M&A Monitor

Market valuations continue upward trend - M&A activity poised for 2010 increase

by Curt Tatham

The mood remains notably improved as those of us at our firm advise our clients regarding the potential sale of their company or the potential acquisition of another company. The overall economic outlook has improved meaningfully over the last year amidst the almost universal sense that the worst of “The Great Recession” appears to be behind us.

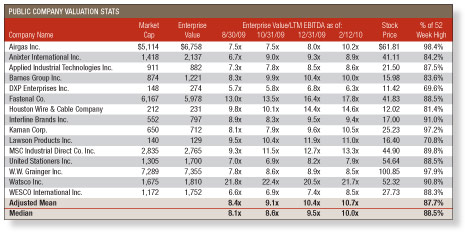

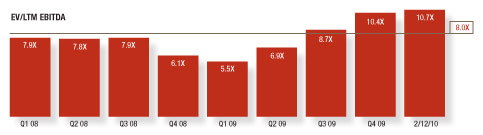

Distribution companies have historically served as useful “canaries in the coalmine” regarding public and private market valuations, given the fact their underlying performance results tend to be effective leading indicators of broader economic trends. Our firm tracks a group of Industrial Distribution public companies in an index that we refer to as the Lincoln International Industrial Distribution Index (the Lincoln IDI). The total combined market capitalization of the Lincoln IDI exceeded $30 billion as of February 12, almost $10 billion or 47% higher than one year previously. The meaningful increase in market value has been driven by an almost doubling of the Index’s mean EBITDA multiple (enterprise value/last 12 months earnings before interest, taxes and depreciation) which, as the bar chart displays, increased to 10.7x, almost double its lowest level of 5.5x at the end of the first quarter in 2009.

Distribution companies have historically served as useful “canaries in the coalmine” regarding public and private market valuations, given the fact their underlying performance results tend to be effective leading indicators of broader economic trends. Our firm tracks a group of Industrial Distribution public companies in an index that we refer to as the Lincoln International Industrial Distribution Index (the Lincoln IDI). The total combined market capitalization of the Lincoln IDI exceeded $30 billion as of February 12, almost $10 billion or 47% higher than one year previously. The meaningful increase in market value has been driven by an almost doubling of the Index’s mean EBITDA multiple (enterprise value/last 12 months earnings before interest, taxes and depreciation) which, as the bar chart displays, increased to 10.7x, almost double its lowest level of 5.5x at the end of the first quarter in 2009.

Meanwhile, the outlook for industrial distribution M&A volume and valuation multiples also has turned brighter in recent months supported by a number of factors in addition to the overall more positive economic outlook:

Meanwhile, the outlook for industrial distribution M&A volume and valuation multiples also has turned brighter in recent months supported by a number of factors in addition to the overall more positive economic outlook:

- Positive year-over-year quarterly results

- Sequential quarterly revenue growth

- Anticipated future profitability growth in excess of revenue growth, resulting from cost-cutting measures as the top-line recovers (“operating leverage” benefits)

- Exit from a “bunker mentality/crisis mode” and a re-focusing on external growth opportunities via acquisition

- Recent acquisitions by strategic acquirers (W.W. Grainger, Motion Industries, Lewis-Goetz, etc.)

- Perception of distribution sector to be pro-cyclical with low capital expenditure requirements

- Recovery in the financing markets

The recovery in the buyouts financing markets over the last six months has occurred more rapidly than most had anticipated. Total leverage multiples have improved notably while at the same time pricing has come down as well. The M&A recovery remains in the early innings and, like past cycles, the “distribution” of companies being sold early in the recovery resembles a barbell marked by companies that either A) have been able to perform well through the economic downturn and thus garner premium valuation or conversely, B) companies that have struggled meaningfully and are being sold in a “distressed sale.” As the M&A cycle progresses, absent any geo-political or external economic shock, one should expect the M&A volume of “mainstream” profile distributors to increase notably in the latter half of 2010 and into 2011.

Curt Tatham is a managing director at Lincoln International, where he leads the firm’s Distribution Group. Lincoln specializes in merger and acquisition, debt advisory and valuation services for companies involved in middle-market transactions. He can be reached at (312) 580-8329 or ctatham@lincolninternational.com.

This article originally appeared in the MarchApril 2010 edition of Industrial Supply magazine. Copyright 2010, Direct Business Media, LLC.