Sharks in the Water

By Scott Benfield

As online buying grows in B2B distribution, new competitors are springing up that compete with the traditional full-service distributor. Our research finds these models accelerated their growth, as online software improved post-recession, and gives a customer experience that rivals the full-service model. Their existence and growth has significant implications for full-service distributors and industry manufacturers.

Since the Great Recession bottomed out, there has been an explosion in technology to drive B2B sales online. The technology spawned growth of new e-commerce competitors versus the traditional full-service distributor. At the beginning of 2016, we count five new or recent competitor types that use e-commerce and supporting online technology to compete against the traditional distributor. These models typically reduce channel

redundancies and offer the buyer a better price.

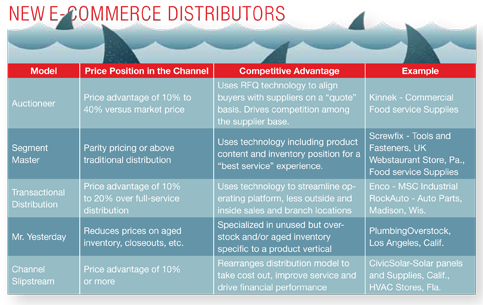

Through our continuing research we have cataloged these models in Exhibit 1.

First up is the Auctioneer model which, as the name implies, is a site dedicated to “quoting” or price comparisons for material lists. Typically, the auctioneer is an independent site that does not carry inventory but assembles quotes from competing wholesalers or manufacturers. They drive price competition in the supply chain and are often used for large dollar and/or non-standard purchases.

Akin to the auctioneer are sites dedicated to quoting material lists but belong to one entity. While they often do not seek competitive bids, they do specialize in online RFQs and generally offer good pricing and acceptable vendors. The premium supplier of the new e-competition is called the Segment Master. These firms typically target the core segment(s) of a product/market sector with extensive inventory, quick shipping, technical backup and specialized services. An example is Webstaraunt Store; a Pennsylvania-based food service supplier, which has separate sites and specialized inventory for nearly two-dozen differing segments including bakeries, bars and coffee shops, among others. The Segment Master pricing is typically on par with existing distribution.

Transactional Distributors go to market with a reduced price of 10% to 20% less than full-service distribution. They get cost advantage through limited sales support, limited brick and mortar locations and simple, no-frills service. Transactional Distributors started in the early 2000s but sprang to life post-recession with online technology that specialized in B2B markets. A good example of the Transactional Distributor is Enco, which advertises low prices and is backed by MSC Industrial. Another example is RockAuto of Madison, Wis., which gives competitive prices on an extremely large SKU base of automotive supplies.

If the end-customer doesn’t mind obsolete or overstock inventory, they can purchase from entities we call Mr. Yesterday. These firms specialize in non-current inventory and often have agreements with manufacturers and distributors to advertise and sell their slow-moving or no-value material. An example is PlumbingOverstock that sells plumbing fixtures for a substantial discount. It considers itself a retailer but, since most plumbing wholesalers have showrooms and sell to homeowner specifications, we consider them a competitor to the traditional full-service plumbing house.

Finally, the Channel Slipstream model offers a reduced price as they bypass redundant parts of the channel. For instance, in the HVAC sector, there is a three-step channel with sellers and inventory at the manufacturer, distributor and dealer level. HVAC Stores (A/C Wholesalers Div.) sells condensing units and supplies to homeowners and bypasses the traditional dealer channel. Our comparisons find their prices are 15% to 30% less, on average, than purchasing the supplies direct from the dealer. Another slipstream offering, CivicSolar, sells solar heating and power generating supplies direct to the end-user and bypasses much of the traditional brick and mortar warehousing found in existing channels.

We find most of these entities are growing and target full-service distribution. Most compete with reduced prices and derive the cost advantage through targeting a slice of the full market with narrow inventory, basic service, limited brick and mortar locations and few sellers. They have no desire to be all things to a lot of customers, which is often the strategic quicksand that sales-driven wholesalers find themselves in. The sales-driven firm, over a period of decades, becomes victim to sellers who drive gross margin dollars but promise away services and/or specialized inventory.

A growing number of wholesalers realize the predicament and are attempting to improve the economics of their target market through allocating service costs to customers (activity costing) and lessening service or outright firing of the most costly (low or negative profit) customers. Unfortunately, we view customer profitability and righting the customer portfolio through service alignment and price adjustments to be yesterday’s tactics. Why? Activity management, the output of operating cost allocations, can’t compete with the low-price, stripped down cost models that use technology to give the customer an acceptable buying experience while negating tranches of redundant services or skipping entire links in the channel. Additionally, the new e-commerce models can scale easily where traditional distribution, even with activity-managed alignment, has trouble. Hence, the new models grow, often rapidly. A prime example is Zoro Tool, a transactional entity of W.W. Grainger. The online, low-cost entity started in 2010 with no sales and, based on recent press releases, is nearly $300 million in revenue five years later.

The Implication for Distributors and Manufacturers

The immediate implication for full-service distributors is that new, streamlined models are growing and will continue to grow. Additionally, buyers who want great service and are willing to pay for it but desire the latest in online technology, will seek out Segment Masters. Some of the new models can be a sales outlet for full-service distributors including Auctioneers and Mr. Yesterday.

