Press '1' for Tech Support

What distributors want (and don't want) In a 'Flagship' ERP system

by Neil Gillespie and Allen Ray

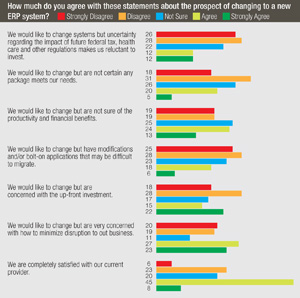

Distributors want ERP providers to improve functional performance in specific areas while adding leading-edge capabilities. That's a key finding from a survey of distributor executives conducted in October by Growth Wizards, a collaboration of Shamrock Growth Associates and Allen Ray Associates. The biggest issue, however is uneasiness among a significant number of users about the future of their business systems. They are highly concerned about future support and development, given their system may not be the "flagship" product among many in the developer's acquired portfolio. Some have expressed lack of responsiveness from support personnel already and are clearly agitated. They are not sure their system providers are listening.

The results also suggest that ERP system providers are selling technology rather than business process productivity. Based on distributor responses, they fail to communicate the productivity and the financial returns to automating different processes and may fail to adequately educate distributors on how to automate processes. In short, they fail to communicate their potential value to distributors. This is important if a system provider is to overcome the distributor's number one fear factor about conversions: disruption to their business.

Regarding support and development, half don't trust their ERP providers to support their packages as in the past with technical support, training and leading edge development. That results in half of the respondents considering conversion to a different brand of ERP system in the next three years. You can't extend that percentage to the whole industry, we realize, but we believe it does merit close attention. In some offices that sounds like opportunity. In others, an alarm, if you're listening, that is.

Just over 100 industrial and electrical distributor respondents (half of them CEOs) answered our survey, representing a broad range of distributors with $20 million or more in annual revenues. The other half was mostly IT or operations executives. They hailed from all regions (see graph to the right.)

Just over 100 industrial and electrical distributor respondents (half of them CEOs) answered our survey, representing a broad range of distributors with $20 million or more in annual revenues. The other half was mostly IT or operations executives. They hailed from all regions (see graph to the right.)

Growth and Productivity Initiatives since 2008

Distributors were not very aggressive with their growth strategies in these industries. They preferred to attempt selling more to existing customers and growing share at competitors' customers. Judging from the overall contraction, not many were all that successful. But they WANT to do these things. This ties directly to answers to a question asked later in the survey — distributors want system providers to analyze customer-purchasing behavior for additional profitable sales opportunities. They also want the system to provide better connectivity to customer systems and Web site technology that rivals the look, feel and performance of Grainger or Amazon.

Distributors are still focused on managing inventory and purchasing as their primary method to improve productivity. There it is: the stuff we sell again. From our experience in the industry, we're pretty sure that focus on inventory and purchasing is misapplied in most cases. Distributors tend to focus on the bloated or inadequate assets instead of the processes and mathematics that created them that are the root causes. We think distributors would do well to familiarize themselves with the math driving their purchasing algorithms, and alternate ways to set up logistical configurations of CDCs and branches or hub-and-spoke arrangements as well.

The distributor's most important role in the supply chain is getting products from the supplier to the customer. Hence, distributors should become experts at the forecasting and order quantity calculation capabilities of their business system for every product line in every branch. That's the math of your business and it is the key to distributor productivity and performance for the customer.

Leading Edge Capabilities Distributors Want Most

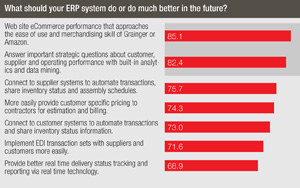

Distributors are most interested in selling things. Hence it is not surprising that they want the ultimate low-cost salesperson doing more of their work. They want a Web site that rivals Grainger and Amazon to do more selling for them. The cost of that is a whole different story, however, in this business for the kinds of customers most full-line distributors serve.

We're not exactly sure how to get an ROI out of the investment required to rival Grainger and Amazon. Amazon spent hundreds of millions, if not a billion dollars all tolled, on their technology. Grainger heavily invested in not just technology, but a custom-built product database that industrial and electrical industries don't seem to either want to address or fail to address adequately. You need the slick technology and the product database or you will fail to get the return on investment. But you also need customers that will buy enough of their needs online to pay it off as well. Will yours? Remember, Grainger gets a piece of everybody's purchases, and rarely gets high share of anybody's. That's not the average distributor's strategy.

Ah, but distributors are connection specialists. They connect suppliers with contractors and end customers. Hence, it's not surprising to learn that they want leading edge capabilities that help them perform better and know more about their relationships.

Before we finalized our questions for the survey, we interviewed some prominent independently owned distributors we considered to be thought leaders. They helped us choose the leading edge capabilities to test with our survey respondents. We were surprised how all of their ideas were right on the money in terms of response rates. All of their top wish list items captured the fancy of over two thirds of respondents.

The highest responses were for a competitively featured Web site, better analytical tools to understand customer and supplier behavior and connectivity to suppliers to sense inventory and production schedules in order to meet customer requirements (see graph at right.)

The highest responses were for a competitively featured Web site, better analytical tools to understand customer and supplier behavior and connectivity to suppliers to sense inventory and production schedules in order to meet customer requirements (see graph at right.)

Basic Functional Issues

Systems have come a long way in automating basic functions like automated purchasing, receiving and invoice processing. But other functions like SPA contract importation and SPA claims tracking need work in the opinion of distributors. They also have issues with freight charge capture and linking to customer invoices for nonstock items and some directs. And they have a devilish little issue with "orphaned" nonstocks, which result in untraceable nonstock inventory. These result from customers canceling orders for nonstocks while the items are in transit to the distributor. They show up on your receiving dock and you have no valid customer order with which to associate the item, so it goes in the "limbo" bin and, unfortunately, stays there until you clean it up. Then there is no trigger in the system to make you clean it up. But these are not the biggest issues.

Business System as The Master "Brain" of the Business

The biggest issue with systems is that it's not enough to address these important but less than strategic functional issues. The business system needs to be more than that.

It needs to build in best practice operational, supply chain partner connectivity and relationship analytics to help a distributor run their business. For a system developer to do this, we dare say you need to learn the distributor's business better than they know it if you're going to build in truly "best" practices, processes and decision support capabilities.

Easier said than done. The point is, it can be done. Who will step up to the task?

Neil Gillespie is a veteran distribution consultant, speaker and author. Neil has distilled his profitable growth methods in his Eight Steps to Breakthrough Growth in his book Discover Your Core, Then Go For More, available at Amazon.com and growthwizards.com. Contact Neil at neil.gillespie@growthwizards.com.

Neil Gillespie is a veteran distribution consultant, speaker and author. Neil has distilled his profitable growth methods in his Eight Steps to Breakthrough Growth in his book Discover Your Core, Then Go For More, available at Amazon.com and growthwizards.com. Contact Neil at neil.gillespie@growthwizards.com.

Allen Ray has 45 years experience as a distribution business owner, marketer of product data and consultant to wholesale distributors. Allen advises clients on strategies to stop "Profit Leakage." Contact Allen at allen.ray@growthwizards.com.

Allen Ray has 45 years experience as a distribution business owner, marketer of product data and consultant to wholesale distributors. Allen advises clients on strategies to stop "Profit Leakage." Contact Allen at allen.ray@growthwizards.com.

This article originally appeared in the Jan./Feb. 2012 issue of Industrial Supply magazine. Copyright 2012, Direct Business Media.