Know your team, see your opportunity

by Nelson Valderrama

In the July/Aug. issue of Industrial Supply, I talked about the massive opportunity facing industrial distributors that understand the upside of focusing on their pricing as a growth lever. Far too many distributors are getting tied up only with pushing volume, while in fact, the numbers actually suggest that optimizing pricing can produce three to four times greater profit growth than volume adjustments alone.

In this issue, I want to dive into some simple frameworks that will help you better categorize your current organizational practices, and find simple opportunities hidden in the data you already have.

Which Club do You Belong To?

Depending on your passion around margin and pricing, your company might fall into any of the following buckets:

The Inertia Club. Companies that belong to this group firmly believe that the way they have been doing things for years (some for decades) is the way to do business. Pricing is a magic recipe for them, built on best costs, a target gross margin percent (GM%), and a tribal guideline that their sales people need to apply. If at month end the GM% is better or higher than expected, they believe it has to do with the tough negotiation they had with a vendor a couple of months ago or maybe they are selling parts with greater GM%, which reinforces their idea that their business model is working.

Some individual contributors (the curious ones) might have their own report or Excel files to keep track of things, but companies that belong to the Inertia Club almost always fail to backup their intuition/experience with data. Bottom line, this club wants the ball to keep rolling without tinkering or toying with anything too complex.

The Play-Hards. The sales teams for the companies that belong to this club are hard workers, have great individual contributors that have decent account penetration, and have conversations that revolve around increasing volume and/or finding new opportunities.

This group’s pricing philosophy is based on the same principles as the Inertia Club, but the difference is that the owner and/or the finance/operations guys are somehow monitoring the GM% at the customer level and manually trying to spot anomalies. These teams can spend hours lost in multiple Excel reports before they wonder if there is a better way to do this, but they are so busy working hard, they do not have time to explore new solutions.

The Work Smarts. In this camp we have companies where the owner and/or GM is a visionary who protects the current business but invests time to collaborate with her/his team to expand their business. The companies that belong to this club have developed (or are working) to have pricing built in to their ERP, so every line quoted has the best price coming from the aggregation/iteration of decades of commercial intelligence from the most experienced salespersons.

For these teams there are no surprises at the end of the month. They know how they made money and, more importantly, when people leave or retire from these companies, the owners don’t have to freak out because the tribal knowledge is gone. Instead, they can confidently move forward knowing the data lives in their systems for anyone to use. As I said, these GMs or owners are visionaries.

You Get What You Measure

By the time you read this article, we will be starting the fourth quarter of 2019. With the current dynamics in the market you play in, with the geopolitical context we are living (including tariffs), and your sales growth initiatives, ask yourself:

- Do you really know what is driving monthly sales changes from period to period?

- Is there anyone (sales, finance, operations) within your company who can explain the sales changes you are experiencing?

If you do not have a reporting system, business intelligence, or analytics in place, you might receive answers such as:

- We have a mix issue; we are selling items of lower price

- Demand is soft, our customers are buying from us but buying less volume

- It is a very competitive market right now, we’re losing some orders due to pricing but our best sales guy rescued some big orders lately

- Our bookings are strong but shipments are down because our vendors’ delivery is weak or we did not have the stock to fill

Changes in sales from month-to-month, year-to-year, or any other time period should not be a mystery but, often, is just that. I meet with companies all the time that go to great lengths to develop an annual, calendar sales budget but when the actual results flow in monthly, they’re at a loss to explain what is happening from that budget, and I hear:

- Sales are higher but we know for a fact there have been no sales price increases

- Sales of the XYZ widget are through the roof, but profits just aren’t there

- Our GM% is under pressure every month but we have no clue which items and/or customers are the biggest offenders

It’s Time to Resolve the Mysteries in Your Business

It’s Time to Resolve the Mysteries in Your Business

With the desktop you have in your office (which has 1,300 times more processing power than the computer that landed Apollo 11 on the moon) and some formulas of Sales Variance Analysis (SVA) in a simple spreadsheet (Excel or Google Sheet), you can resolve the mystery so you can discuss profitability in simple terms with your team.