Some full-service distributors may want to duplicate these models but this is much easier rationalized than done. For the most part, these models are stand-alone entities. Their culture is vastly different from the full-service, sales-driven firm. Additionally, their

e-commerce technology is top-notch and includes the full e-commerce software bundle of PIM, faceted-search, punch-out and modern-day transaction platform. For a distributor to replicate these models requires careful planning, new support personnel and big expenditures in technology. New models, successfully launched by full-service wholesalers, are different organizations with different names, market M.O. and culture.

Manufacturers that market through traditional full-service distribution are not always aware of the growth of the new models. Too many channel, marketing and sales managers look at their channels monolithically and don’t realize the change wrought by the new technology. Manufacturer marketers who have not mapped and quantified the new competitors are late, but not too late. However, we predict that by 2020, much of the new entrants will be set in place and online purchasing will be 30% or more of all goods sold. For manufacturers to wait until then or push analysis of the new models out a few years is not prudent. Channel policy and channel supports usually require significant change as new entrants emerge. This requires planning, communication, good metrics and good financial justification of channel costs and trade-offs.

The new distribution models, based on our research, will increase for the next five or so years and then level off. Full-service wholesalers and manufacturers that don’t research and plan for these competitors will, more often than not, lose sales to them. Firms that take the new models seriously and understand their value proposition(s), will find it easier to defend against them or partner with them where it makes financial sense.

Scott Benfield is a consultant for the B2B supply chain in the areas of mergers and acquisitions, operating performance improvement, and digital marketing. He can be reached at (630) 428-9311 or scott@benfieldconsulting.com. His site is www.benfieldconsulting.com.

Scott Benfield is a consultant for the B2B supply chain in the areas of mergers and acquisitions, operating performance improvement, and digital marketing. He can be reached at (630) 428-9311 or scott@benfieldconsulting.com. His site is www.benfieldconsulting.com.

This article originally appeared in the Jan./Feb. 2016 issue of Industrial Supply magazine. Copyright 2016, Direct Business Media.

Thanks for the review and thoughts on the Sharks in the Water research. I initially focused on hard goods product and those of a commodity nature. They are the first group to be "picked off" by advances in e-commerce. The assembled sale, brokered by the manufacturers rep, is certainly vulnerable. Online RFP/RFQ sites that put buyer and seller together will eat into both rep firms and manufacturers who don't understand how to link up with potential buyers online.

I have not studied this, but know the buying dynamics having submitted unique "quotes" for distributors and as a mfg. rep. early career. I think Kinnek does some of this in food service and they are in the article but there is substantial cost in a rep coverage versus making the RFQ process online. The value of the rep and the manufacturer who is loyal to them is not always seen by the customer and, generally, is more expensive than an online quote.

Thanks again for the insight.

Scott

One premise of the article, though, seems to limit breadth of validity. It seems to be written primarily focused on products toward the simpler end of the B2B buying complexity curve (tools, MRO, etc.) In those areas there will be a reckoning and substantial consolidation among distributors. As you note, there is still a window of opportunity for savvy distributors to use ecommerce and other digital approaches to buy themselves time to adapt a viable business model.

In contrast, however, my observation is that complex, engineered solutions are simply bypassing the distribution channel. An extra layer of discount was the early objection - today however, it's that precious few distributors actually create "thought leadership" or authoritative marketing materials (sadly not many more manufacturers do.)

Therefore as buyers research their challenges and explore possible solutions using the internet they're not receiving any value from distribution. Once they're 70% of the way through their buying journey, to the point of selecting from among viable suppliers of the solution upon which they've settled, a search will turn up the manufacturers. And the manufacturers' sites will carry the burden of the bit of virtual sales (mostly just comparing features at that point) remaining and acting as a "contact us" conduit to the local channel.

In nearly every case, at that point, the channel engages in non-value added back and forth communication between the buyer and the factory experts, negotiates a final price, complains about their discount, and adds essentially no value to the transaction for any party - except the often hollow reassurance that in case of expensive downtime there's a nearby technician (who may not have parts in stock, probably has forgotten much of what they learned in a week of factory training two years ago, etc.) Buyers resent wasting their time this way - yet distributors get up every morning convincing themselves they're adding value.

That's the problem distribution has in complex industrial sales - and it's nearly intractable. It's also revealing to see which manufacturers are able to visualize this change and begin to build parallel if not alternative models to help prospects find them and to build relationships with customers. The opposite is also interesting - many manufacturers are willfully ignorant of this evolution, and negligent in their management performance.

There's an interesting parallel problem with industrial reps. Many rep firms flourished during a very different market time. Yet the owners and sr managers of many industrial manufacturers are close, loyal friends with the reps. They built business together, travelled together, celebrated customer wins together. Often the rep firms are a single personality with deep contact relationships - and nearing retirement. There's no enterprise value - there's merely a revenue stream, and often a much less effective deputy who will gradually assume control. Their loyal friends running the manufacturing companies won't abandon them, yet they're not delivering. In some cases because of technophobia, inability to connect with younger engineers/buyers and their limited work schedule, they're not even "answering the mail."

Manufacturers are "whistling past the graveyard" as much as the distributors you call out in your article.

It will be an interesting trend to watch over the next several years.