Valuations increasing

Scarcity value and improved financing markets support stronger M&A valuations

by Curt Tatham

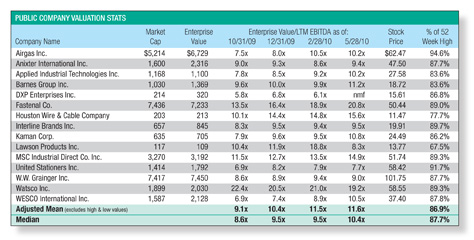

Public market valuations of industrial distribution companies, as seen in the

table below, remain relatively stabilized at the higher levels achieved a few months ago after a steady climb from the depths reached over a year ago.

Meanwhile, private market M&A valuation multiples have begun to follow suit in their recovery, riding a continued string of positive news from leading economic indicators and improved operating performance that is supporting a positive change in the psychology surrounding M&A markets. However, M&A volume, while recovering off its trough levels, remains low by historic comparisons and deal volume pickup appears to be lagging the improvement in the valuation multiples of the relatively select transactions that are getting closed.

This recent dynamic is being driven primarily by the fact that the vast majority of recently completed non-distressed transactions, such as the sale of The Hillman Companies, involve very high-quality companies that generally managed to meaningfully

outperform throughout the recent severe economic downturn. Meanwhile, capital to complete acquisitions in the sector remains abundant from strategic acquirers who returned to the market late last year with de-leveraged balance sheets seeking to grow their businesses. Notably, in the last several months, private equity buyers are also beginning to participate meaningfully in the select number of M&A processes of high-quality companies coming to market. This combination of lower deal "supply" of high-quality companies, amidst an increasing number of well-capitalized strategic and private equity buyers, is driving scarcity value, resulting in some notably higher valuation multiples on a number of recently completed transactions.

The increasing return of private equity groups reflects a financing market recovery which has occurred more rapidly than most had envisioned. Six to nine months ago, the financing market revealed that while the broader economy was beginning to emerge from the recession and company performance was improving, credit was available for only the highest quality companies. However, over the last six months, improvements in the large cap markets, as well as decreases in troubled credits, have resulted in improved conditions for the middle market and new providers (e.g. new finance companies) are entering the middle market at every level of the capital structure. As a result of relatively low deal flow, debt multiples are increasing and pricing is decreasing, making it easier for private equity groups to once again become more competitive in their valuations.

This current scenario of abundant capital, limited supply, and the fact that the limited supply is of very high quality, will likely continue to drive healthy multiples for these scarce assets for several months. As we move into next year and transaction volume increases, it is likely that much of that increased volume may involve less stellar performers than those companies being brought to market today. The combination of increased supply and potentially lower deal quality may result in M&A multiple contraction from the current levels, as the current scarcity value dynamic evaporates. This potential dynamic regarding valuation multiples is a factor worthy of consideration for owners who might be contemplating a potential sale in the next 18 months.

Curt Tatham is a managing director at Lincoln International, where he leads the firm's Distribution Group. Reach him at (312) 580-8329 or ctatham@lincolninternational.com.

This article originally appeared in the July/August 2010 issue of Industrial Supply magazine. Copyright 2010, Direct Business Media.