Smarter pricing for distributors

Pricing is the last unplowed field of opportunity for industrial distributors

by Brent Grover

What mental image does "unplowed field" conjure up in your mind? Can you

imagine muddy ruts in an unplanted patch of ground, fertile earth that could produce abundant crops if the hard work of strong backs and skillful hands were applied along with some fertilizer, rain and the right seeds?

So many top-quartile (and almost top-quartile) distributors do the right things, and they do them right: growing sales, controlling people and non-people costs, managing receivables and turning inventory, handling the debt side of the balance sheet. Their one blind spot, their last unplowed field, is inability to be at the helm of their company's pricing function.

The research our firm conducted for NAW shows that salespeople set prices for most distributors – and that most sales reps make pricing decisions without the benefit of market pricing information. They are essentially "data-free" determinations, based mostly on anecdotal information and impressions. If a sales rep has 100+ accounts in his portfolio, perhaps only 20 or 30 of those customers are active (buy at least once each month). Of these, the sales rep is only in close contact with the eight, nine or 10 customers who make up 80% of the rep's sales and income. Virtually all the rep's market

information, if you can call it that, is provided by a small handful of large customers, possibly in different segments, who may or may not be truthful or accurate about the data they offer.

Sales reps also pick up pricing impressions from more experienced reps during the training process. Many of those initial beliefs about what discounts are needed to capture business are wrong, but they stay with the rep throughout a long career. We find that pricing patterns can often be traced to the sales rep as opposed to the value of the product to the customer.

Sales reps also pick up pricing impressions from more experienced reps during the training process. Many of those initial beliefs about what discounts are needed to capture business are wrong, but they stay with the rep throughout a long career. We find that pricing patterns can often be traced to the sales rep as opposed to the value of the product to the customer.

Most wholesale distribution reps have a significant portion of their compensation at risk, the variable portion being based on gross margin dollars generated from their accounts. These reps tend to be under-managed because management relies on the alignment of sales compensation with gross margin dollars. We find that many sales reps, acting in their own enlightened self-interest, strive to earn more by pushing for sales volume rather than investing the time needed to optimize margins.

The desired sales rep behavior, optimizing margin percent, takes a back seat to building volume for several reasons, including enormous time pressure, fear of alienating customers by being perceived as high-priced and lack of faith in the company's suggested list prices. The commissioned sales rep's path of least resistance is to simply mark up the company's cost by certain percentages (or discount list prices) and move on to the next opportunity. The biggest earners sometimes are motivated less by making more income than they are by getting more leisure time.

The buzzword today is strategic pricing, but the use of the word "strategic" may be confusing. Is pricing tactical, day-to-day actions or is pricing truly strategic, meaning a long-term grand design?

For distributors, we say pricing is indeed strategic. The fundamental management decisions to provide guidance rather than leave pricing to the discretion of the sales reps, to base pricing on customer value instead of product cost, and to learn from transaction data to determine market pricing are fundamental to strategy.

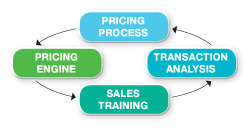

We advocate a four-step "Smart Pricing" approach to distributor pricing. The four steps we identified are:

Our job is to analyze 12 months of actual transaction line items and to recommend selling prices for each customer-item combination and for new sales (transaction analysis); to identify changes needed to fix the pricing process; to suggest design changes in the software (pricing engine) used to manage pricing; and to train the sales reps to delegate more and become stronger negotiators (sales training). We love salespeople and know that changes cannot be made without winning their hearts and minds.

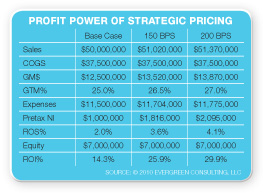

For most distributors, the result of plowing that last field and getting smarter about pricing is an increase in return on sales of over 2% and an increased return on investment of 10% or more. That kind of profit boost cannot be obtained by simply cutting staff and squeezing suppliers.

Brent Grover has written five books for the NAW Institute for Distribution Excellence and numerous articles about distribution management. He is a regular contribuor to Industrial Supply magazine. Reach him at (216) 360-4600 ext. 101 or brent@evergreen-consulting.com.

Brent Grover has written five books for the NAW Institute for Distribution Excellence and numerous articles about distribution management. He is a regular contribuor to Industrial Supply magazine. Reach him at (216) 360-4600 ext. 101 or brent@evergreen-consulting.com.

This article originally appeared in the May/June 2010 issue of Industrial Supply magazine. Copyright, 2010 Direct Business Media.