CRM Talk – A Q&A with Benj Cohen

Part 2 of an online series based on our May/June article, "Not All CRMs Are Created Equal" by tech expert Rachael Radford.

Industrial Supply: Are distributor reps consistently utilizing the full functionality of their company’s CRM? Why or why not?

Cohen: Most distributor reps don’t fully use their CRMs because they weren’t built for them. These systems are packed with features that make sense for other types of businesses, but not for how distributors actually sell. And most CRMs don’t integrate cleanly with the ERP, where all the critical data lives.

So reps end up swivel-chairing between systems: logging notes in one place, looking up pricing in another, digging through spreadsheets to find product info. And if they’re on the road and need to check inventory, then they have to pull out a laptop, VPN in, and basically hack the NSA just to see what’s in stock.

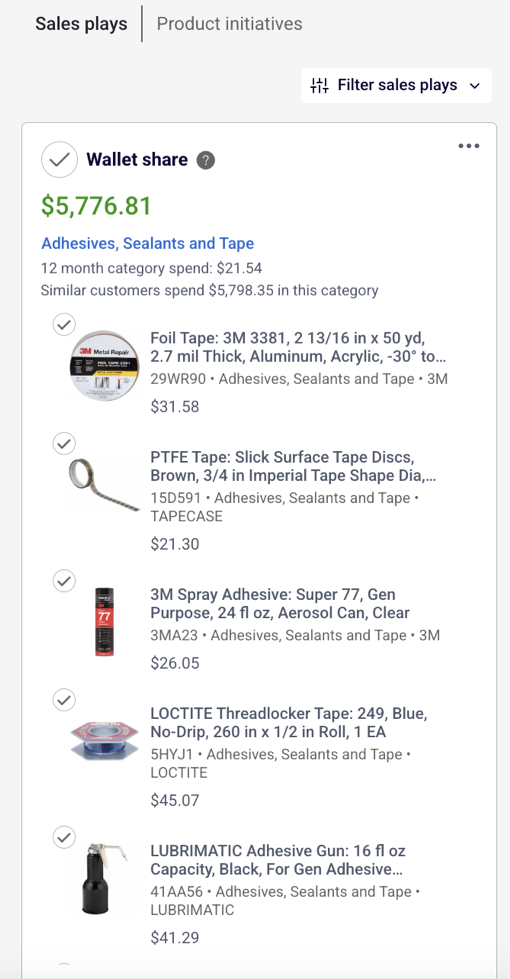

Even when you manage to get the data in, the structure still doesn’t fit because the majority of CRMs are built around leads and opportunities. That’s great for companies chasing new customers but for most distributors, the real opportunity is growing wallet share in the accounts they already have.

This boils down to a fundamental problem in the CRM’s data model: it’s not built for the way distributors do business. That’s why reps don’t use them.

Industrial Supply: When is the right time for a distributor to think about upgrading or changing their company CRM?

Cohen: It’s time to change CRMs whenever the tool is taking up more time than it’s giving back to your team.

CRMs aren’t cheap. So when it shows up as a big line on your P&L, reps aren’t using it, the data’s a mess, and no one trusts what’s in there, it’s time to ask: what are we actually getting out of this?

For a lot of distributors, the trigger is seeing someone else make it work. They hear from another distributor who’s using a CRM that actually helps reps sell, and it reframes the whole conversation.

If your CRM isn’t pointing you towards opportunities to grow revenue that you wouldn’t otherwise see, it’s not doing its job. The right CRM doesn’t just pay for itself. It will make you money, save time for your reps, and help you grow.

Here are three signs your current CRM isn’t delivering ROI:

1. Reps avoid it. A CRM is meant to help teams sell, not slow them down. When reps refer to it as “Big Brother,” it usually means the tool feels more like surveillance than support. In those cases, adoption drops. Reps go back to gut instinct, sticky notes, and spreadsheets. That kind of workaround culture leads to missed follow-ups, lost deals, and limited visibility into what’s happening in the field.

It doesn’t have to work that way.

When a CRM gives reps the information they need (like which customers are underspending or which quotes need follow-up) it becomes something they want to use. As one sales leader put it, “It’s like throwing my team the keys to a sports car.” Not because it’s flashy, but because it’s fast, powerful, and built to help reps win.

