Out of the Fire: Repositioning Independent Distribution

Part Three: Clean up and Rebuild

by Neil Gillespie and Allen Ray

After a forest fire, only the strongest trees remain alive. In business language, the economic "bubble" burst, went flat and there you are, right where you started before the bubble inflated. You're also left with a lot of dead stuff you need to get rid of and turn into some cash. And as long as you need to rebuild some processes, why not rebuild them so you can operate with minimum staffing?

After a forest fire, only the strongest trees remain alive. In business language, the economic "bubble" burst, went flat and there you are, right where you started before the bubble inflated. You're also left with a lot of dead stuff you need to get rid of and turn into some cash. And as long as you need to rebuild some processes, why not rebuild them so you can operate with minimum staffing?

To make the most profit as soon as possible, it is best to launch productivity and growth initiatives simultaneously. But when assets and productivity are in tough shape, you need to get the army's "rear elements" in order. That's directly from Sun Tzu's "The Art of War," and we dare not question the master's wisdom.

We will discuss how to see growth opportunities in a new framework in the next article. For now, let's generate some cash and productivity.

DEALING WITH A SUDDEN CHANGE IN VELOCITY

Booms increase the velocity of business, increasing the pace and productivity of your salespeople, inventory, receivables, delivery vehicles and warehouse investment. This stimulates asset turnover and people productivity. Few distributors take care to stir up slow moving inventory, receivables, special price authorizations (SPA) credit lags or people productivity in a boom period.

When things slow down, marginally profitable salespeople become grossly unprofitable. Some A items become B items. Some C Items become dead items. Customers that pay in 30 days now pay in 60 days. Suppliers issue SPA credits slower, accepting fewer returns, approving fewer items and enforcing the fine print to the letter.

You probably didn't stay vigilant by stirring up slower moving assets and improving productivity during the boom. Increased velocity made things good enough. A decrease in velocity is ugly, though. You get stuck with more dollars in slower velocity brackets. People productivity plummets from reduced demand. You wish for the boom days again. But growth could kill you from the increased cash requirements and the banker's windows are closed up tight this time.

The Starting Point: Cash and Productivity

If you're on credit hold, having trouble-making payroll or skipped a paycheck to yourself lately, you're in a cash crisis. You need to immediately take action to generate cash before doing anything else.

If you're in great shape with asset turns and productivity, you could probably stand a tune-up while simultaneously discovering new growth opportunities. Nevertheless, let's take Sun Tzu's advice and start with cash generation and productivity.

THE GREAT EIGHT PRODUCTIVITY DRIVERS

1) Increase the speed of SPA (rebate) collections

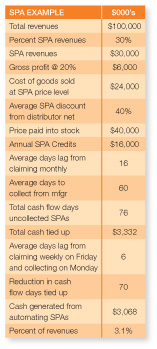

If you do a significant amount of business requiring SPAs, such as 30% of sales at an average 40% or more discounts from book prices, and you claim manually, this could be the single biggest source of uncollected cash in your entire company. The symptoms won't directly show up in your PAR report or financial ratios, either, so don't look there. Think about it. You claim once-a-month, and that's a 16-day average lag. You submit manually, so manufacturers must process manually. That takes another 60 days for a total of 76 days. You can short-circuit this whole lag to six days by cleaning up your product data, matching it to the manufacturer's, making sure you entered your SPA prices correctly and claiming electronically once per week with your manufacturer and get paid a few days later. Depending on how much SPA volume and the depth of the discount, the result is you could generate anywhere from 1% to 7% of revenues in instant cash. Is it worth the effort?

2) Increase the velocity of current assets

2) Increase the velocity of current assets

The problem with inventory: Think of current assets like a pond fed by a spring. The spring slows down. Some areas of the pond don't get agitated - they die. Everything else is less agitated and slows down, slipping a bracket or two. A's become B's, and C's become dead, etc. Your mix of inventory now contains 50% or more dollars of slow moving items vs. A and B items, which self-adjust with reduced purchasing activity. The dead don't move.

The solution: Use your business system to report how much you have in each velocity bracket in dollars to shock yourself to attention. Then start computing days of inventory and dollars by unit in those brackets. Consider anything without a sale for six months as possible dead items for removal. You can organize returns for some inventory that is returnable. You can auction off other items that are truly dead to generate cash if you're really in a crisis. Finally, you can write things off and save taxes if you're in the black. The worst thing to do with a lot of dead and near dead items is nothing.

