Manufacturers, do you understand your distributor?

by Frank Hurtte

Lately, I have been thinking about how many times I have heard one of these phrases:

“Distribution is a cornerstone of our business.”

“We can’t serve our customers without a healthy channel.”

“Our distributors are our partners.”

These sentiments are good to hear and great fodder for distributor meetings, but do actions by suppliers match their words? More importantly, do the people closest to the distributor truly understand, or believe, those words?

Ironically, over the course of my career in distribution, I have also heard a variation of these rules for working with a manufacturer from a local supply partner:

Rule One: We are the manufacturer; you are the distributor.

Rule Two: The manufacturer is always right.

Rule Three: When in doubt refer to Rule Two.

It’s possible I may have been packing a bad reputation and attitude at the time, but I have learned I am not the only distributor manager privy to this message. Dozens of distributors have called me in a fit of anger and frustration after hearing the same message.

To be fair, our supply partners have their own sets of frustrations. It seems distributors also use special catchphrases. Here’s what our manufacturing partners report:

Regardless of the product, competitive situation or need to apply resources, my distributors always ask for more margin. Yet, when I ask for some justification, they lack any specific data. They just want more margin.

To quote from the movie classic, Cool Hand Luke, “what we have here is a failure to communicate.” Let’s walk through what every manufacturer and distributor should know about their channel partners.

Distribution is a skinny business

Forget what you might think about big gross margins; the real lifeblood of any company is bottom-line profits. Just what is the bottom line for the typical distributor? Using the formal benchmarking done by many distributor associations, the median bottom-line profit is between two and three percent. Consider this report by corporatefinanceinstitute.com:

“You may be asking yourself, ‘What is a good profit margin?’ A good margin will vary considerably by industry, but as a general rule of thumb, a 10 percent net profit margin is considered average, a 20 percent margin is considered high (or good), and a 5 percent margin is low.”

Distributors show up as one of the lowest profit-producing businesses and one might question the concept of investing in distribution. Maintaining profitability is important. In a time of gross margin squeeze, distributors walk a thin line between profit and loss. If they push for more gross margin on customer special pricing, there is a good reason for the fight.

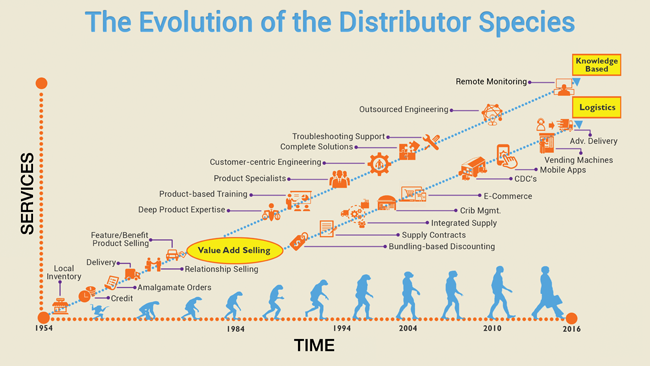

There is a difference in distributor types (see illustration)

To better define the type of distributors we worked with in the early 2000s, I coined the phrase “knowledge-based distributor.” The distribution industry was in a state of evolution. Some distributors focused on logistics, others focused on their ability to provide application and technical support for their customers. Some distributors became very good at providing low-cost logistics and easy access to inventory. Others, the knowledge-based distributors, became locally available experts ready to help their customers through problems. The logistics distributors shipped boxes from Point A to Point B, while the knowledge-based distributors shipped a little bit of their know-how with every order. Know-how is expensive. Engineering and technical resources, along with application savvy sellers, create a higher cost to sell.

Allow me to back up this statement. Comparing distributors across different lines of trade demonstrates that distributors not practicing the knowledge-based model typically produce lower gross margin percentages. For example, an electrical wholesaler might generate an average gross margin of 20 percent while an automation specialist generates an average of 27 percent. One might expect a vast difference in bottom-line results, but the bottom-line profit percentage is, for all practical purposes, the same.

People are a distributor’s biggest cost/investment

Based on formal benchmarking data, employees represent the biggest single cost to a distributor. Forget the cost of buildings, company vehicles, carrying inventory and all the rest; no other expense comes close.

For every dollar of gross margin produced, employee compensation and benefits consume between 60 cents to 68 cents. The variation depends on economic

conditions and the level of new people added to the distributor’s team. The percentages are high during recessions because of the downturn in sales and gross margin. Similarly, a couple of years after the economic storm has cleared, distributors move into expansion mode. New employees do not generate enough sales/gross margin during their first years of employment to offset the numbers.

