Full-Service Distribution: Vulnerability in the Digital Age

As distributor customers move online, they are increasingly served by non-traditional business models.

A white paper by Scott Benfield and Steve Griffith

Our financial analysis of the operating profit generation of full-service distributors’ customer portfolio finds that full-service/traditional distribution firms are vulnerable to low-cost online competitors. If these competitors target commodity purchases of top activity profit customers, 80% of operating profits can be wiped out from only 15% of sales. Distributors should move quickly to use technology to lean out their operating platforms while developing offensive strategies to securing customer loyalty.

As distributor customers move online, they are increasingly served by non-traditional business models. Among these are New Age distribution entities including firms such as Zoro Tool (www.zoro.com), Civic Solar (www.civicsolar.com), Show Me Cables (www.showmecables.com), Sustainable Supply (www.sustainablesupply.com) and Automation Direct (www.automationdirect.com). These firms are prospering as purchases move online. Additionally, B2B marketplaces including Amazon Business and Alibaba.com are giving end customers more buying choices, including buying from the marketplace provider.

Our work and research are corroborated by a growing number of end-user buyer studies that find New Age distributors, marketplace providers, and manufacturer-direct shipments are increasing share of the omni-channel. Often, they compete directly with traditional distributors that, in many instances, are customers. Because of their efficient business models with few, if any, outside sellers and few branches, they can reduce cost and often take the price advantage to market. Our work finds that these e-commerce-based models can reduce price to the end-user by 10% or more and have a higher return on sales of 2x to 3x that of full-service distributors. Additionally, our work in transaction-based activity costing and structure of the customer portfolio finds that full-service wholesalers are vulnerable to these new models and that small sales losses can become financially damaging in a short time frame.

Cost Advantage of New Age Distribution Firms and Manufacturer-Direct

The cost advantage of New Age firms comes from their business model, which is a basic search and purchase online experience. New Age distributors typically ship from a few branches, have limited outside sales and offer limited service variation. Their technology is, usually, top notch and they take their business model efficiencies to market in the form of a price advantage to the customer. They often grow volume quickly. An example is Zoro Tool, a “single-channel” model launched by Grainger in 2011 that, by the end of calendar year 2015, had $300 million in sales. The most current forecast predicts Grainger’s single-channel models will increase to $2 billion in sales by 2019 year end; Grainger recently moved Zoro to the UK to capture volume there.

Manufacturer-direct shipments are also on the rise. A recent survey of 140 manufacturers found that 80% were increasing investment in e-commerce, with 54% planning on selling direct and bypassing existing intermediaries. Over the years, manufacturers have increased channel investments for distributors - including volume rebates to co-operatives, marketing development funds and special pricing allowances - while supporting sales efforts. These channel supports can easily run 10% of sales or a full third of operating expenses. For example, a manufacturer selling a $1,000 compressor at a 40% gross margin normally nets $100 in operating profit with $100 spent in channel supports and sales forces and another $200 in warehousing, storage, packaging, shipping, accounting, etc. Should the manufacturer sell the product direct to the contractor online, the company could pocket much of the $100 in channel support costs, with the transaction yielding sufficient margin dollars to cover the downstream fulfillment costs.

New Age firms and manufacturer-direct shipments have prospered as B2B e-commerce software offered an acceptable buyer experience. We date specialized B2B e-commerce software to around the Great Recession when transaction platform software first appeared. As the software became more specialized, New Age competitors and manufacturer-direct shipments began to appear. These omni-channel competitors figure prominently in surveys of distributor customers and research finds they are increasingly competing against distribution firms for the online customer order. Cost advantages of these alternate channel models varies but common ranges measured as percent of distributor sales include:

- Limited sales complement where the customer self-serves: 3% to 6% advantage

- Reduced branches (often, less than a handful serve North America): 2% to 4% advantage

- Simple service platform (which is much more efficient than complex product/service offerings and supporting staff of full-service distributors): 8% to 10% advantage

The cost advantages total a common range of 13% to 20%. In general, half of the cost advantage is taken to the market as a price decrease over full-service distribution while the rest is taken to the bottom line.

