Deal Makers and Operators

by Scott Benfield

The 150-year-old sector of North American B2B distribution has proven value through numerous economic cycles. The resilience of the core model of seller-laden local branch thrives in an environment of change that includes newer e-commerce sellers, often from outside the industry, vying for a piece of the $3 trillion durable goods market.

For several decades, acquisition has been favorite mode of growth for both financial and strategic buyers in the sector. While we still see financial buyers (read private-equity) active in the distribution space, increasingly large regional, national and global distribution firms act as strategic buyers of distributors in their third and fourth generation. The formula for acquisitive success has been leveraging the buy-side as vendor purchase volume increases while streamlining redundant functions such as purchasing, material management, warehousing and, increasingly, customer sales and service.

Our caution to acquirers in the space is that the easy money in acquisitions is coming to an end. This is a function not only of e-commerce players that reduce operating costs, and the move toward more customers buying online, but also because smaller distributors are members of powerful co-ops or buying groups where they pool their buying power with larger kin. An undisclosed but significant problem also awaits acquisitive buyers in the distribution space. Accretive firms that make acquisition an ongoing model of growth should recognize the problem and address it head-on or risk becoming victim. There is a growing recognition for resurrecting organic growth and operating principles to drive profitability through more efficient processes.

The Weight of Past Success

Acquisition is tempting as it promises quick gain albeit some short-term pain of changing the acquired culture to the buyer. Culture change is often ad hoc except for a few firms that carefully plan changeover of their acquisitions and whose profit generation is driven from buying fixer-uppers and improving them within 12-24 months.

The unrecognized problem in acquisitive growth is the weight of past processes, across different cultures, impedes the smooth functioning of the firm and can degrade profitability. Practically, this is seen in firms whose order rework rates are high, pricing is dysfunctional, quality of service declines and operating costs are higher than average, often growing faster than sales. Most acquirers don’t plan on these problems and don’t anticipate they can turn the firm from a juggernaut to a house of cards. But our consulting work over the past two decades finds many acquisitive distribution firms are woefully underperforming because of the weight of acquisitions and an outright mess of internal processes.

When one acquires multiple businesses, the firm is left with numerous interpretations of how to get things done. This includes but is not limited to pricing, processing returns, non-stock processing, material management, vendor relations, fee-based services and a host of other operations. Over time, left unaddressed, internal processes become gummed up. Buyers cannot easily clean and restructure the operation and they become dysfunctional and detrimental to future growth and profitability.

Inside this problem is a management philosophy of Deal Maker and Operator; one is over-done while the other shows signs of resurgence.

Finance is Sexy, Smooth Operations Take Time

The growth of acquisitions in the distribution space is a function of generational transfer, historically low borrowing costs and finance as a highly compensated position. The majority of distributor acquisitions are family businesses in the third and fourth generations where family has waning interest in operating the firm and sells out. This is accelerated by borrowing costs that have fallen for decades and have, until recently, shown a propensity for long-term increase. Finally, the outpouring of well-paid business graduates working in finance has increased acquisition growth. Most growth prior to the late 1990s was from greenfield sites or organic through customer acquisition. For the last quarter of a century, however, growth has been acquisitive, and it is rare to find a distribution firm of size that does not have an acquisitive history. Ergo, the culture of the Deal Maker was born.

As finance has grown, operations as a career path and necessary to profit generation, has been overshadowed. With the finance function becoming dominant, operations have atrophied. Operating acumen gained from years of experience and education in a functional area is difficult to find. Many operating positions are revolving doors; we too often find managers in these positions with scant experience and current knowledge in operating functions. In many instances, pay is below par, career progression is unclear or limited, and the firm too often transfers a tranche of broken processes from

one manager to the next.

We are, however, finding signs that distribution executives are cognizant of the problem and have begun to consider changes to their operating platform including increased funding for operating positions. There is no shortage of distribution firms, especially mid-market, suffering from acquisitions and post-acquisitive process blues. In several instances, we’ve seen performance so sapped by Deal Making without process review and rationalization, that the firm must slow down or stop acquisitions. Tell-tale signs are ballooning of inventory, poor to no strategic pricing, sales efforts that do whatever they want, and customer defection because of a poor service platform. The need for operators to balance deal making is at hand.

