Container rates surge amid the Red Sea crisis

In response to the escalating Red Sea crisis, Container xChange, an online container logistics platform, has released a comprehensive report detailing the far-reaching effects on container trading and leasing rates worldwide.

The report explores the intricate dynamics of the crisis, shedding light on the unprecedented surge in container prices and leasing rates, as well as the ripple effect on global trade routes.

Impact of Red Sea Attacks on Container Prices

As container vessels take longer routes, capacity constraints contribute to a revival in container rates. The China to Europe trade lane has witnessed significant surges, with trading spot rates soaring in key Chinese ports. The disruptions are not confined to China; leasing rates bound for Hamburg, Germany have doubled since January 1, 2024.

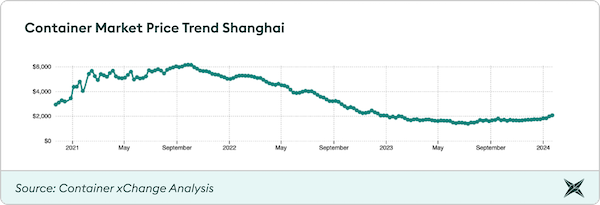

To provide context on the current state of average container prices in Shanghai, China, in comparison to the peak demand period during the COVID-19 pandemic (2021), we present a chart illustrating the price trends from 2020 to January 29, 2024. The container prices skyrocketed to historic levels in 2021 due to the pent-up demand post COVID, reaching a peak of $6171 in the last week of September 2021, and falling since then until December 2023 (keeping aside minor seasonal hikes). However, container prices have experienced a significant increase since the beginning of January 2024.

|

|

Chart 1: Average container price trends in Shanghai, China November 2020 – January 2024 |

Weekly China – Europe Trading Spot Rates Continue to Shoot Up

Trading spot rates for 40-foot-high cube cargo-worthy containers have witnessed a significant surge in key Chinese ports. Noticeable week-on-week increases have been recorded in Xiamen (23%), Shekou (19%), Guangzhou (10%), Huangpu (8%), and Nansha (8%). These disruptions are not confined to China; leasing rates bound for Hamburg, Germany have doubled since January 1st, 2024.

“Since the beginning of the Houthi situation, the trading prices for 40-foot-high cube units in China significantly increased because there is expected tightness around equipment availability in Chinese main ports ahead of Chinese New Year because the loop around Africa soaks up capacity and delays the return of empty equipment to China,” said Christian Roeloffs, cofounder and CEO of Container xChange.

“At present, there is still surplus in the market. However, the challenge lies in securing space on vessels, and the PUCs (pickup charges) are considerably high. The suppliers are hesitant to reposition their containers to locations with elevated storage fees, and if they do, they often seek to offset these costs by demanding higher PUC,” a customer added.

A Container xChange customer from India added, “Storage charges in India are inexpensive. Consequently, some NVOCC opt to utilize containers from other companies rather than moving their own.”

Container xChange's research indicates a global impact on container trading prices, with the top 10 locations experiencing substantial month-on-month percentage increases. European ports like Le Havre, France, and Duisburg, Germany, witnessed significant decreases, while ports in North America showed mixed results. Meanwhile, Asian ports, including Shanghai, China, and Xiamen, China, saw an increase in average container prices, indicating adaptation to disruptions.

Container Leasing Rates Continue to Rise

Container leasing spot rates have mirrored the spikes observed in trading prices, especially in the China to Europe route. Rates have steadily increased, reaching notable highs. The expected continuation of disruptions indicates a prolonged period of challenges, requiring industries to adapt to structural imbalances in supply and demand.

"We've witnessed a continuous surge in leasing rates since around August-September 2023, starting at a low of approximately $200 for a one-way move from Ningbo or Shanghai to Hamburg, often referred to as pickup charges," said Roeloffs. "This escalation is primarily driven by two key factors. Firstly, the widening price gap in trading prices has played a pivotal role, and secondly, there's a notable equipment scarcity across China. As the price gap widens and equipment availability tightens, the spike has become more evident since the beginning of 2024. It's clear that the attacks in the Red Sea are not merely a passing phenomenon; they have substantial implications on the routing of container vessels, causing delays in their return trips to China. We have witnessed this surge to top at $800 for a one-way move, marking a fourfold increase.

“We do expect that after Chinese New Year the situation will decelerate and easen up owing to the drop in demand, carriers will be able to reconfigure their network and adjust to the longer transit times around the cape of good hope and are supposed to have a structural supply demand imbalance with a significance supply overhang.” Roeloffs added.

“The situation is expected to persist for a longer than expected period of time and hence, we will probably have to live with this for a long time.