Surviving the COVID-19 Cash Crunch

By Rich Vurva

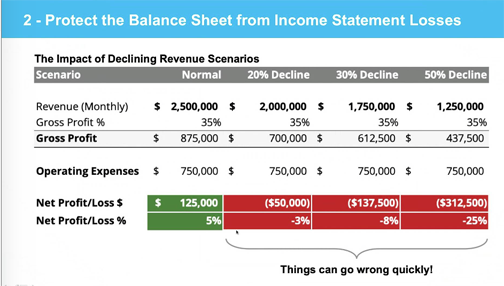

In downturns, revenue and cash levels always fall faster than expenses. For most distributors, that means the next few months may get ugly from a financial standpoint.

But there are things that you can do to lower your risk and improve your chances of success, according to a recent webinar sponsored by Industrial Supply magazine.

Nelson Valderrama, CEO of Intuilize, and Peter Baldwin, a pioneer and thought leader in the fractional CFO services industry, explain how to leverage your financials, balance sheets and income statements to mitigate the recession caused by the coronavirus.

Valderrama suggests that distributors have found themselves in a reactionary environment with declining revenues caused by macroeconomic events outside of their control. “But at the end of the day, there are things that distributors can control and things that you cannot control. The objective is to take responsibility for your own survival,” he says.

Baldwin points to two key areas from a company’s balance sheet to pay attention to during a financial crisis: liquidity and solvency. “Liquidity is our ability to pay our current obligations with our current cash flow. It’s very easy to get upside down in this type of situation as customers are stretching us out and we’re still in automatic mode making payments. It’s easy to become illiquid,” he says.

Baldwin urges distributors to resist the temptation to take on too much additional debt. By taking on long-term debt, companies effectively leverage their future to pay short-term bills. Another mistake that some companies make is to delay or stop making payments on obligations that only aggravate the situation. “Some of the things that I’ve seen that I really caution against is slowing down payments to what I call the ‘triple whammy’, IRS payments, property taxes and utility payments. You get penalized pretty heavily when you start slowing those things down,” he says. “I’d advise against that.”

He also stresses the importance of managing expectations of stakeholders. Baldwin suggests monitoring accounts receivable balances regularly in order to quickly learn if payments from customers have slowed. “Identify where your cash loss is, and compared this to your payables and begin working with your stakeholders,” he says.

He offered three key areas to protect your company’s cash position. Preserve your days sales outstanding (DSOs) as much as possible; slow vendor payments commensurate with slowed receivables; and renegotiate long-term payments.

Valderrama emphasized the importance of segmenting customers to understand what actions to take for each segment during a financial crisis. He divides customers into four groups: core, VIP, standard and drain accounts.

Core customers are your largest customers. It’s important to protect these customers at all costs. Make sure that you continue to provide the products and services these companies need to get through the crisis so you don’t risk losing this important customer segment.

VIP customers are those with growth potential. Your objective should be to try to expand this customer segment. Maybe they are from a specific industry that continues to operate fully during the pandemic, such as the health care industry. Allocate your resources to grow this segment.

Standard customers are those that buy just a few times a year. Optimize your operation to ensure that you’re serving these customers efficiently.

Drain customers are companies that consume your resources but don’t pay enough to cover your costs to serve. “These are guys that call you at 4 p.m., ask you to do a drop shipment to their end user, they want UPS Red and they want you to pay the freight. They want a 25 percent discount, they want to pay in 120 days and they’re demanding that you ship right away,” Valderrama says. Your objective with this type of customer is to transform the relationship. Either raise the price these customers pay or consider getting rid of them all together.

Other ideas to consider to get through a slowdown include promoting cross-selling opportunities, implementing or improving your company’s quote follow-up process, and understanding where it might be necessary to adjust pricing on certain SKUs.

Another mistake to avoid is reducing inventory purchases as order bookings slow down. As orders slow, some companies move quickly to reduce their inventory levels. If they’re not careful, however, they may run low on inventory of critical items that their customers need on a regular basis. Valderrama urges companies to avoid stock outs of these bread and butter items. “You want to make sure that you don’t run out of these items. This is very important,” he says.

Click here to view the webinar.