Finally, the percentage of gross margin required for covering employees is the same for both types of distributors. From a purely “sales tonnage” perspective, logistics distributors appear to be more efficient, but as we will see, they do not do the same work as the knowledge-based distributor. Manufacturers are forced to do more work when they use logistics distributors.

Who does the selling work?

Distributors must be classified and compensated for the work they perform. Clearly, some do much more than others. Let’s look at some of the “active selling” and service-oriented tasks performed by distributor supply partners. These can be broken into six general categories:

1. Market creation (discovering new uses for the product)

2. Application of the products in known situations

3. Generation of non-price proposals

4. Technical support

5. Troubleshooting existing products

6. Maintaining local inventories

There are significant differences between the services provided by supply partners in each category. The chart on the right indicates the estimated efforts provided by the supply partner in the market for each of the tasks. Please note, the inventory portion of the services varies from company to company.

When the distributor assumes a greater portion of the important selling tasks, a cost shifting takes place. Knowledge-based distributors require a higher gross margin to fund the efforts.

Tiered Distribution makes sense, but

Different workloads require different “pay scales” and, in the case of distributors, the difference comes in the way of gross margin opportunities. Many supply partners have built tiers to allow for this plan, but these plans break down. Special Pricing Agreements (SPAs) developed to offer up competitive pricing levels for customers who leverage their purchases for deeply discounted prices impact the situation.

Most manufacturers insist the distributor participate in the discounting with lower than normal margin levels. While the idea sounds solid, a couple of issues beg to be addressed. First, the costs of selling remain the same for the distributor. Secondly, in the case of OEM accounts, by making the sale the distributor is creating more profitable and likely book-price MRO business for the manufacturer; that is typically handled by a different distributor so they receive no benefit.

One alarming trend comes via the growth of SPAs. Distributors report that supply partners channel 70 percent to 80 percent of their sales through these agreements. While most distributors don’t realize it, in a lot of instances, the profitability of the business is questionable, at best.

For distributors, more margin is always the answer

Supply partners retort that distributors always want more margin but lack supporting data as to precisely how much extra they need to provide the right customer service. Understanding the cost of various tasks tied to selling is a weakness for all but a few distributors. This is evident in the services they provide to customers under the guise of value-add service, but it’s even more striking with the services done for supply partners.

The need for analytics and data tied to the customer-facing side of the business grows in importance and, for informed decisions to be made and shared with supply partners, we are reaching a breaking point. Until better data is gathered, I recommend that distributors and suppliers use data from the previously mentioned Profit Analysis Reports provided by distributor associations.

Distributors and suppliers must work together to eliminate costs

Supplier reviews of distributors are relatively common. Most are delivered annually and start with things such as sales levels and marketing activities and end with a goal for the coming year. The better ones outline shortfalls in specific functional areas, such as efforts tied to a product launch, inventory levels or training needed to access the supplier’s distributor portal.

Discussions rarely turn to ways the manufacturer and distributor could make their partnership more efficient. How might they eliminate bottlenecks, duplication of efforts, unnecessary paperwork and other steps which provide no value to the customer?

It’s time for distributors and suppliers to streamline their relationship in a formal way. Driving meaningful change requires more than a meeting with the local supplier sales team. Many costly issues involve distributor policy, logistics, support and issues outside the realm of selling.

Bringing all of this together

Manufacturers, if distribution is a cornerstone of your business and if you truly see distributors as partners, it’s critical to invest in gaining a better understanding of your partner’s business. This understanding needs to be pushed down to those who have daily contact with your distributors and incorporated into policies impacting distributors.

Distributors, the time has come to measure the actual costs associated with every facet of your business. Analytics and data are critical to backing up your message to supply partners. There are fundamental differences in the way distributors think and operate. I’ve provided some of the differences between knowledge-based and logistics distribution. Now is the time to educate your partners. Call if I can help.

Straight talk, common sense and powerful interactions all describe Frank Hurtte. Frank speaks and consults on the new reality facing distribution. He has a new book out – “Plan on Breaking Through – Strategic Planning for Accounts.” Contact Frank at frank@riverheightsconsulting.com, (563) 514-1104 or at riverheightsconsulting.com.

Straight talk, common sense and powerful interactions all describe Frank Hurtte. Frank speaks and consults on the new reality facing distribution. He has a new book out – “Plan on Breaking Through – Strategic Planning for Accounts.” Contact Frank at frank@riverheightsconsulting.com, (563) 514-1104 or at riverheightsconsulting.com.

This article originally appeared in the March/April 2020 issue of Industrial Supply magazine. Copyright 2020, Direct Business Media.