Channel Conflict in the Age of Digitalization

By Scott Benfield

Channel conflict between distributor and manufacturer is historic. Since the beginnings of industrial channels, distributors and manufacturers have struggled to work together to grow end-user markets. The firms are fundamentally different, which drives conflict. Manufacturers have significant fixed costs in plant, property and equipment. They want long runs of high-contribution products. Distribution is a variable cost or step-variable cost enterprise. Distributors seek to drive down investments in inventory and rationalize operating expenses in short time frames.

Over the course of time, like the big yellow dog and grizzled tom cat of suburbia, both entities have learned to get along while staying out of each other’s food bowl. In the last decade, sans private labeled brands from China, distributors and manufacturers have had little to spar about. However, this tranquil period is about to change and we believe a significant round of conflict will work its way through MRO channels in the coming decade. The driving force of conflict is digitization of the industry and the slow adaptation of both distributors and manufacturers to the digital buyer.

The Research Evidence

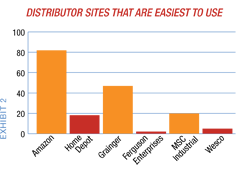

Our proprietary research in the MRO sector finds that the predominance of volume for e-commerce sales is done by a small cadre of wholesalers. Furthermore, non-traditional firms are entering into the wholesale space and taking share. In Exhibit 1, we asked both end-user customers and their distributors how much they purchased or sold online. The response ranges are the same but the distribution of responses are eye-opening. Some 75% of distributors sell 5% or less of their volume online while the corresponding  purchases (5% or less) finds the customer respondents at 43%. Our further review finds that distributor participation in e-commerce approaches a Pareto (20% of the firms transact 80% of the online volume). Multiplying the response mid-range by the respondent percentages (customer and wholesaler) gives an approximation of total online volume. Wholesalers sell 7% of their volume online while customers purchase 16% of their demand online. The gap between purchases and sales is significant and can be explained, in part, by Exhibit 2. In the exhibit, we asked end customers which sites were easiest to

purchases (5% or less) finds the customer respondents at 43%. Our further review finds that distributor participation in e-commerce approaches a Pareto (20% of the firms transact 80% of the online volume). Multiplying the response mid-range by the respondent percentages (customer and wholesaler) gives an approximation of total online volume. Wholesalers sell 7% of their volume online while customers purchase 16% of their demand online. The gap between purchases and sales is significant and can be explained, in part, by Exhibit 2. In the exhibit, we asked end customers which sites were easiest to  use. We included Amazon and Home Depot as suppliers as they came up in our qualitative research (interviews). To our surprise, Amazon was rated the top use site and Home Depot scored nearly as well as MSC Industrial which, admittedly, has approximately half of their sales online. The takeaway is that non-traditional firms are entering MRO markets and taking sales. Today, because of the fragmented markets and the enormity of the sector ($130 billion in North American sales) the sales loss is hard to pinpoint. Our forecasts for online purchases, however, find the loss will be significant if rank and file distributors don’t improve their online presence.

use. We included Amazon and Home Depot as suppliers as they came up in our qualitative research (interviews). To our surprise, Amazon was rated the top use site and Home Depot scored nearly as well as MSC Industrial which, admittedly, has approximately half of their sales online. The takeaway is that non-traditional firms are entering MRO markets and taking sales. Today, because of the fragmented markets and the enormity of the sector ($130 billion in North American sales) the sales loss is hard to pinpoint. Our forecasts for online purchases, however, find the loss will be significant if rank and file distributors don’t improve their online presence.

We took the $130 billion MRO market and added growth factors of 2.5% GDP growth, 3.5% organic growth (over nominal) exhibited by top e-commerce firms, 3.5% migration of Millennials into buyer roles, and a 5% growth preference for online purchases. The output, by 2020, is that 25% of MRO volume will be online. Our further work in digital commerce finds that firms with large caches of SKUs (500,000+) exhibited a 3.5% growth rate over inflation and their wholesale brethren who, typically, trick out their e-commerce with 20,000 to 40,000 SKUs. All the large SKU content firms had a PIM (Product Information Management) solution. In a straw poll of approximately three dozen wholesalers in the $100MM to $1B in sales range in the fall of 2014, we found less than 10% knew what a PIM solution was. Our assessment is that the rank-and-file wholesalers do not have the technology necessary to compete for online sales, as a PIM solution is prerequisite to quality product content which, in turn, is the heart of the e-commerce offering. In summation, our customer research, wholesaler research and field experience paint a picture that online commerce in B2B supply chains is growing. However, the vast majority of distributors and likely many of their vendors, are not participating in this growth and therein lies good soil and seed for channel conflict.

Structure of the Escalating Conflict

Industrial supply chains have become comfortable over the decades. Tensions exist but they have been sedated by the inertia of predictable growth over time and the propensity of manufacturers and distributors, in daily contact, to avoid conflict. However, the skewed participation of online growth creates significant problems for manufacturers including:

- Access to top distributors that dominate online sales may be limited as they have existing sources of supply.

- The growth of end-user purchases will outpace the ability of distributors that are slow to adopt technology, currently sell little online and see the investment risk as too great.

- Distributors may balk at the capital expenditures needed to develop a modern-day e-commerce effort. We estimate the expenditures to be well into seven figures; our field work found a publicly traded industrial distributor recently spent in the neighborhood of $5 million to “do it right.”

These events point to a channel with too-comfortable relationships and where few manufacturers have an existing distribution base ready to compete in the new technology platform. If the online growth moves quickly, we believe channel conflict is significant and unavoidable.

What Can Channel Members Do Today?

Distributors and manufacturers have found numerous challenges over their 140-plus year history. Advancement of technology and ability to work together to answer customer demands has created an enviable record of success and growth for both parties. To avoid channel conflict and get current with online efforts, we suggest the following for consideration:

- Associations bring together both parties to assess the extent of the problem within their respective industries—customer research is highly recommended.

- Distributors and their manufacturers review ways to establish standards for product content and rules for updating the content throughout the supply chain.

- Manufacturers consider using co-op funding to help distributors defray the expense of developing a modern day online presence.

- Bring together knowledge sources to help in defining and working through the issues.

These steps should help in developing a plan where distributors can invest confidently in their online efforts while keeping their manufacturers on a growth path. Diminishing or denying the problem, which appears to be the current preference, will only make conflict escalate along with sales loss.

Scott Benfield is a consultant for B2B channels. He is the author of six books and has participated in a variety of research projects in the B2B supply chain. His firm is located in Chicago and he can be reached at (630) 428-9311 or scott@benfieldconsulting.com. His firm’s site is www.benfieldconsulting.com.

Scott Benfield is a consultant for B2B channels. He is the author of six books and has participated in a variety of research projects in the B2B supply chain. His firm is located in Chicago and he can be reached at (630) 428-9311 or scott@benfieldconsulting.com. His firm’s site is www.benfieldconsulting.com.

This article originally appeared in the May/June 2015 issue of Industrial Supply magazine. Copyright 2015, Direct Business Media.