It Starts at the Top

Many distribution CEOs are acquisition bent and, too often, don’t always equate poor earnings to overloaded and ill-defined operations. The realization of this problem is unfortunately learned when the firm is not generating enough cash to fund another acquisition; free cash is being sapped by process problems, order rework, excessive turnover and a host of inefficiencies. The upshot is that the CEO, often a generational family member, must realize the problem with the operating platform. They then are required take a leap of faith to review processes and make plan(s) for improving them.

In the short run, process review, rework and improvement are expensive. The firm may need new managers and will have to engage the discipline of formal Business Process Improvement (BPI). IT will also be involved and there are often needs for new programming or new software integrated into the ERP. These investments can easily run into six or seven figures. Done properly, however, they can be stunningly profitable.

Major Areas of Process Improvement and Organic Growth

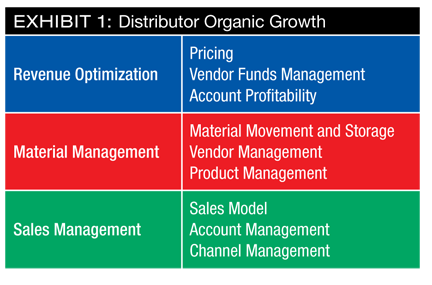

We are often asked which areas of process improvement are distributors lacking in? The answer varies. However, our audits cover the following major areas of distribution internal processes as shown in Exhibit 1. In the Exhibit, we list the major areas of Organic Growth and Profitability. They include:

Revenue Optimization includes pricing, vendor funds management and account profitability. Currently, the disciplines are viewed as separate with account profitability and pricing having an ongoing history in the sector with vendor funds management being a newer subject. Vendor funds include volume rebates as well as SPAs (special pricing allowances), co-op and marketing funds. Our work finds that 50 percent or less of these funds come from co-operative membership. Hence, it is important that distributors form a discipline around these funds inclusive of specialized managers, unique processes and software to help capture and use vendor-supplied monies. As pricing goes, there has been scant innovation in the subject for over a decade and too many distributors equate having pricing software as having good pricing; nothing could be further from the truth. Finally, account profitability, a subject explored over three decades, is a perennial discipline. Given operating pressures from online, low-cost competitors from outside the sector, the functions surrounding cost-to-serve will be ongoing.

Material management and movement processes include all functions related to managing inventory including vendor interactions, operating systems and physical facilities. As more different and unique service demands arise, material management will be tasked to become more flexible with increasing accuracy. We place product management under the material management function as it is closely related to vendor management and how vendors support the sale of their product(s).

Organic growth, for full-service distributors, will involve personal selling and sales management. These disciplines have been researched and enhanced over decades. New sales models, new software and new products, begat new services that keep the function changing. Channel management, a discipline that is currently ad hoc in most distributors, is new for the sector. As e-commerce grows and new avenues of marketplaces, specialty online distributors and retail/wholesale distinctions blur, distributors should consider experienced channel managers that can seek out and serve varying channels with different product/marketing/pricing plans. Today, many distributors serve entire channels where they drive negative operating profits as they don’t tailor service and product offerings specific to the unique needs of a particular channel.

Organic Growth Leads to a Stronger Accretive Firm

While acquisitive growth has been the rage for over two decades in distribution, the need to review, revive and improve organic growth is prescient. Acquisitive opportunities remain in the distribution sector, albeit their pace will likely decline as the number of independent, privately owned firms declines. A hard-learned but common lesson is that numerous acquisitions, piled on over the years, gum up the operating platform of the firm, inclusive of revenue management, materials management and sales structures.

Successful acquisition is supported by well-documented and well-designed process flows. The better the operating platform and smoother the processes, the easier and more profitable future acquisitions.

Scott Benfield is the author of six books and numerous B2B research projects. His client base includes numerous mid-market and Fortune-rated firms in B2B markets across North America. Reach him at Scott@BenfieldConsulting.com or (630) 640-5605.

Scott Benfield is the author of six books and numerous B2B research projects. His client base includes numerous mid-market and Fortune-rated firms in B2B markets across North America. Reach him at Scott@BenfieldConsulting.com or (630) 640-5605.

This article originally appeared in the May/June 2022 issue of Industrial Supply magazine. Copyright 2022, Direct Business Media.