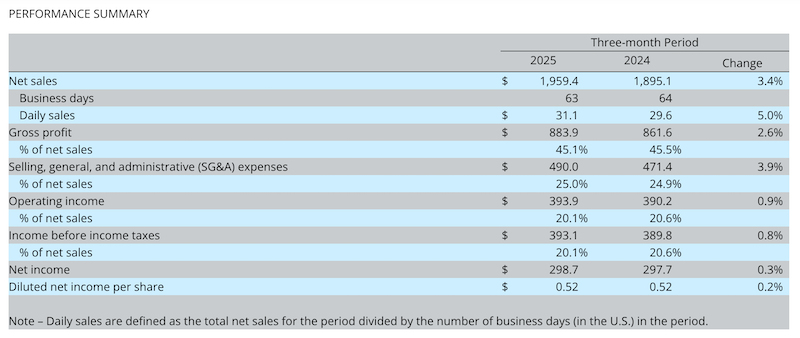

Net sales increase 3.4% in Fastenal's first quarter

Fastenal's net sales increased $64.3, or 3.4%, in the first quarter of 2025 when compared to the first quarter of 2024.

Results reflected contribution from improved customer contract signings over the past twelve months, which was partially offset by sluggish underlying business activity. Changes in foreign exchange rates negatively affected sales in the first quarter of 2025 by approximately 50 basis points as compared to having an immaterial impact in the first quarter of 2024.

The company experienced an increase in unit sales in the first quarter of 2025. This was due to a growth in the number of customer sites spending $10K or more per month with Fastenal and, to a lesser degree, growth in average monthly sales per customer site across all customer spend categories. The impact of product pricing on net sales was not material in the first quarter of 2025 and 2024. Price levels remained relatively stable in the first quarter of 2025.

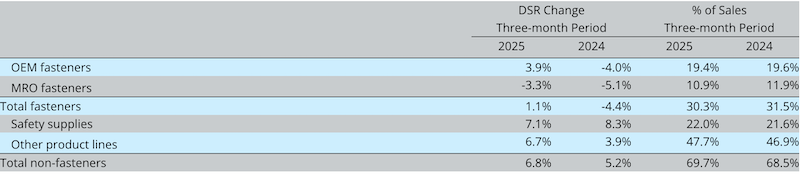

From a product standpoint, Fastenal has three categories: fasteners, including fasteners used in original equipment manufacturing (OEM) and maintenance, repair, and operations (MRO), safety supplies, and other product lines, the latter of which includes eight smaller product categories, such as tools, janitorial supplies, and cutting tools.

With industrial production still sluggish in the first quarter of 2025, the performance of our fastener product line continued to lag our non-fastener product lines. The fastener category experienced growth in the first quarter of 2025 after seven consecutive flat or declining quarters. This was driven by easier comparisons and increased contribution from large customer signings.

The company achieved growth in its safety category reflecting the lower volatility of PPE demand, which tends to be utilized in more MRO than OEM applications, growth of our vending installed base, and success with warehousing and data center customers. Other product lines experienced growth from MRO-oriented lines, such as electrical and janitorial, rather than from OEM-oriented lines, such as cutting tools and welding/abrasives, reflecting continued soft manufacturing demand. The DSR change when compared to the same period in the prior year and the percent of sales in the period were as follows:

Read more here.