Get Strategic with your Pricing

By Cathy Veri

In the last 40 to 50 years, we’ve all heard references to the four Ps of marketing: Product, Place, Price and Promotion. Business schools teach it. Marketing managers preach it. But are the Ps enough to compete in today’s world and in the future?

In the last 40 to 50 years, we’ve all heard references to the four Ps of marketing: Product, Place, Price and Promotion. Business schools teach it. Marketing managers preach it. But are the Ps enough to compete in today’s world and in the future?

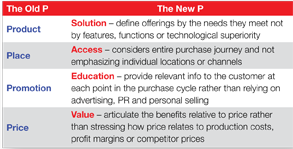

In a word? Nope. Customers are more sophisticated and have more choices and more channels. The customer sometimes has more information than the salesperson. The Ps have changed right before our eyes. And the marketing tools have changed, too. If you look at a Harvard Business Review article from 2012, the marketing Ps are now much more broad, and it is likely that the price P, now value, might be more critical than ever before.

Customer focus and aligning services to serve the most valuable customers (customer centricity) is what is driving the P-word changes. If your most valuable (and most profitable) customers’ needs are truly the focus of your business and your selling proposition, the four Ps are way out of date. Especially for larger volume customers.

What does the customer-centric model force you to contend with? 1) The Internet and access to information leads to access to more products from everywhere, easily; 2) More channels – the customer expects their price to be the same whether ordering online, by phone, or in person; 3) New tools – customers (and distributors) have more access to data and have the ability to research pricing and availability faster; 4) Expedited shipping – customers no longer feel the need to order from the closest distributor; 5) Competition’s capabilities – your competitor is working to cater their services and products by segment, catering to specifically what each customer needs, forcing you to do the same.

So what is a distributor to do? How can you establish marketing advantage and maintain margin in a world where everyone has more data and tools? The answer may lie here: Replace the old P of price with “value” and get some professional analytic tools.

For a distributor, price is most often a cost-plus or list-less calculation. Sometimes it’s “last price paid.” Sometimes it’s the common friend-of-John (FOJ) discounted price. Some distributors choose to create everyday low pricing, while some opt for a higher selling price, knowing they will promote frequent discounts or buy-in deals with quantity.

In customer surveys across all of distribution, price is very important. Price and delivery are usually one of the top three reasons to buy. Very often, if price is not No. 1, it’s No. 2.

And as a distributor, what can you do to make your price = value proposition to the customer? How can you communicate that the price for an item is much more than simply cost-plus? You have to factor in your customer service folks, your same-day shipping capability, your ability to stock for Just-In-Time, and you have to charge for your technical support, your e-commerce software, your accounts receivable staff, your ERP software, your outside salesperson or outbound caller, your promotions, your mailings, your training, and so much more. Price just got very complicated, right?

New analytic tools required

If price or value is No. 1 for nearly every customer, and they have the Internet and access to other data and tools, can you truly afford to keep selling on “price” and keep on establishing “price” with no new analytic tools?

Strategic pricing initiatives are still relatively new for industrial distributors. Over the past decade, more than 10 software companies have come into our industry with pricing intelligence software that targets the largest distributors with $2 billion in annual revenues or more. There is software that focuses on maximizing margin and maximizing price. There is even such a thing as the Strategic Pricing Association. And lately, in the last three years or so, some software and firms are targeting much smaller distributors, even those that do $20 million annually.

Pricing software gives you a tool to view all of your invoices to a particular customer, and it can view all sales of a specific SKU to customers located in a given ZIP code radius or other geography, over time, and it can recommend the best price for that SKU for that customer. You can tweak the “dials,” so to speak, and become more or less competitive on value (price) depending on factors you add to the algorithms in the software. Software is based on either predictive modeling or prescriptive modeling, the latter being the end-all-be-all Grand Daddy of analytics:

- Predictive modeling: what will happen based on historical performance combined with rules, algorithms and sometimes outside data.

- Prescriptive modeling: makes recommendations based on predictions using business rules, predictive analysis and descriptive analytics, predicts what will happen and when, and gives you tips on how to take advantage of these predictions, showing also what the outcomes or risks might be. (Descriptive analysis is what most companies do today, which is finding reasons for success by looking at past performance and mining historical data.)