New Age entities and manufacturer-direct shipments will become more prominent as channels digitize. Today, online sales in most B2B sectors are 10% to 15% of total sales. Many of these sales are for commodity products where the buying risk is reduced. Our research finds that commodities represent 40% to 70% of all channel sales, which means current B2B online market share has only reached 15% to 25% of full potential; there’s a lot of growth to come. B2B online markets grow overall at 7.4% per annum. By 2028, 30%+ of sales will be online.

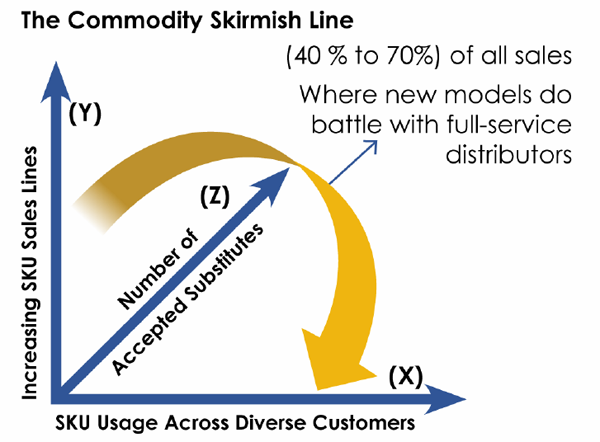

Exhibit I

Exhibit I is a graphic called the Commodity Skirmish Line that depicts the competitive battlefield where New Age models and manufacturer-direct shipments will compete with full-service distributors for the online customer. We measure commodities using three definitions of: 1) Increasing SKU sales per line, 2) Number of accepted substitutes and 3) SKU usage across diverse customers. Our consulting research and work finds that commodities are purchased in volume, often by rote, and there are, typically, a handful of manufacturers with competitive price and acceptable performance. Hence, an online buyer can review and source these products with a minimum of risk and potentially significant savings. It is not uncommon to find B2B customers who purchase seven figures worth of goods from distributors. A $2 million account, buying 50% of its demand in commodities, could save $100,000 annually using a New Age distributor.

When we offer this comparative illustration, many distributors rightfully counter that they have moved further into the supply chain with unique services, on-demand service, consultative advice and light manufacturing. These efforts, distributors argue, offer their customers significant “operating cost or channel cost” savings. However, many of these savings are “soft” being that the customer must change their operating procedures to realize the gain, whereas price reductions are “hard” savings and, generally, directly improve a customer’s profitability. Our experience in competitive B2B sectors is that hard savings are almost always more desirable than soft savings.

The upshot of New Age distributors and manufacturer-direct efforts are that full-service distribution firms will have growing competition from mostly low-cost/limited service competitors. Because of their hard savings on low-risk products, these firms can build volume quickly and become formidable over time. Strategically, these competitors act as classic disruptors in that they serve small and mid-sized customers, thereby avoiding strong competitor responses. Over time, they move to larger customers with larger transactions; this is where they can financially upend the full-service distribution firm.