The problem with receivables: Most distributors stay on top of this one better. But the problem is the same. Reduced demand diminishes ability to pay, and payers slip into lower performing brackets. You have to stir up "the pond" to stimulate life and more cash. Use your business system's aging reports to manage this as usual. No rocket science here. But you do need to guard against an increasingly more common trick. Some businesses wait until you yell, like 60 days past due. Then they pay with a credit card. Your fees go up, and combined with the cost of money on the 60 days, wipe out your meager net profit. You might as well flag the customers that do this, and get them on credit card to begin with. At least you get the cash up front.

3) Increase productivity of the back room

a. Purchasing

No purchasing agent can outperform a computer's ability to generate stock replenishment orders and manage inventory. But many purchasing managers are not entrusted with

managing inventory. That's a problem.

Another problem is that purchasing managers don't understand how different purchasing models work: EOQ, Min-Max with Order Points and SCM models. Your business system's consultants can teach your people to use these methods in appropriate situations. It can also reduce the number of people required. Purchasing

managers can handle more suppliers and generate more line items per person, per year. Switch to generating automatic replenishment orders electronically using EDI or similar methods and you can reduce purchasing personnel up to 75% while increasing customer service levels.

b. Automate the warehouse with wireless handheld receiving, stocking and picking

The best measure of logistical efficiency is cost-per-line-item delivered. Receiving, stocking and picking are the lion's share of that. You can increase efficiency by managing shifts and using wireless technology to receive, stock and pick items. Wireless warehouse management and bar code utilization reduces the "warehouse walk" and put up and picking errors. Depending on your size and sophistication, you can affect 20% to 40% reduction in warehouse force, and you don't need people with a deep and broad product background. That spells dramatically lower warehouse costs.

c. Do the three-way match in accounts payable

If you did your homework, cleaned up your data and synced to manufacturer data, you're almost ready for a miracle. If you sent your orders EDI, obtained an electronic receiving document EDI, and an invoice via EDI, you can set tolerances for errors on invoices before involving a clerk to fix them. The computer looks at all the line items for price, quantity and item errors and omissions. For example: don't even look at an invoice unless errors are more than $75 or 5% of the invoice total. Why? It probably costs $75 to look at an invoice and fix it manually. Just pay all the other invoices via electronic funds transfer or an outside payment service. The computer checks them, not your clerk. This can

reduce personnel costs up to 75%.

d. Drive invoicing and accounts receivable productivity

What's the best way to send invoices through the mail? Don't do it. That's labor that either somebody else could perform more cheaply, or not perform at all. You can bill using e-mail manually. You can also bolt on payment systems that save customer billing preferences such as pay by invoice online via ACH draft, e-mail invoice, or pay by statement online with ACH draft. Bill Trust is one proven solution. Let the computer do the work unless you've got outstanding invoices and need to intervene. Wouldn't you like to allocate personnel to making collections vs. sending invoices?

4) Drive pricing productivity

4) Drive pricing productivity

Part of your market identity is perceived price level. Normally, you are perceived as the low price player, a competitive player, or a high price / high service player. There's not a lot of room for the third category today except as a niche player. You need to be competitive on the right items or you're out of the game. But which items? That's only one problem.

Another problem is velocity slippage. If the relative investment increases for an item because the volume decreased, you need to increase the price to compensate in order to hit target return on investment. So think about this. If you're going to be smaller for a while, your turns will naturally slip and relative investment will rise. That means your overall gross margin percentage needs to increase to hit ROI targets. If you need to be competitive on certain items more than ever today, which items should you increase?

Solution: Determine your Everyday Low Price (EDLP) items. Follow the market daily on these and adjust your price tactically. Look at B, C and D items carefully for opportunities to raise prices incrementally to affect the overall gross profit percentage increase you need for the higher relative inventory investment.

Another problem is failing to increase prices as soon as the manufacturer raises its price. If you want to have enough cash to handle the next incoming shipment, you need to increase prices promptly.

5) Drive sales productivity

The recession slowed things down. It made marginally profitable salespeople unprofitable. Though most companies' measure sales total, sales variances, gross profit percentages and the like, they are woefully incomplete measures of sales forces. You need to measure Return on Sales Expense by computing a ratio of gross profit dollars generated vs. sales expenses. Total up salaries, commissions, bonuses, training, insurance, benefits, car expense, travel and living and any other expenses you pay on behalf of salespeople. Do this for each salesperson, each sales force, and each region and for the whole company. Take action on performance issues.

Inside salespeople don't have discretion to spend money, so measure their output, i.e., line items produced per period, per person. You can also measure gross profit percentage, especially on nonstock items, where there is a strong tendency to price things low because salespeople think carrying costs are low. This ignores costs of returns, which can exceed $60 per event. Keep "nonstick" gross profit levels at 30% or more.

