Midyear Industrial Outlook

Healthy but Cautious

|

| istockphoto.com |

Data points to a flat finish for 2024.

by Kim Phelan

Their manufacturing customers are expressing those vibes, as illustrated by a survey-taker from the Institute for Supply Management’s May Manufacturing ISM Report On Business, who wrote:

“Backlog is dwindling as we get caught up on orders; new orders are not coming in as robust as the backlog is going down. Inflation continues to be a problem with pricing of raw material and interest rates. We expect a flat rest of calendar year 2024, especially given that it’s a presidential election year.”

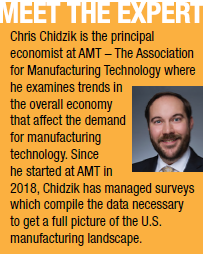

According to Chris Chidzik, principal economist at AMT – The Association for Manufacturing Technology, the longer-term trend will see the decline in orders appearing to stabilize.

At AMT’s Spring Economic Webinar, Oxford Economics revised their forecast to predict 2024 will end flat or slightly down compared to 2023, implying a pickup in order activity through the remainder of the year, Chidzik reported. Through April, new orders of durable goods were nearly flat compared to the beginning of 2023 and industrial production had fallen 7.6% from its post-pandemic peak.

Oxford Economics further predicted that industrial production had reached its lowest point of the current business cycle in most advanced economies. Orders in the second half of the year are expected to exceed the first by nearly 10% on average. Should industrial production and new orders pick up through the remainder of the year, manufacturers will begin to need additional capacity right around the time the doors to IMTS 2024 open in Chicago this November, Chidzik added.

Before going to press, Industrial Supply asked Chidzik for a little more insight about the economic outlook for the industrial sector. Here’s what he had to say:

Industrial Supply: As we near the midway point of 2024, how do you assess the industrial and/or manufacturing sector landscape?

Chidzik: The manufacturing sector seems to be in a healthy but cautious place. Data through April shows that durable goods orders have been on the rise. While manufacturing technology orders, measured through the USMTO report produced by AMT, have continued to decline in 2024, orders are still above their historic averages.

A further indication of the health of durable goods manufacturers is continued demand for cutting tools, the consumable component used in the manufacturing process. The latest CTMR report published by AMT and USCTI show the demand reaching a plateau, but at a very elevated level, indicating that manufacturers of durable goods are continuing to produce product.

IS: What sectors are performing well, which are weak? Any major concerns through the rest of this year?

Chidzik: Contract machine shops, which are typically the largest consumer of manufacturing technology, have been holding back on orders of new machinery in recent months. These shops tend to be small- to medium-sized businesses and have been particularly affected by heightened interest rates.

The automotive sector has also significantly pulled back orders of manufacturing technology in 2024 after making some pretty significant investments at the end of 2022 and through 2023.

Aerospace has been an area of noticeable growth in orders for manufacturing technology. Electronic equipment manufacturers have also made significant investments in the first four months of 2024.

IS: What trends are you expecting to either continue, begin, or change?

Chidzik: The one trend that is likely to continue through the remainder of the year is heightened interest rates. We began the year with the expectation of three rate cuts by the Federal Reserve, but that has reduced to one at best. While that has caused a bit of uncertainty, the difference is probably half of a percentage-point, so regardless of the number of cuts, rates will remain at an elevated level for the foreseeable future.

Another trend is the increased level of government investment in manufacturing. The majority of the funding allocated under the infrastructure bill, CHIPS Act and Inflation Reduction Act have yet to be spent. Throughout the remainder of 2024, this spending will likely be put on the fast-track as the Biden administration wants to ensure programs begin in case they lose the election in November.

The biggest trend-setting event for the industry is going to be IMTS in September. The show has been proven to bring a noticeable spike in orders.

IS: What will be the big challenges/threats for the North American industrial sector in the last half of this year?

Chidzik: A likely coming issue is increased shipping costs . . . a byproduct of the environmental and geopolitical issues disrupting global shipping.

IS: How should industrial distributors be planning for 2025, in your opinion?

|

Chidzik: Most forecasts point to a strong economy and surging demand for manufacturing technology in 2025. While this was predicated on easing interest rates and normalization of inflation, resilient consumer demand could make this forecast a reality.

The biggest hurdle in this scenario would be labor issues. Throughout the COVID recovery, the consistent experience of businesses in manufacturing and everywhere else was the struggle to find, train, and retain enough labor to take advantage of the demand. The best preparation for the next upswing in demand will be to focus on your current staffing needs and plan how you would respond to a sudden spike in demand, similar to the one seen between 2017 and 2018.

IS: What caution and/or advice can you offer for these companies that provide products and services to the industrial/manufacturing sector of North America?

Chidzik: Find a good source of benchmarking data to gauge your business against the overall industry. AMT produces data through the USMTO, CTMR and AWT programs. This allows participants to very granularly track their performance against the industry. This is especially important when there are divergent trends between industries and broader economic measures do not reflect any industry-specific trends.

If anyone needs help finding a good source of data, AMT will be happy to look into it and offer some suggestions if we do not have the data source.

This article originally appeared in the July/August 2024 issue of Industrial Supply magazine. Copyright 2024, Direct Business Media.