A History of Change

Hubbard Supply Co. will celebrate its 150th year in business in 2015

|

|

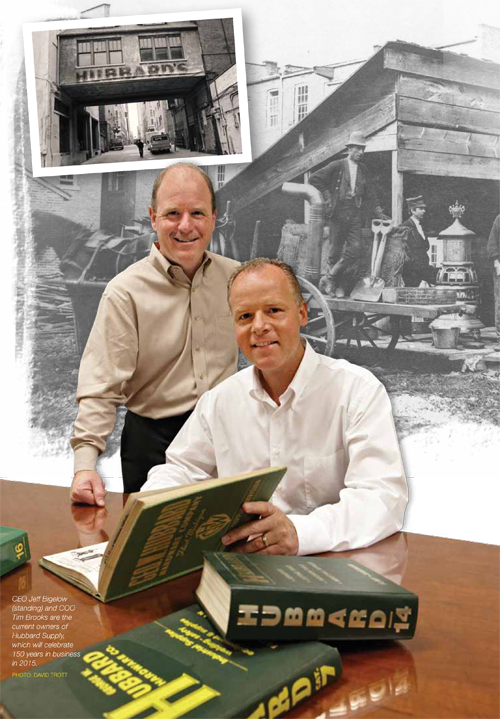

CEO Jeff Bigelow and COO Tim Brooks are the current owners of Hubbard Supply, based in Flint, Mich. |

By Rich Vurva

As one of the oldest continually operating businesses in the city of Flint, Mich., Hubbard Supply is adept at navigating through change. The company was founded in 1865 as a retail hardware store and added an industrial supply division to focus on the growth of manufacturing in the late 1930s. This eventually became the core focus of the business. Ownership changed hands only a few times as the company survived the Great Depression, two world wars and, more recently, the Great Recession.

One thing that hasn’t changed, however, is that the company has remained independently owned and operated while other distributors are being acquired by national consolidators. Current owners, chief executive officer Jeff Bigelow and chief operating officer Tim Brooks, were longtime employees who bought the company from Robert Fuller in 2007.

Bigelow and Brooks credit Hubbard’s longevity to an ability to recognize economic trends and modify their business model for continued success. The company most recently demonstrated its ability to reshape itself when one of its largest customers, General Motors, navigated through its recent Chapter 11 reorganization.

“The business in this region is built around heavy manufacturing. There’s a lot of automotive and automotive related industry here, so when the Great Recession hit, it hit hard,” Bigelow says.

The Michigan economy has been heavily dependent upon General Motors for decades. When GM filed for bankruptcy, Michigan-based companies – especially in the Flint and Detroit areas – were dealt a major blow. For some, business dropped nearly 50 percent at the height of the Great Recession, Bigelow recalls. Employment levels across the state fell dramatically.

|

|

Salesman Tony Magalski (left) and sales manager Dave Albee demonstrate a vending system used at many customer locations. |

As an example, GM employed 80,000 people in Flint operations in 1978. As the company began shifting auto production out of Michigan to Mexico and other U.S. states, employment plummeted to just 8,000 by 2006. According to the Bureau of Labor Statistics, the unemployment rate for Flint peaked at 16 percent in 2009 and remains above 9 percent today.

Like every industrial distributor closely tied to one industry, it was clear that the company needed to diversify its customer base. “But how do you diversify in a regional economy that’s owned by one type of overall industry?” Bigelow asks.

The company recognized the need to diversify as far back as the 1980s, but business was good and the existing opportunity pipeline was strong. The challenge became devoting resources to prospect for new industries when the existing customer base required an all-hands-on-deck effort.

It was also becoming increasingly clear that the automotive employment environment was changing – shrinking in fact – and the area’s population was decreasing, too.

For Hubbard Supply, the answer was first to expand geographically and then to begin reaching out to non-automotive industries.

Reaching outward

Even before the Great Recession, then-owner Bob Fuller recognized the need to expand beyond the metro region. He opened a regional distribution center in nearby Saginaw and established branches in Lansing and Livonia. The latter two branches were later consolidated into a more centralized corporate structure as logistical efficiencies advanced within distribution channels.

Hubbard acquired the industrial supply division of Kendall Electric in Battle Creek, Mich., in 2004, opening new opportunities and centralized distribution points in the western part of the state. It also provided experience in dealing with customers in industries outside of the automotive sector, such as food processing, pharmaceutical and even commercial and institutional businesses.

