Full Steam Ahead

Signs Point to Healthy 2011 M&A Outlook

by Curt Tatham, Lincoln International

As 2011 has begun it certainly appears that numerous positive dynamics will continue to drive the strength in merger and acquisition activity which began to exhibit itself in earnest early in 2010. For the year, 2010 M&A volume was up 25% to $2.74 trillion vs. $2.2 trillion in 2009. Most market watchers are predicting a 15% M&A volume increase in 2011.

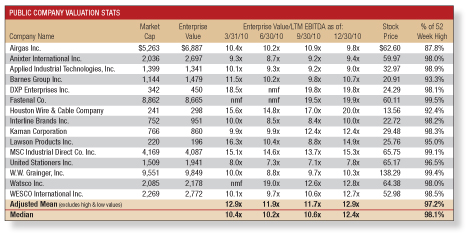

One major factor continues to be the fact that most strategic players now enjoy pristine balance sheets. At the end of the third quarter in 2010, cash held by the 419 non-financial companies within the S&P 500 was up 49% vs. three years ago while total debt was up just 14%, a 35% increase in their net cash position. In addition, public companies in the sector continue to enjoy strong valuation multiples as seen in the table below. This adds another valuable form of currency to potentially utilize as merger consideration in lieu of or in addition to cash, while resulting in less ownership dilution to existing

shareholders.

Meanwhile, companies will increasingly seek to supplement internal growth via acquisitions in 2011. Corporate profits continue to go higher with total U.S. corporate profits in the third quarter of 2010 up 26% to $1.64 trillion. However, the outlook is for the rate of profit growth to slow in 2011 on tougher comparisons. Most outlooks call for 8% profit growth in 2011 versus the 26% surge recorded in the third quarter of 2010. Rest assured, CEOs and CFOs at large public strategic players are working hard to put that record cash to work in strategic growth initiatives that include acquisitions, versus simply increasing dividends or initiating stock buybacks.

Meanwhile, companies will increasingly seek to supplement internal growth via acquisitions in 2011. Corporate profits continue to go higher with total U.S. corporate profits in the third quarter of 2010 up 26% to $1.64 trillion. However, the outlook is for the rate of profit growth to slow in 2011 on tougher comparisons. Most outlooks call for 8% profit growth in 2011 versus the 26% surge recorded in the third quarter of 2010. Rest assured, CEOs and CFOs at large public strategic players are working hard to put that record cash to work in strategic growth initiatives that include acquisitions, versus simply increasing dividends or initiating stock buybacks.

Meanwhile the M&A outlook remains supported by private equity firms which continue to be active with massive amounts of capital to put to work while debt markets can be viewed as increasingly supportive. Buyout deals increased 84% in 2010 to $194.6 billion vs. $105.5 billion in 2009.

Finally, the positive M&A "deal environment" dynamics are at work amidst a supportive overall economic outlook generally calling for 3% GDP growth in 2011. According to the Institute for Supply Management Manufacturing Report, U.S. manufacturing activity grew for the 17th straight month in December. New orders, production and prices also grew in December. The ISM report shows that 11 out of 18 industries experienced growth in December, including fabricated metal products, machinery and computer and electronic products. Paper and printing industries shrank. The PMI, an index of manufacturing growth, registered 57% in December, up 0.4 of a percentage point from November. A PMI reading above 50% indicates that the sector is expanding.

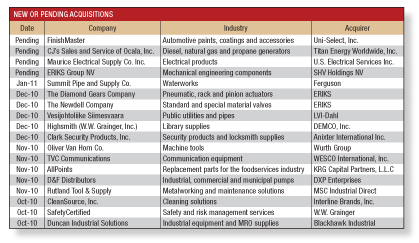

The favorable drivers discussed above will continue to support a healthy level of M&A in 2011 within the industrial sector, just as it did in the fourth quarter of 2010, which saw numerous transactions in the sector announced, including those listed above.

Curt Tatham, managing director at Lincoln International, leads the firm's Distribution Group. Reach him at (312) 580-8329 or ctatham@lincolninternational.com.

This article originally appeared in the Jan./Feb. 2011 issue of Industrial Supply magazine. Copyright 2011, Direct Business Media.