That’s what ORS Nasco experienced after switching to Proton. Their previous CRM didn’t deliver insights, and reps avoided it. Once they moved to a system that surfaced helpful, relevant data from their ERP, adoption climbed to 84%. The tool fit the way they work and helped them sell better, so reps were excited to use it.

2. You have data, but no insights. Distributors aren’t short on data. The problem is, it’s scattered: locked in ERPs, buried in spreadsheets, and split across eComm platforms. Your CRM might track what’s happened, but it rarely points to what should happen next. And while ERPs hold rich data, they weren’t built for sales teams.

Reps are left cobbling together insights across multiple systems just to prep for a single customer call. That’s the difference between a CRM that tracks history and one that helps close deals.

Take MSC, a $3B+ industrial distributor. They wanted to turn their call center into a profit center by making smarter recommendations during customer interactions. Their old sales intelligence tool wasn’t cutting it. After switching to Proton, they increased upsell and cross-sell revenue by 20x. Same team, same accounts, just better visibility into what to pitch and when.

And it’s not just sales reps. At USESI, a warehouse manager used Proton to spot a buying pattern and close a sale. No report pulling. Just the right insight, surfaced at the right time.

This is the future of CRM. It’s not about collecting more data, it’s about making that data useful for everyone on your team. The distributors who win won’t be the ones who have the most information. They’ll be the ones who know how to use it.

3. Sales leaders lack visibility. At a lot of distributors, sales managers are flying blind. The CRM shows call logs, email counts, and meeting notes, but not what actually moved the deal forward. You see the activity, but not the outcome.

Was that call a breakthrough or just a check-in? Did we uncover a blocker or just catch up? Without those answers, coaching becomes guesswork. And so does forecasting.

ORS Nasco felt that firsthand. Their team was using a previous CRM, but adoption was low. Without consistent data, leaders couldn’t reliably see where deals were stalling, which accounts were advancing, or how reps were spending their time.

Once they switched CRMs to Proton and tied rep activity to revenue outcomes, their 1:1s changed completely. Managers moved from general check-ins to targeted coaching. Instead of asking “What’s going on here?”, they could say things like:

- “You’ve had three meetings with this customer. Why haven’t we pitched anything new?”

- “They flagged price as a blocker. Did we follow up with a lower-margin alternative?”

This is how modern sales teams level up: not by tracking more activity, but by understanding which actions close deals. That’s the kind of visibility every CRM should deliver.

Industrial Supply: What’s trending in CRM technology in 2025?

Cohen:

AI. Distributors are realizing that the data living inside their CRM is only valuable if someone (or something) can make sense of it in real time. AI is a lever that helps reps move quicker, spot more opportunities, and spend less time digging through dashboards.

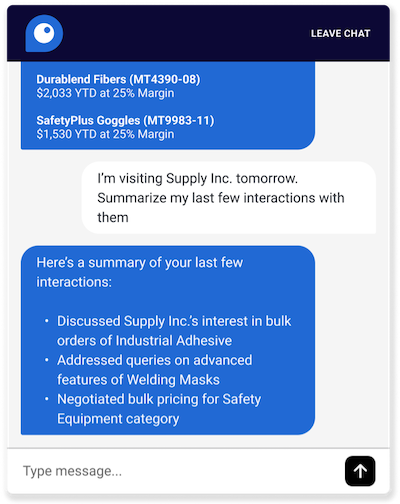

That’s why AI is the foundation of Proton’s core product. Every customer gets access to Pronto, our AI assistant, right out of the box. No upsell, no separate login. It’s built to help reps prep for meetings, spot high-margin opportunities, and focus their time where it’ll make the biggest impact.

And this is just the beginning. The future isn’t just asking AI what to do, it’s asking it to go do it. We’re building toward a world where your CRM doesn’t just recommend a follow-up, it actually writes it, sends it, and tracks the results. That’s what a true AI agent will eventually look like.

