“Cutting tool consumption is on pace with durable goods production, a positive sign that supply chain issues and shortages of raw materials are easing,” commented Jack Burley, chairman of AMT’s Cutting Tool Product Group and Committee. “Despite fears of a recession, cutting tool usage has not been affected so far, and industrial production capacity remains steady.”

Costikyan Jarvis, president of Jarvis Cutting Tools, also spoke on durable goods, stating, “The GDP measures durable goods, non-durable goods, and services, so is it possible that the forecasted recession will largely avoid durable goods. The 12-month CTMR average is only 90% of pre-pandemic levels. Commercial aerospace production is still recovering, and the automotive market, after only selling 13.7 million units, has the possibility to stay flat.”

The Cutting Tool Market Report is jointly compiled by AMT and USCTI, two trade associations representing the development, production, and distribution of cutting tool technology and products. It provides a monthly statement on U.S. manufacturers’ consumption of the primary consumable in the manufacturing process – the cutting tool. Analysis of cutting tool consumption is a leading indicator of both upturns and downturns in U.S. manufacturing activity, as it is a true measure of actual production levels.

Historical data for the Cutting Tool Market Report is available dating back to January 2012. This collaboration of AMT and USCTI is the first step in the two associations working together to promote and support U.S.-based manufacturers of cutting tool technology.

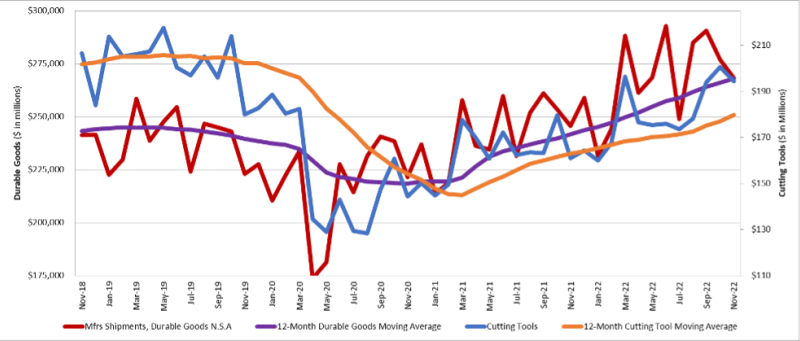

The graph below includes the 12-month moving average for the durable goods shipments and cutting tool orders. These values are calculated by taking the average of the most recent 12 months and plotting them over time.