Cautious optimism

Economic indicators bode well despite concerns

by Curt Tatham

As the first quarter drew to a close, numerous economic reports continued to suggest that industrial distributors will enjoy an increasingly positive economic environment, but not without concerns. Manufacturing activity remains very strong, according to data released by the Institute for Supply Management (ISM). In its March Manufacturing Report on Business, the ISM reported that the PMI index, which it uses to measure manufacturing activity, was 61.2%, a 0.2% decline from February's 61.4. However, February's level had marked the highest PMI level since May 2004. Any reading 50 or higher represents economic growth and March resulted in the 22nd consecutive month economic growth has occurred.

On the jobs front, the Labor Department reported that the economy added 216,000 new jobs in March, offsetting layoffs by local governments. The second straight month of strong hiring was the latest sign that the economy is strengthening nearly two years after the recession ended. Private employers, the backbone of the economy, led the gains. They added 230,000 jobs in March, on top of 240,000 in February. It was the first time private-sector hiring topped 200,000 in back-to-back months since 2006 — more than a year before the recession started. Meanwhile, the unemployment rate dipped from 8.9 percent in February to 8.8 percent in March. The rate has fallen a full percentage point over the preceding four months, the sharpest drop since 1983. The number of unemployed people dipped to 13.5 million in March, still almost double since before the recession began in December 2007.

However, optimism regarding manufacturing activity and the upside for industrial suppliers is being tempered by growing concerns primarily surrounding commodity pricing. Many suppliers are indicating that the prices they have to pay for goods are rising and pressuring margins, at least until they can successfully pass those increases on to their customers.

In addition, consumer confidence experienced its biggest decline in more than a year in March, falling sharply because of growing concerns about rising prices and stagnant incomes. The Conference Board said its consumer-confidence index dropped to 63.4 in March from a revised 72.0 in February, marking the biggest one-month decline since February 2010. The index had risen five straight months until backtracking in March. The slow pace of hiring, meager wage increases and rising prices of gas and food are the biggest concerns of consumers.

Finally, economists and pollsters say the disaster in Japan and political turmoil in the Mideast also likely contributed to a more pessimistic mood. The biggest concern regarding Japan is the disruption of factory production there. That could slow movement of parts to U.S. companies, particularly those that make autos and electronics. Japan plant shutdowns could result in production cutbacks at U.S. auto plants over the next two to three months. Most are hopeful that any lost production will be made up later this year.

Recent events in the Middle East and Japan prove yet again that industrial suppliers must plan for any eventuality. However, despite developments in those reasons that likely did not appear on anyone's crystal ball, the overarching momentum of the economy remains positive for the nation and the industrial base.

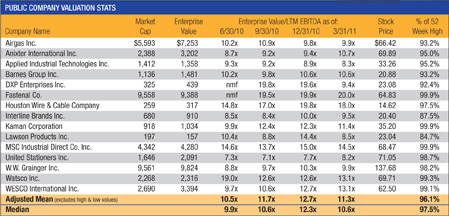

Curt Tatham is a managing director at Lincoln International, where he leads the firm’s Distribution Group. Lincoln specializes in merger and acquisition, debt advisory and valuation services for companies involved in middle-market transactions. He can be reached at (312) 580-8329 or ctatham@lincolninternational.com.

This article originally appeared in the May/June 2011 edition of Industrial Supply magazine. Copyright 2011, Direct Business Media, LLC.