Is your business insured for COVID-19?

Four types of business insurance offer potential options for business owners.

by Thomas Stilp, JD, MBA/MM, LLM, MSC

by Thomas Stilp, JD, MBA/MM, LLM, MSC

Apart from health insurance businesses already know about, there are four (4) other types of insurance that most businesses will have in one form or another that might be considered for coverage concerning the COVID-19. We hope this information is useful. We discuss each type of insurance briefly in turn:

1. Business Interruption Insurance: According to our insurance expert, Andy Cocallas of Insurance Services HQ, acocallas@mchenryins.com: “For businesses, the first question we get is regarding the interruption of your business due to a mandatory shut down.”

Generally, insurance for Business Interruption (BI) protects against loss as the result of suspended operations because of property damage (e.g., fire, hurricane or other casualty). Because contagious diseases are not “property damage,” there is usually no coverage. Cocallas would agree, commenting that: “The sad truth is that insurance companies have basically reduced to zero the likelihood of payments for loss of business income due to COVID-19.”

That said, a business might argue coverage if there was contamination to equipment or property, such as HVAC systems, that had to be cleaned, repaired or replaced. Still, insurance policies may exclude loss due to “bacterial, mold or virus.” But if your policy only has a mold or bacteria exclusion, you may have coverage because a “virus” is neither mold nor bacteria.

Related to insurance for BI, there may be insurance for supply chain disruptions or losses caused by mandated closure of businesses by the government. Again, exclusions may apply but it is certainly worth taking a look at your Policy of Insurance. For example, some insurance companies have argued the “pollution exclusion” to avoid coverage on contamination, however, a virus is not “pollution” as defined by the insurance policy.

2. Commercial General Liability Insurance: According to Cocallas, another question is: “Then what IS covered? . . . While the COVID-19 outbreak itself does not directly trigger coverage under your policy, there may be some coverage under the liability section of your policy with regard to customers, vendors and others who come in contact with your business. Such coverage (liability) may exist if they can prove that they contracted to virus due to contact at your place(s) of business. There can be coverage for third party liability for COVID-19 related issues.”

Insurance under a Commercial General Liability Policy (CGL) may be very useful if claims are made against your business for failure to protect, or take adequate safeguards to protect against exposure of infection. But Cocallas stated that insurance companies will not give answers to hypothetical cases. To know whether coverage exists: “They tell us to find out by filing a claim. None have occurred yet.”

Without any actual claims filed, there is uncertainty.But it should be remembered that Courts have declared that an insurance company’s duty to defend such claims is often more broad than other obligations the insurance company might have to your business.Thus, well-worth reviewing your policy should such claims arise.

Analogous for our purposes here, insurance for Directors and Officers (D&O) protects management against claims that management failed to take proper action, have plans in place, provide disclosures of the virus, or follow required government protocols to minimize risk.

The insurance companies often raise “Exclusions” to coverage, but we have found time and again that many policies contain amendments, endorsements and “Exceptions” that would allow coverage to be restored despite any “Exclusions.”Again, it is worth taking a look at your policy to know for sure.

3. Workman’s Compensation Insurance: Coverage extends to injuries “arising out of in the course of employment.” Arguably, your business should be protected against claims if any employee gets sick at work. But Cocallas cautions that: “Employees receive workers’ compensation benefits under your policy ONLY IF the cause of their illness is related to the workplace. For COVID-19, that would be difficult to prove so we fully expect the treatment of this issue to be a medical insurance matter rather than a workers’ compensation matter.” The good news is that, according to Cocallas, health insurance companies, like Blue Cross, are stepping up on coverage and payment.

4. Business Travel Insurance: What if a business trip or convention is cancelled due to the COVID-19? Because a pandemic is so unpredictable, insurance would not cover losses here as insurance companies like to cover risks that can be assessed and shy away from wildly unknown risks caused by the COVID-19. But what if an employee gets sick with the COVID-19 or a trip is cut short? In that instance, we would argue, there should be medical care and coverage provided under the business travel insurance.

Cocallas concludes that: “This is like a blizzard where we are just hunkering down and waiting for it to pass. . . . it is evolving information and subject to change.”

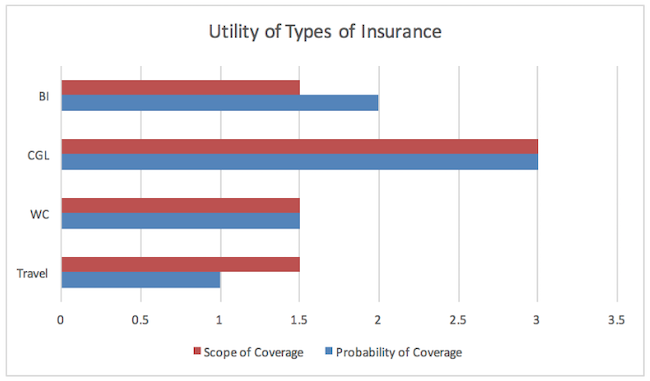

To wrap up, when considering the types of insurance your business has, the following might apply (using a 1 to 3 scale, where 1 is low scope of coverage and low probability for coverage, and 3 is broader scope of coverage and higher likelihood of coverage):

Under the circumstances of COVID-19, the Commercial General Liability usually has the most effect for your business and should certainly be reviewed and considered.

Final Note: Although discussing private insurance in this article, public funds may be available under the SBA’s Economic Injury Disaster Loans, which offer up to $2 million in assistance per small business and can provide vital economic support to small businesses to help overcome the temporary loss of revenue businesses are experiencing. These loans may be used to pay fixed debts, payroll, accounts payable, and other bills that can’t be paid because of the disaster's impact. The interest rate on these loans will be 3.75%. See www.SBA.gov/disaster.

Please let us know if this article was useful for your business.

We would be happy to look at your Policy of Insurance at no charge and provide some guidance. Please contact us at 312.242.4000 or visit www.stilpbusinesslaw.com.

Thomas Stilp is a graduate of Northwestern University, Bachelor of Arts (BA), Master of Management / Master of Business Administration (MM / MBA) from Northwestern’s Kellogg Graduate School of Management [Northwestern granted the MM which became the MBA], Loyola University School of Law, where as a senior editor on the Law Review, he earned a Juris Doctor (JD) and a Master of Laws (LLM) in Real Estate at The John Marshall Law School.

Stilp is also owner of The Pneufast Co. which manufactures collated nails for use in name brand pneumatic tools including Bostitch, DeWalt, Duo-Fast, Hitachi/Metabo HPT, Makita, MAX, Paslode, Senco, and others.

As trusted legal counsel, Mr. Stilp represents businesses, professionals and entrepreneurs, provides creative transactional and litigation strategies, and helps clients successfully resolve their real estate and business issues. Having conducted over 150 trials, many in business and real estate disputes, Mr. Stilp is admitted to practice before Trial Bar, Illinois and several federal district and bankruptcy courts, and has argued and appeared before the 7th Circuit Court of Appeals and the Illinois Supreme Court. In addition, Mr. Stilp was appointed to serve as a Special Assistant Attorney General for Illinois and has acted as counsel for the Office of the Public Administrator handling contested probate matters.

Prior to Law School, Mr. Stilp was employed by a textile manufacturer, where he learned first- hand the problems facing small businesses and honed an interest in manufacturing. A member of various trade, manufacturing, real estate and bar organizations, Mr. Stilp also sits as a member of the boards of directors of a number of private business corporations and non-profit organizations.

Readers can reach him at (312) 334-3441 and tstilp@StilpBusinessLaw.com