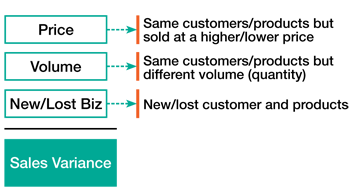

The idea of SVA is to compare your sales in two time periods (let’s say the past period is the first semester 2018 vs. the current period which is the first semester 2019) to calculate the variance (difference) but, most importantly, to have visibility of what is causing that variance.

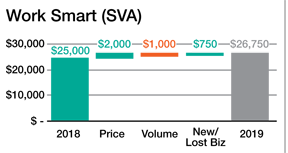

Let’s start with basic math. For example, if your sales were $25M in first semester 2018 and $26.75M in first semester 2019, your sales grew 7 percent and the variance was $1.75M ($26.75M - $25M). Somehow we know in the industrial distribution industry that something drove the $1.75M gain; it could be pricing, volume or mix.

Every month, authorized users of Intuilize (an ERP plug in) have visibility of the main drivers that cause the sales variance in a given period as follows:

Let’s see how three companies respond to an SVA of $1.75M depending on which club they belong to from our breakdown above. If your company belongs to the Inertia Club

Everyone on your team will be doing high-fives and celebrating an amazing first semester. The 7 percent growth will reinforce the belief that you are terrific negotiators with vendors and that your great relationships with customers matter more than ever before. You feel that your sales are hitting on all six cylinders and your business model is good.

The Work-Hard team

Your team will look into their top customers and vendors, review bookings, GM% and sales trends. The owner/finance guy might dig into the main variances by customer, which will take them a couple of weeks to generate/calculate and — if time permits — they will provide some comments to the team. Best performing individuals will be rewarded and the rest of the team will feel that their team/company is doing good because they are growing by 7 percent and there were no major changes in the top customers.

The Work-Smart team

Know that before celebrating the $1.75M variance, they want to understand what is driving the number. By using an SVA report (such as the one on page 31), in minutes they will spot that initiatives around pricing are bringing $2M and the activities captured by the outside sales team in the CRM are bringing new business of $750K — but they might have a major issue on volume due to the negative $1M they see (which means that they are selling fewer quantity of pieces overall).

In the next staff meeting, the sales leader will have key takeaways about the new/lost business; the operations and sales teams will present to the GM the root cause of the lost volume ($1M) and, most importantly, they will spell out potential ways to mitigate risk going forward and explore options to get that business back. Based on the detailed analysis of the SVA by product commodity and customer segment, the VP of finance will share with the team the successes as well as where they need to work closely to keep the momentum.

Work Smart (SVA)

Work Smart (SVA)

The owners and GM of Work-Smart companies appreciate how everyone at her/his company work hard but know that the true potential to ensure long-term viability of their business is playing smart and hard by:

- Measuring success (or failures) of pricing initiatives by isolating the impact of price changes at the customer level. This provides true visibility into the success of your price increase implementation.

- Spotting out opportunities to gauge cost changes, evaluate their magnitude, and pass them on to your customers.

- Quantify the impact of initiatives in your business like new product launches (mix), new customer acquisition (mix), customer account penetration (mix) vs. pure volume and pricing changes.

So, which club do you want to belong to?

As a business leader, you’re always driving to make your company more profitable. We live in a world that is automated, evolving, and connected in ways we’ve never imagined. Doing things the same way we did 30, 20, even five to 10 years ago will simply not keep you competitive.

The blueprint is there for you, and your pricing is at the heart of the biggest opportunity on your plate. If you are a business leader in the industrial distribution sector, now might be time to start letting your data do the driving for you.

Nelson Valderrama is the CEO of Intuilize, which specializes in helping mid-size distributors transform data into profits. Nelson has 22 years of experience in the industrial distribution industry helping businesses uncover hidden competitive advantages and unleash the power of data in the new digital economy. For more information contact him by email nelson@intuilize.com or visit www.intuilize.com.

This article originally appeared in the Sept./Oct. 2019 issue of Industrial Supply magazine. Copyright 2019, Direct Business Media.