The Tottering Customer Portfolio and Financial Risk

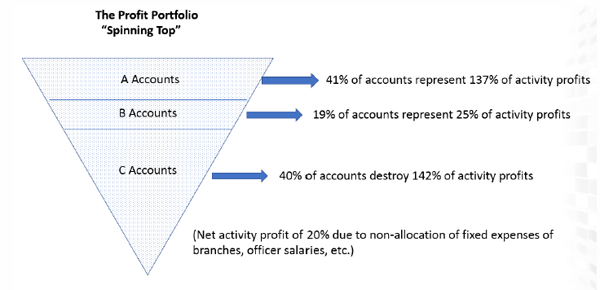

The field of activity costing in full-service distribution has been applied, with varying success, since the early 1990s. We did consulting work in the sector with a transaction-based modeli from 2006 to 2013. Based on our work, and congruent with other customer-based activity allocations in the sector,ii the typical customer portfolio resembles a “spinning top” configuration (Exhibit II) with the following profit profile: A-Accounts represent 41% of Accounts and 137% of Activity Profits; B-Accounts total about 19% of all accounts and 25% of activity profits; and C-Accounts represent 40% of accounts and <142% of activity profits. The firm’s future rests with the A-Accounts. As distributors move further into the value chain trading services for product sales, the profit picture worsens. Additionally, gross margin dollar compensation drives sellers to accelerate dependency on A-Account customers as services are offered at unplanned intervals or unique services are not fee-based. In short, compensation does not measure expenses below the gross margin line and sellers commit the firm to increased services and service variation, which raises operating expenses without corresponding margin increases. Hence, as distributors attempt to grow in mature relationships and mine niches, they have to increase pricing on A-Account customers to compensate for the growing unprofitability of B and C customers.

Exhibit II

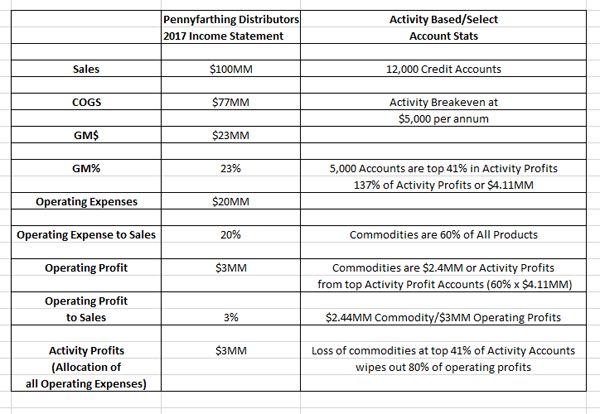

Wholesalers have tried increasing prices or limiting service variations for B and C customers with mixed results. These customers are generally smaller in annual volume, have smaller transaction sizes in dollars, and are more price in-elastic in their buying behavior. As full-service distributors grow acquisitively, they also need increasing capacity buffers in brick-and-mortar locations and people to keep the top spinning. They are vulnerable to low-cost competition selling commodity products. To illustrate the financial vulnerability, we developed an income statement simulation for Pennyfarthing Distributors based on common financial statement ratios across durable goods distributor markets. In Exhibit III, we’ve modeled $100 million in annual sales at a 23% Gross Margin Percent and 20% of sales as operating expenses. The firm nets $3 million in operating profit or a 3% return on sales.

Exhibit III

The firm has 12,000 credit accounts that are the vast majority of sales. An activity profit “breakeven” is $5,000 in annual purchases. This is the annual volume where accounts begin to have a greater than 50% probability of yielding an activity profit. (Note: For simplicity, we’ve allocated all operating expenses as activity costs. This is not our normal procedure but simplifies the analysis with nominal compromise to its validity). Since 41% of accounts are the top activity producers, this means that 5,000 accounts represent 137% of operating profit or $4.11 million (1.37 x $3MM OP). We’ve made commodities 60% of all sales for Pennyfarthing, which translates to $2.4 million in operating profit (.6 x 4.11MM). When we compare (or ratio) the commodity contribution of operating profits of A-Accounts ($2.4 million) to total operating income of $3 million, we find it represents 80% of all operating profit; a point at which the full-service firm’s financial viability is questionable.

Translated to top-line sales, if $5,000 is the activity breakeven, then 5,000 accounts are equal to $25 million in top-line sales, of which 60% are in commodities, meaning $15 million is vulnerable. Should

New Age competitors or manufacturer-direct shipments target the commodity sales of A-Accounts (15% of total sales) they can severely damage the financial well-being of Pennyfarthing Distributors.