Professional services or technology, or a combination of both, can provide this analysis. Some firms are selling software that integrates to specific ERP software, such as SAP, and some offer integration to almost any system. In the last several years, a few firms have changed their pricing model so that distributors with $400 million in annual sales, or even less, can afford to use the software and pay for it as a monthly subscription (SaaS). Of course, the pricing software works best if it is integrated into your ERP, and your ERP has the ability to do customized pricing across all sales channels. (Some vendors will agree to a short-term pilot test.)

Some strategic pricing firms focus solely on industrial distributors. One such company that has experience with Fortune 2000 distributors and some mid-size industrial distributors is Zilliant, based in Austin, Texas.

“Strategic, data-driven pricing is a core strength for companies looking for top- and bottom-line growth. Using cloud-based tools like price optimization, they can balance win rate, share, and gross margins, confident that they are hitting market sweet spots across disparate customer segments and product lines,” says Eric Hills, vice president of marketing for Zilliant. “The data and analytics helps them quantify growth opportunities and capture their unique value proposition.”

Hills adds that larger distributors tend to have full-time strategic pricing administrators and pricing teams, who are incentivized for margin and sales growth.

Adds Jim Miller, of Supply Chain Equity, an investor in dozens of distribution companies in the U.S., “We explore strategic pricing opportunities with all of our portfolio companies and I would advise any distributor to learn about it.”

- Even if your company is a smaller distributor, under $40 million in sales, you can still benefit from a more strategic approach to establishing price/value.

- The important thing to remember is price is no longer just “price.” It’s “value,” which is a bucket of services, value propositions, and prices that each customer pays for its products. That value can and should be different depending on the customer.

- Strategic pricing is not just a method for trying to raise prices on C and D items to specific customers. While valid, it’s much more sophisticated and further reaching than simply that.

So, where does value establishment sit in your organization? Is it a finance team function, or is it marketing? Does it sit in product management? Perhaps it is a mix of those functions or a new position; a sales finance position or a pricing administrator. It’s too important of a job to have no one assigned to it.

You think you don’t need software yet to help establish price? You are probably wrong. Even people who sell on eBay are using pricing software to establish price, and change prices, on a daily basis. Internet Retailer magazine showcased pricing software recently, and gave the example of a Halloween costume seller online, who is able to use online pricing software to adjust prices daily for a Frozen Elsa movie costume, moving hundreds of these costumes at different maximized price points over three weeks.

Amazon changes prices sometimes 7,000 times per day. Think about that! Maybe it’s time to get tools in your building so you can truly analyze your historical prices on a per-customer basis. Maybe it’s time to put away the practice of “let’s raise prices 3 percent.”

How do you get started?

- Learn! Spend time online and read. Sign up for information from a variety of strategic pricing firms. Get their white papers. Become a novice, then an expert.

- Attend seminars. Accept invitations to listen and participate in seminars. Some software firms offer one- and two-day events to learn about pricing strategies and explore their software.

- Get quotes. Invite strategic pricing companies to present and provide a quote to you.

- Try! Test! With some of the firms, you may be able to negotiate a three-month trial.

- Talk to the right people. Some employees of the larger consulting firms leave their firms to work for a manufacturer or a distributor directly. Some will often be seen giving a seminar, or maybe you might get one of these people on the phone one day for 30 minutes. Use LinkedIn.

With today’s customers, cost-plus is not a long-term strategy. Strategic pricing and maximizing margin and price for each customer is the future. I hope you will start the process of learning now, and see how strategic pricing and establishing value might trump almost anything else in your marketing arsenal.

Cathy Veri, an industrial distribution marketing consultant, has worked with five of the top 50 industrial distributors in the U.S. since 1999. The former marketing director for JLK Direct in the 1990s during their growth and IPO often works on marketing growth initiatives with industrial distributors selling MRO, electronic components, medical, and security hardware products. Email cathyveri@gmail.com, www.cathyveri.tumblr.com or call (512) 650-0698.

Cathy Veri, an industrial distribution marketing consultant, has worked with five of the top 50 industrial distributors in the U.S. since 1999. The former marketing director for JLK Direct in the 1990s during their growth and IPO often works on marketing growth initiatives with industrial distributors selling MRO, electronic components, medical, and security hardware products. Email cathyveri@gmail.com, www.cathyveri.tumblr.com or call (512) 650-0698.

This article originally appeared in the May/June 2016 issue of Industrial Supply magazine. Copyright 2016, Direct Business Media.