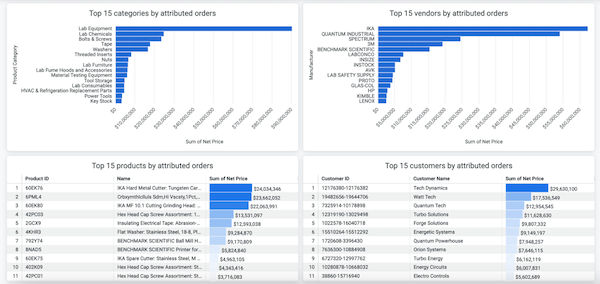

BI in CRM. Growth doesn’t just come from nice dashboards, it comes from fast and confident decisions. But when reporting tools live outside the CRM, every decision takes longer.

That’s changing. CRMs like Proton are bringing enterprise-grade reporting directly into the platform reps and managers already use. With Proton BI, teams can see performance metrics, spot trends, and dig into details without bouncing between tools. That means fewer delays, smarter calls, and more wins.

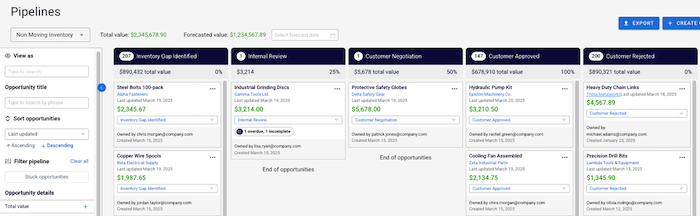

Connecting Siloed Teams. In 2025, one of the most important shifts happening inside distributor CRMs is the collapse of old silos, especially between sales and inventory. These teams have always worked in parallel, but not always together. And when systems don’t talk to each other, critical information gets lost in the gap.

For example, most CRMs don’t flag when a customer backs out of a purchase. Forecasted orders fall through, no one notices, and distributors are left sitting on inventory that doesn’t move. That’s exactly what happened to one of the largest industrial distributors in the U.S.

Products were collecting dust, and sales had no insight into the problem.

With Proton, they built an “At-Risk Inventory” pipeline to track forecasted orders that never materialized. Reps could see what was slipping and follow up immediately:

"You forecasted X units, but we haven’t seen the order yet—still planning to buy?"

Inventory is cash. If it’s stuck, the business can’t reinvest in fast-moving products or respond to new demand. Before, sales didn’t know which customers had gone quiet. The inventory team didn’t know what sales reps were hearing on the ground. They were working in parallel, but not together.

By connecting those teams, their CRM didn’t just surface data, it turned it into action. Reps got notified when orders fell through. Inventory flagged at-risk SKUs. Together, they cleared out millions in non-moving inventory and freed up cash to reinvest back into the business.

All three of these trends point to a future where CRMs are smarter, more proactive, and a natural part of a distributor’s day-to-day. But they won’t just help individual users. They’ll bring teams together so it’s easier to sell more, clear out slow-moving stock, and take better care of customers.

Industrial Supply: Please explain what you consider to be the top 5 features industrial distributors should prioritize in their quest for a new CRM? [And describe how your product offering for distributors meets those priorities].

Cohen: Choosing the right CRM isn’t about picking the one with the longest feature list, it’s about picking the one that actually drives sales. Here are the top features that will help you do that:

1. AI-Powered Recommendations

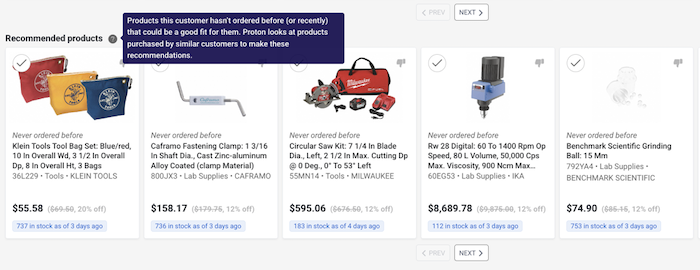

One of the quietest ways distributors lose revenue is through missed opportunities in customer conversations. Not because reps aren’t trying, but because they don’t know what to suggest. Most CRMs leave them with little more than purchase history and gut instinct. So reps either stick to the basics, lean on broad promotions, or skip the upsell entirely.

