Selling your business?

by Joseph Thompson

Based on my recent experience in selling my business of 25 years, I know that deciding on the right time to sell can be a difficult decision for any business owner. Although selling is a process most business owners will go through only once, it’s one that most will need to undertake at some point. A substantial number of the baby boomer generation have reached retirement age and selling their business allows them to achieve three main goals: removing themselves from day-to-day operations; monetizing the value of their business in order to enjoy their wealth; and, “taking chips off the table” or limiting their downside risk by diversifying their wealth by making other investments.

Admittedly, there are significant benefits to selling. However, there are also many risks. One key thing for sellers to realize is that the highest offer they receive is not necessarily the best one. Offers are often difficult to compare “apples to apples.” Further, the form of compensation and the types of potential buyers are important considerations. Often, owners do not have clear succession plans in place and must decide to whom they want to sell their business. This decision is arguably the most important part of the selling process and understanding the pros and cons of the different types of buyers is essential.

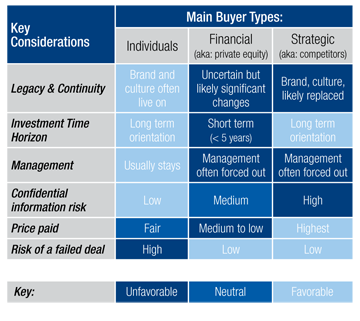

When sellers begin to examine the universe of potential buyers, they discover that buyers can be categorized into three main groups: Financial buyers (“private equity” or “family offices”); Strategic buyers (the seller’s competitors, suppliers, or customers); and finally, Individuals (entrepreneurs and employees from within the company). Each group has significant advantages and disadvantages. For example, strategic buyers can often pay the highest price for a business due to the synergies they can extract by optimizing processes within or between their existing business and the acquisition. However, these synergies often come at a cost – with employee and management layoffs commonly being a chief source of the synergy value realized. Further, in due diligence (a fact-finding and investigative process) before completing the sale of the business, the seller will be required by these buyers (who are competitors, customers, or suppliers) to release highly sensitive customer lists and details on profit margin and other competitive advantages. If the deal should fall through, the other party walks away with this confidential information, which could be very damaging to the seller.

When thinking about the types of potential buyers a seller is likely to encounter, the chart to the right can be a helpful reference guide.

When thinking about the types of potential buyers a seller is likely to encounter, the chart to the right can be a helpful reference guide.

As shown in this chart, another key consideration when selecting a buyer is the risk of a failed deal. Before a company can be officially bought or sold and money wired, due diligence must be performed. Due diligence requires costly lawyers and accountants. More importantly, it consumes hours of the seller’s time. The worst thing that can happen is for the seller to get all the way through due diligence and be ready to close and complete the transaction when the buyer suddenly ends up not being able to close. In these situations, sellers are left at the altar. This can be an incredibly frustrating, costly and damaging exercise. Often, the seller will have incurred substantial professional fees and wasted hours of valuable time. Further, key employees and customers may have learned of the impending sale and decided to move on. For these reasons, selling to an individual may be riskier than selling to a firm with significant financial backing.

While most of the key considerations noted on the chart can be reliably applied to these buyer categories, it’s important to note that there are a few exceptions. For example, very small firms known as “search funds” have emerged over the last decade. Search funds are small firms founded by entrepreneurs that raise capital from investors with the sole purpose of acquiring a small- to medium-sized business. Often the searchers are graduates of top MBA programs who go on to run the business in the former owner’s place, providing a fresh perspective and bringing a new skillset. Many sellers find comfort with this type of buyer as they consider the legacy they are leaving to the new owner of the business.

Al Danto, a lecturer in enterprise acquisition at the Jones Graduate School of Business at Rice University, believes that search funds can offer sellers many benefits when compared to other buyer categories. For example, he notes that search funds can be more flexible on deal terms. “Often a business owner wants to take capital out of their business while also still retaining some upside. Search funds have been known to offer sellers the opportunity to reinvest, which can be very attractive with the new energized owners in place,” Danto noted. “Additionally, searchers’ skillsets and knowledge in areas like digital advertising, data analytics and other emerging technologies may allow formerly stagnant businesses to achieve new levels of growth and energy.”

There are other exceptions. Private equity firms typically have a fixed investment horizon based on their agreements with their limited partners (investors) which forces them to sell investments after only a few years. This is obviously a concern for a seller who wants to have some certainty about who or what will own their business down the road. “Evergreen” funds are meant to address this issue by structuring their investor agreements to allow for much longer term holding. “Family offices” are similar and are generally run as private companies that make longer term investments on behalf of a wealthy individual or family.

Pegasus Industries (www.pega-industries.com), an investment firm based in Houston, Texas, with whom I serve as an advisor, fits somewhere in between a search fund and a family office. Unlike private equity, which focuses on maximizing their three- to five-year return on a business, Pegasus has a long-term investment horizon and strongly prefers to keep employees and brands intact post-acquisition. The firm’s leadership is made up of entrepreneurs with both financial and operational expertise in order to bring the benefits of both an entrepreneurial and financial buyer, while minimizing the downsides of both.

In addition to understanding key buyer types, a wise seller should insist on having competent business advisors, including an attorney and accountant on their side. While many sellers have existing relationships with attorneys or accounting firms who may seem like obvious choices for representation, often these intermediaries have limited or no expertise in mergers and acquisitions. Qualified attorneys and accountants specialize in M&A because it requires a unique set of skills and knowledge. Sellers should ensure that whichever third party they decide to use has adequate experience in this field. It may also be a wise decision to hire an intermediary that specializes in selling businesses, known as a “business broker” or “investment banker.” Further, owners should plan ahead for a sale and maintain thorough and accurate accounting and financial records.

As I learned first-hand, selling a business is no small feat for an owner. Often, it can be an intimidating and bittersweet process. It is important for owners to realize the potential pitfalls of a sale. By arming themselves with an understanding of the process, a few basic tools, and the right team of advisors, a seller can ensure that one of the most important decisions of their career is the right one.

Joseph Thompson served for 27 years as executive V.P. of NAHAD, the Association for Hose & Accessories Distribution and as founder and CEO of Thompson Management Associates LLC, the association management firm which manages NAHAD, the FPDA Motion & Control Network and eight other industry trade organizations. For information about Pegasus Industries, or to discuss your business transition plans, in complete confidence, visit www.pega-industries.com or call Joe at (713) 826-1807.

Joseph Thompson served for 27 years as executive V.P. of NAHAD, the Association for Hose & Accessories Distribution and as founder and CEO of Thompson Management Associates LLC, the association management firm which manages NAHAD, the FPDA Motion & Control Network and eight other industry trade organizations. For information about Pegasus Industries, or to discuss your business transition plans, in complete confidence, visit www.pega-industries.com or call Joe at (713) 826-1807.

This article originally appeared in the March/April 2019 issue of Industrial Supply magazine. Copyright 2019, Direct Business Media.