The Kendall acquisition was the second time the company grew by buying another distributor, having purchased Shand Electronics, a Flint-based electronics supplier, in 1993. An acquisition strategy is a core component of the company’s current growth plan. Hubbard is eyeing opportunities that offer the proper strategic and cultural fit and align with the company’s business development plan.

Hubbard expanded its geography even further by following the growth of several customers to other states. The company currently has teams of people that manage traditional and integrated supply relationships with customers in Kansas, Maryland, Ohio and Indiana. The Hubbard team believes the strength in delivering on its core value proposition will continue to build this type of growth opportunity.

Today, only a small fraction of the company’s core business comes from Flint. The business opportunity that remains is robust but has changed considerably from the past. Advances in technology and process efficiencies have significantly changed the employment landscape in manufacturing.

“It used to be that a GM plant would employ thousands of employees and we did business with most of the plants,” recalls Tony Magalski, a salesman with 24 years at Hubbard. “Today, they’re down to four main plants, and a big plant employs 1,400 to 1,500 people vs. several thousand.”

GM has shifted much of its automotive assembly operations out of Flint, leaving vacant lots where assembly lines once stood. But, much still remains. In 2013, GM announced plans to invest $600 million to upgrade its Flint Assembly facility, including construction of a new paint shop. As a result, Hubbard has developed expertise in surface preparation and paint finishing, which has opened up opportunities within automotive and other industries that focus on surface finishing.

“The typical independent distributor works hard for their customers to do the difficult work. That’s what we get. Our national competition largely gets a lot of easy stuff, the commodity stuff, and our customers depend on us to do everything else,” Bigelow says.

Research and development facilities also remain a major part of the Michigan market, and Hubbard provides an array of industrial products and value-added services to those facilities.

“Everything that is currently happening in the automotive industry today started five years ago in the R&D side of the business,” Bigelow explains. Hubbard’s efforts historically focused on providing commodity management and integrated supply services for its core products to the manufacturing facilities. Today, much of that effort has transitioned to serving R&D facilities.

“When you think of an R&D facility, they’re designing a product, they’re testing a product, they’re building the production lines that eventually go in to a manufacturing plant but on a smaller scale,” Bigelow says.

The focus on R&D support is not limited to the automotive industry. According to the Michigan Economic Development Corporation, the state of Michigan has more engineers per capita than any other state, and its R&D centers provide engineering, design and research for several industries, including automation, materials, defense and manufacturing systems.

“So you’re seeing kind of a rebirth of Michigan, based around the engineers that we have that reside here,” says Tim Brooks. “As automotive companies have downsized and companies have left, you still have a pool of talent here. So I think a lot of the new manufacturing and the new business that’s coming into Michigan is a result of the engineering base that we have here.”

About 50 percent of Hubbard’s business is automotive related, down from more than 90 percent a decade ago. When customers that were Tier 1 suppliers to the automakers expand into other segments, such as aerospace or the medical industries, Hubbard has followed them.

“As people within our customers have left and gone to work for other companies, they brought us along with them, because we’ve done such a good job supporting them,” explains Dave Albee, sales manager.

Changing landscape

Bigelow believes that it’s important for independent distributors to continually adapt to changes in the marketplace. For example, he says the integrated supply concept continues to evolve as major manufacturers outsource non-core activities. In some cases, manufacturers are contracting with facility management firms to oversee multiple plant operations. Some may own the property. Others manage maintenance of the property, including the building, the production line and even hire the employees on the assembly line.

Commercial real estate and property management firms have developed integrated facilities management teams that help manufacturers with engineering support, provide advice to improve safety and productivity, reduce energy costs and evaluate and manage suppliers in the supply chain.

“That is starting to change the relationships with companies like ours that have managed indirect materials that support production,” he says. “We’re not likely going to take on that larger role but what you may see going forward is companies like ours will become commodity managers under those larger integrators.”

Bigelow says Hubbard Supply will adjust and grow its distribution and integrated supply models as the marketplace changes and customers require a more sophisticated value proposition. It’s an approach that has enabled the company to prosper for nearly 150 years, so there’s no reason to change the philosophy now.

This article originally appeared in the Nov./Dec.. 2014 issue of Industrial Supply magazine. Copyright 2014, Direct Business Media.