That’s where AI can help, not by replacing the rep but by giving them sharper signals. At MSC, for example, their call center team wasn’t built to upsell. Their job was to take orders and keep things moving. But once they started using Proton’s AI-driven recommendations in their CRM, the dynamics shifted. Reps could see what similar customers were buying, what products paired well together, and what might be worth suggesting next. It was a small change in their workflow but it led to a 12% increase in sales.

Another example: on a ride-along with a rep, I noticed he had Proton on his phone but wasn’t using it. I nudged him to try the Wallet Share Sales Play before his next meeting.

When he did, Proton flagged a $70K gap in wire. He was skeptical but asked the customer a few questions during the visit. Turns out, the customer was buying wire, just not from him.

They didn’t even know he sold it. He put together a proposal, and a few weeks later, won the wire business.

Later he told us that he wouldn’t have caught that without Proton.

That’s the real potential of AI in CRM. It’s about giving your team clearer guidance, right when they need it, so they can have more purposeful conversations and uncover value they might have otherwise missed.

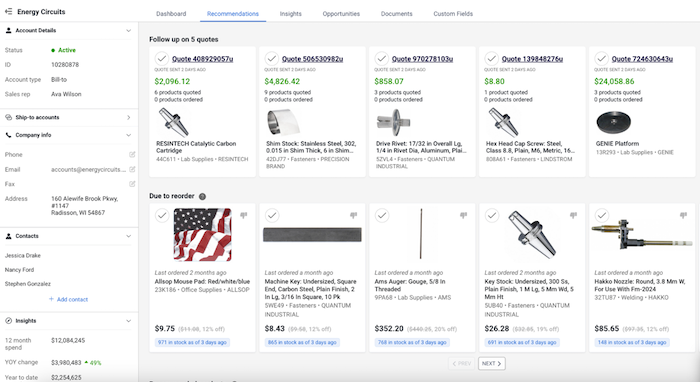

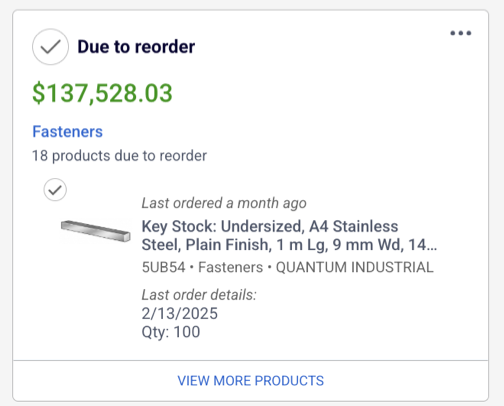

2. Automatic Reorder & Quote Follow-Up

For distributors, two of the easiest wins are reorders and quote follow-ups. Lots of customers tend to buy the same products on a regular basis. When that cadence suddenly drops off, your CRM should flag it.

Most people think of this as a win for the distributor. And it is. But one of my favorite client stories is about how it saved their customer from a major headache.

Proton flagged that a high-volume product wasn’t moving. The rep reached out to check in. The customer thought they were still ordering it but a glitch in their system had stopped the orders from going through.

That one call saved the client from running out of stock. They fixed the issue, placed the order, and told the distributor: “You’re a real partner for catching this.”

That’s what a good CRM should do: spot issues before they become problems, even for your customer.

Same with quotes. They’re near-closed deals, but easy to lose in the day-to-day. If your CRM isn’t connected to your ERP, reps have no idea what’s been purchased and what still needs a follow-up. One large distributor using Proton increased quote-to-revenue conversions by 60% just by giving reps visibility and a process to act on it. That’s the power of having the right info at the right time.

3. Strong Integrations

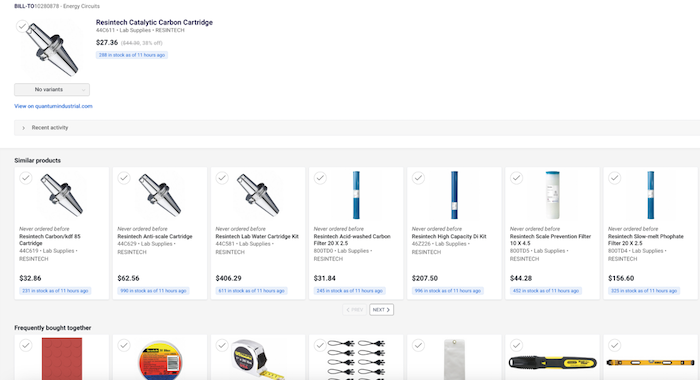

When key data is scattered across systems, reps lose time and momentum. A modern CRM should solve that by centralizing the information they use daily, starting with ERP data. But too often, teams jump straight into the integration and stop there.