Our analysis is based on a static simulation of activity profit averages across differing industries. But distribution executives want to know if the simulation holds up in the “real world” of day to day competition. To answer this question, we move to observations from our consulting and parallel events in similar business models. The most common parallel is the sector of brick-and-mortar retail where major retailers including Sears, Macy’s and Walmart have struggled online. Other firms, including Toys-R-Us, have recently been added to the store closure list that, in 2017, found 7,000 stores close due to online competition. The need for store closures is a drive for efficiency where Amazon has 103 warehouses and 61 delivery stations for close to $180 billion in sales. In short, the productivity of Amazon is far greater than an individual retail firm and the company places considerable cost pressure on full-service retail that operate many local branches and employ multiple floor sellers.

New Age B2B models also share similar characteristics to Amazon, including Zoro Tool, Grainger’s low-cost entity. As of 2017, Zoro had five distribution centers serving the U.S. market. Grainger does not separate out Zoro Tool sales in their financial reporting. However, at the end of 2015, Zoro had $300 million in online sales from its start in 2011. Using past growth rates, if U.S. sales for Zoro were approaching $500 million, each distribution center would ship $100 million in sales. In the U.S., durable goods distributors sell $2.75 trillion out of approximately 257,000 locations, meaning each location averages between $10 million to $11 million in sales, or one-tenth of Zoro’s estimated sales per location. Hence, Zoro leverages its warehouse space by a factor of 10x over competing distributors. Additionally, Grainger has reduced its branch complement around 35% from slightly over 400 several years ago to around 250 today.

Along with reduction in branches comes reduction in warehouse personnel, inside sales, customer service and administrative positions. As purchases move online, buyers compare prices and are driven to order the lowest cost commodity of comparable performance. Based on our analysis of the retail sector and large wholesale entities, we believe that operating cost efficiencies will be used as leverage against full-service distributors whose value proposition was carved out in an earlier age where supply chain information of product, price, availability and delivery estimate was much less accurate than today. Online technology has approached near perfect supply chain information while the supply chain infrastructure of traditional distributors has changed little. While there is a difference in the value offering of full-service distributors, we believe that it does not sufficiently differentiate commodity products. Based on our financial analysis, the sector is vulnerable for as little as 15% of sales at top-activity profit accounts.

What Should Distributors Do?

Our recommendations are for distributor executives to analyze their individual firms and sectors. Surveys on end-user buying habits from New Age firms should be done as well as a thorough financial analysis of commodities, top-activity customers, and their price sensitivity. Additionally, management should run simulations of how they can get cost out of the existing structure, including sellers and branches. After a thorough analysis, executives should make changes in their infrastructure, replacing excess sellers and branches with e-commerce ordering while consolidating order fulfillment for online purchases. We also recommend that full-service distributors examine service promises for individual accounts and understand if the account warrants special services. The alignment of capacity with customer value can help reduce inefficiencies. Finally, we encourage distributors to engage new fee-based services to help differentiate their value to key customers and away from commodity product sales.

Our work and research finds that B2B online commerce is growing at 3x traditional distributor growth rates and New Age competitors and new business models are using operating platform leverage to take commodity sales from full-service firms. The sooner distribution executives research their sectors and use e-commerce to lean-out their business models, the better.

Scott Benfield and Steve Griffith are consultants for B2B distributors and manufacturers in the digital economy. They are members of an association of consultants, Digital Channel Advisors, whose goal is to help mature B2B firms compete online. They can be reached at Scott@BenfieldConsulting.com or SGriffith2353@mac.com. Digital Channel advisors can be seen at: www.benfieldconsulting.com/digital-channel-advisors.html or reached by phone at (630) 428-9311.

i Benfield, S. “Labor Differential Transaction Costing,” Patent Applied For 2011.

ii Most customer activity cost models find that 30% to 40% of customers are highly profitable, while 40% consistently do not cover their costs to serve. The most well-known current research on customer profitability is by Jonathan Byrnes of MIT in his book “Islands of Profit in a Sea of Red Ink,” at: http://islandsofprofitbook.com/

Click here to download a PDF of the white paper.