|

| istockphoto.com |

by Nelson Valderrama

According to Boston Consulting Group’s 2023 research on technology and digital transformation, few business leaders “have cracked the code for winning.” The BCG report says that only 6% “have mastered the ability to realize business value from their digital and data investments, avoiding the trap of lengthy IT projects with large cost overruns.”

However, companies that build for the future generate returns three times bigger than those in the S&P 1200. Leading performers have delivered outsized value by investing “in people, processes, culture, underpinned by strategic technology” to deliver outsized value.

My own research finds that investment patterns for wholesale distributors vary significantly by company size. Small distributors (annual revenue of $26–$50 million) typically invest between $80,000 and $215,000 annually in technology, while larger distributors (annual revenue of $251–$500 million) invest $1.3–2.88 million.

But I would argue that success is not only about spending the most; it’s about spending smarter. The performance gap shows who’s making the right IT investments.

BEYOND SIMPLE DIGITAL TRANSFORMATION

McKinsey & Company confirms this growing performance gap. Their 2024 research suggests there is a strong market for tech investments. However, “only a select few companies are investing in the foundations and people that can support future success.”

Businesses must recognize a digital transformation is not a once-and-done event. Tech transformation has a long tail. It is a new dynamic, a self-evolving operations package, and a constant reality of corporate life that drives a new business model. Investing in foundational tech and talent pays off big time in the long run.

This insight is relevant for distributors, who must navigate an increasingly complex technological landscape while maintaining operational efficiency. Leading distributors have pulled ahead with action in several critical areas

Cloud Adoption at Scale. Distributors must transition their IT structure, applications, and services to the cloud. The cloud increases your bandwidth to handle large operations and growth. It helps you leverage cloud-native technologies that deliver innovative customer-focused solutions that build business. It may be time to reassess your cloud to scale with:

- Enterprise resource planning (ERP) systems.

- Warehouse management systems (WMS).

- E-commerce platforms

- Transportation management systems (TMS).

|

| istockphoto.com |

Operating Model Evolution. It’s not just about adding a task to a help desk. It is not an “add-on” or plug-in. Digital transformation needs IT leadership that can reshape operations to support cloud commitments. The distributor’s C-suite must realign its performance model to meet corporate goals, including:

- Workload migration to cloud operation.

- Automation of basic processes like quote and order entry, leveraging, generative AI, and other “smart” technologies.

- Pursuit of flexible, scalable, and agile technology infrastructures.

Advanced Talent Pool. In a future-built distributorship, everyone must identify fully with the corporate purpose and customer experience. It must re-skill and up-skill everyone who touches the business process. It also means recruiting and promoting the talent required by fully-embedded advanced technologies.

This commitment requires:

- Talent strategies focused on training, development, and reskilling.

- A C-suite-driven culture of innovation.

- Investment in continuing talent transformation

If distributors want to spend smarter, they must rethink their technology investments and their entire organizational approach to digital transformation.

INVESTMENT PRIORITIES FOR DISTRIBUTORS

My research and analysis of technology spending patterns in the distribution sector reveal several key investment areas:

Core Systems Modernization: ERP investments ($50,000 to $700,000 annually); WMS implementations ($75,000 to $300,000); integration capabilities to connect these core systems.

Digital Commerce Capabilities: E-commerce platforms ($20,000 to $300,000); customer portal development; mobile capabilities for field sales and operations.

Advanced Analytics and AI: Business Intelligence platforms ($75,000 to $250,000); predictive analytics for demand forecasting; AI/ML capabilities for inventory optimization.

THE PATH TO FUTURE READINESS

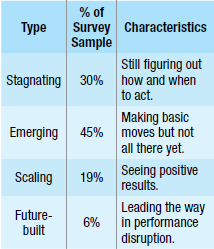

Boston Consulting Group identifies four types of companies based on their technology readiness:

|

For distributors, the path forward requires an actionable assessment of current capabilities and a strategic investment approach. As McKinsey’s research shows, “top performers are more effective than others at executing specific transformation initiatives and at realizing the business value they’re seeking.”

To move forward effectively, wholesale industrial distributors should:

Assess the Current State. Benchmark technology investments against industry standards. Evaluate organizational readiness for transformation. And identify critical gaps in capabilities.

Develop a Strategic Roadmap. Align technology investments with business strategy. Prioritize initiatives based on potential impact and organizational readiness. Create clear metrics for measuring success.

Build a Foundation for Success. Invest in talent development and training. Create agile operating models that support innovation. Establish strong data governance and architecture.

The technology investment gap in distribution is widening, but the opportunity for transformation remains strong. As BCG notes, “Companies need to decide on the business outcomes they seek and the specific use cases they need to build.” Success requires developing your talent pool, creating agile business models, and investing in emerging technologies.

For distribution executives, the message is obvious: strategic technology investment is no longer optional. The gap between leaders and laggards is widening, and the cost of inaction is growing. By understanding current investment patterns, learning from market leaders, and taking decisive action, distributors can set themselves up for success in an increasingly digital future.

|

|

Nelson Valderrama is CEO of Intuilize, a web-based application designed to work in tandem with your ERP (and other digital technologies) to provide price optimization for forward-thinking distributors. He can be reached at: nelson@intuilize.com.

This article originally appeared in the March/April 2025 issue of Industrial Supply magazine. Copyright 2025, Direct Business Media.