Counter people can make or break counter profitability with tie-in selling. Gauge this with the average number of line items per order. You might even reward for performance increases in this measure to drive tie-in selling behavior.

6) Drive gross profit dollars per order

This measure is the single biggest determinant of customer profitability. Why? Each transaction type has relatively fixed activity costs. Additional gross profit dollars on an order go mostly to the bottom line. But measuring this alone doesn't change behavior. You need to promote a broader mix of products and drive sales behavior to sell a broader mix to each customer and on each order.

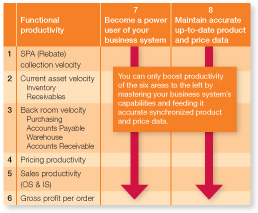

7) Become a power user of your business system

Business systems often lament that their user base makes use of less than 30% of the available functions that can improve a distributor's business results. Many distributors make use of basic order, ship, bill and accounts payable functions to the exclusion of other functions.

That's only part of the problem. The objective is to use your business system to drive the business and to generate more profit by using the right techniques. If you don't know the techniques, you won't see the value of applying a broader range of your system's

capabilities. But,the real problem is your people don't.

Whether it is Activant, Infor, SAP or any other provider, they have consultants that can teach your people both the theory and the application. Your job is to measure your performance in each area and decide your priorities.

Then get started learning. You don't have to write any code. You just need to learn to manipulate the controls on the dashboard. So get busy! After you learn to do these things, you need to tell suppliers that don't transact electronically you'll be selecting another supplier very soon.

8) Maintain accurate and currrent product / price data

It's amazing how conceptually simple this is and how fundamental it is to making money. Yet, hardly anyone does this well. All you need to do is get the UPC number, unit of measure, description and price correct in your database to make line items match in your computer and the manufacturer's computer. Do this right and transactions will flow uninterrupted, untouched by human hands for the lowest possible cost of transacting business.

Clean product data and application of EDI or other electronic transaction techniques can add 2% to 4% to your bottom line excepting SPA claims, which can add significantly more. Using database management tools like SQL, Oracle, Microsoft Access or the database built in to your system, all you have to do is match your database to a correct database on the aforementioned variables, kick out the unmatched items and fix them. Don't feed your computer bad data.

If you haven't figured out what we're saying by now, we'll just come right out and say it. It's all about the cash. Yours may be hiding in the rubble after the fire.

Next Issue: Expanding your view of opportunity

Neil Gillespie is a veteran distribution consultant, speaker and author. Neil worked for GE and Eaton corporations before launching his distributor consulting practice in 1995. He helped Roden Electrical Supply of Knoxville grow more than 500% over 11 years, while more than tripling EBITDA percentage. Neil has distilled his profitable growth methods in his Eight Steps to Breakthrough Growth. His book “Discover Your Core, Then Go For More” is now available. Contact Neil at neilg@shamrockgrowth.com.

Neil Gillespie is a veteran distribution consultant, speaker and author. Neil worked for GE and Eaton corporations before launching his distributor consulting practice in 1995. He helped Roden Electrical Supply of Knoxville grow more than 500% over 11 years, while more than tripling EBITDA percentage. Neil has distilled his profitable growth methods in his Eight Steps to Breakthrough Growth. His book “Discover Your Core, Then Go For More” is now available. Contact Neil at neilg@shamrockgrowth.com.

Allen Ray has 45 years of experience as a distribution business owner, information systems, marketer of product data and consultant to wholesale distributors. Allen advises clients on strategies to stop “Profit Leakage” and create a scalable business that returns an increasing percentage of gross margin dollars to net profits. Allen is collaborating with Neil to help distributors adopt the Eight Steps to Breakthrough Growth, providing expertise in “Leadership Productivity” and “Pricing for Maximum Gross Profit Dollars per Order.” Contact Allen at allen@allenray.com.

Allen Ray has 45 years of experience as a distribution business owner, information systems, marketer of product data and consultant to wholesale distributors. Allen advises clients on strategies to stop “Profit Leakage” and create a scalable business that returns an increasing percentage of gross margin dollars to net profits. Allen is collaborating with Neil to help distributors adopt the Eight Steps to Breakthrough Growth, providing expertise in “Leadership Productivity” and “Pricing for Maximum Gross Profit Dollars per Order.” Contact Allen at allen@allenray.com.

This article originally appeared in the May/June 2010 edition of Industrial Supply magazine. Copyright 2010, Direct Business Media, LLC.