The first step isn't plugging into the ERP. It’s making sure your CRM’s data model fits your actual sales model. This is one of the most common mistakes distributors make. Most CRMs are designed for businesses chasing leads and closing one-time deals. Distribution is different. The primary goal isn’t to land all new customers. It’s to grow the ones you already have.

If the CRM doesn’t reflect that reality, even a perfect integration won’t help. Reps won’t open a new “opportunity” every time a customer reorders gloves or restocks wire. They need an account-first system that’s built for how they actually sell.

Only once that foundation is in place, will an ERP integration truly work. That’s when you can start pulling in live pricing, inventory, and order history. Just make sure that your CRM presents it clearly, without forcing reps to dig through layers of screens. We often hear from teams whose CRM “has the data,” but it’s buried so deep it might as well not be there at all. Remember, if it’s hard to use, reps won’t use it.

The next layer is to add more context for accounts by synching email. This gives reps visibility into every touchpoint: quotes, follow-ups, and past conversations, all in one place. No need to chase down threads or ask around for background. It keeps the entire team aligned and responsive.

CRM integration isn’t a one-and-done feature. It’s a spectrum, starting with structural fit, expanding to clean, accessible data, and growing into a full view of the customer that actually helps teams sell smarter.

4. Instant Access to Product Info

Getting a straight answer for a simple customer question like “is this in stock” shouldn’t take multiple systems and ten minutes of your time. But for many reps today, that’s their reality.

In an industry where speed matters, this is a problem. Not just for the rep, but for the customer waiting on the other end.

Real-time access should mean an outside sales rep can pull out their phone during a customer visit and instantly see inventory, customer-specific pricing, substitutes, and recommendations. No laptop. No VPN. No bouncing between tools.

That kind of visibility doesn’t just help seasoned reps sell more, it also helps new reps ramp faster. One inside sales manager told me it used to take three weeks to get new hires up to speed. Now, with all the product info in their CRM, new reps are making calls in week one.

Whether you use Proton or not, this is where CRM is going. Teams need one place for product, pricing, and inventory info that is simple to access, easy to understand, and always available, wherever the rep happens to be.

5. Reporting That Connects Activity to Revenue

With most CRMs, reporting is an afterthought. You export data, open a BI tool, slice it up in spreadsheets, and try to make sense of it all later. It’s slow, disconnected, and rarely shows how rep activity ties back to sales.

But that’s the whole point of reporting: to understand which actions are actually moving the needle. Most systems don’t make it easy to connect those dots. And when the data lives in another platform, you lose time and context trying to stitch it back together.

Reporting should be built into the flow of work. Managers should be able to see the impact of their rep’s activities – that’s how you coach smarter and spot what’s working in real time.

With Proton, that kind of visibility is built in. No extra platforms. No exporting. Just answers right where you need them.

6. Sales Pipeline Management

Sales don’t start with a quote: they start with the product pitch, a scheduled visit, the follow-up call. But most distributors aren’t tracking any of it. In fact, one of the largest distributors we work with (about a billion in revenue) came to us with a familiar problem: they had no real sales process.

Their outside reps were juggling everything from consumables to big-ticket equipment, but it was all ad hoc. Deals got stuck. Follow-ups fell through. Leadership had no idea what was moving and what was stalling.

They rolled out a structured pipeline in Proton, focused on their equipment sales. Every deal now moves through clear stages, with defined criteria and assigned owners. Reps know exactly what to do next and sales leadership finally has visibility.

And that’s the difference. When you can actually see what’s happening in the pipeline, you can coach smarter, course-correct faster, and close more business.

Benj Cohen is the founder and CEO of Proton.ai. He learned about distribution firsthand at Benco Dental, a family business started by his great-grandfather. He graduated from Harvard University with a degree in Applied Math. In 2023, Benj was recognized in Forbes 30 Under 30 – the first leader in distribution to receive such recognition.