hcoleman@mcaassociates.com.

Howard Coleman, principal of MCA Associates, a management consulting firm since 1986, works with wholesale distribution and manufacturing companies that are seeking operational excellence. Our staff of Senior Consultants provides operational excellence – idea leadership - and implements continuous improvement solutions focused on business process re-engineering, inventory and supply chain management, sales development and revenue generation, information systems and technology, organizational assessment and development, and succession planning. MCA Associates may be contacted at 203-732-0603, or by e-mail at hcoleman@mcaassociates.com. To learn more, visit www.mcaassociates.com.