Winning the war against inflation

by Nelson Valderrama

As businesses have been hit hard by the effects of inflation, many distributors are now re-evaluating their pricing strategies. A large part of the problem is that most pricing strategies are not built to handle rapidly rising input costs. This fact has led to a lot of distributors struggling to keep up with the changes. A clear pricing roadmap can ensure your business is prepared for whatever the future may hold to win this war against inflation.

The silver lining is that companies are now paying attention to pricing issues as never before. Senior leaders know the importance of managing inflation – unless managed properly, rapidly rising costs have a direct impact on profits.

Instead of viewing inflation as a signal to raise prices, senior leaders should heed it as an opportunity. Sharpening the focus on pricing will bring an unprecedented opportunity to update business practices. Aligning strategies to implement best practices will help business leaders to navigate through the storm.

The ability of a company to keep cool and respond well during rough times will determine more than just their current status. They also need to strengthen their resilience and quickly adapt in the face of any unexpected change in economic conditions. As inflation slows down, for example, customers’ procurement teams will hunt aggressively for price concessions.

Get ahead of inflation now

Distributors need to improve their performance in four areas: 1) upgrading costing practices, 2) responding faster to new opportunities, 3) optimizing pricing according to market conditions, and 4) maintaining discipline among the different departments within your company.

To stay competitive, companies need an updated pricing strategy that is aligned with their business goals. This will require them to:

- manage the change process for new approaches

- clearly communicate this information across departments and stakeholders at every level of management so no one gets left behind

But that’s not enough. Distributors also need to make the following actions part of their regular routine:

1) Upgrading costing practices

1) Upgrading costing practices

Analyzing the cost pressures across your business can give you insight into what lies ahead for specific products. How fast is your average price increase compared to the individual costs for each SKU, for example?

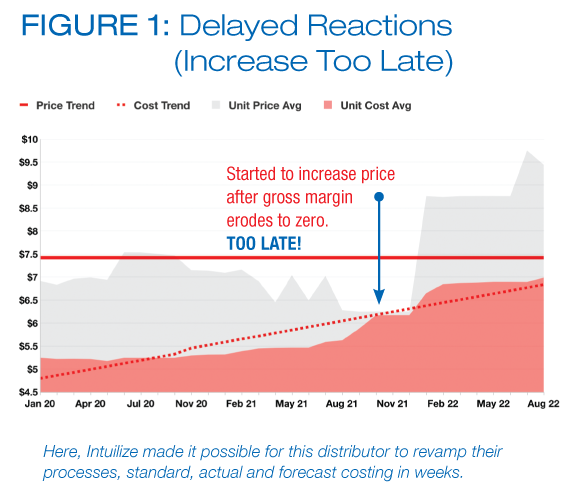

Figure 1 shows the results of a distributor’s pricing change for one particular product. They had not updated the cost or price practices until the end of December 2019. Even so, the GM% was almost zero around Jan 2022. The decision to drastically change prices finally came with the realization that either information or processes were outdated.

2) Acting faster

Distributors must be quick on their feet when costs go up. If a company wants to prevent margins suffering from cost increases, then prices need to be raised ASAP, right? The majority of distributors still allow time lags before making price changes. Even though they now change prices more frequently, there continues to be a delay between a distributor’s

cost increases and the next pricing adjustment. Such hesitation can result in 160 basis points worth of margin erosion.

By jumping out of these slower planning cycles, distributors can speed up their reaction times and make more informed pricing decisions. That’s where war rooms come in. War rooms enable the strategic coordination of your activities while implementing

better governance. This means you can track progress on an ongoing basis so you know when changes are needed and see when opportunities arise. Your company will have greater flexibility with its resources as a result, which will lead to increased profits in the longer term.

3) Optimizing pricing

Distributors should take advantage of their ERP system’s pricing capabilities. Many distributors don’t even know these features exist or don’t know how to use them, but implementing them is actually not very difficult. The ERP enables you to set and provide pricing with a few clicks, while also replicating most of your price guidelines. This method saves time for team members while ensuring they follow best practices in controlling their win rate.

Are you missing out on $200,000 or $500,000 a year just because you’re not utilizing your ERP system pricing feature? A simple tweak in the right direction can help increase profits and save hours of your time every week.

Are you missing out on $200,000 or $500,000 a year just because you’re not utilizing your ERP system pricing feature? A simple tweak in the right direction can help increase profits and save hours of your time every week.

When inflation strikes, many companies resort to price increases that tend to be uniform rather than tailored. Yes, it’s easier and quicker than figuring out how much everything costs per unit or finding out what different customers need – but when, as recently, prices begin to escalate, these simplistic strategies just won’t do the job.

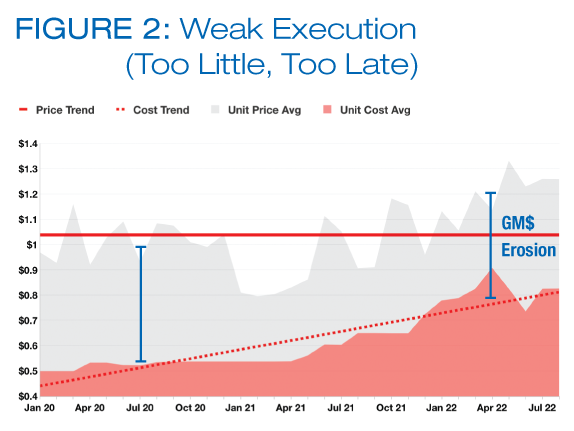

Figure 2 shows how old pricing is eating away at this distributor’s margins. They should have optimized and updated the pricing long ago.

Imagine a typical mid-sized distributor called Distri2020 with 1,000 customers. Let’s also assume they have an average number of active SKUs at around 5,000 and at least 3 quantity breaks (few, medium and many). When you run the math on that you get a whopping 15 million possible combinations that need to be priced properly!

Even the most disciplined pricing gurus among us can attest that – without the right data or models – those numbers would make it very difficult for any owner, finance manager or sales manager to deliver an optimal experience for every customer and for their business bottom line.

4) Maintaining discipline

Companies can sometimes be lax in enforcing their discount policies and their terms and conditions during stable economic periods. They make so-called strategic exceptions to their rule when it benefits them the most. Then BANG! Suddenly an unforeseen event in a period where unpredictable change occurs such as with pandemic strikes or mounting inflationary pressure catches them unawares. A study by Intuilize shows that only 15% of distributors succeed in passing on more than 80% of their input-cost increases to customers in a timely manner.

Don’t wait – Invest in Pricing Now!

The recent rise in inflation provides distributors with a rare opportunity to transform the way they price their products and services. There are no signs that input-cost pressures will subside as 2022 comes to an end, making it more crucial than ever for distributors to look forward, not back, if they want their business models challenged by a higher demand from customers.

Further, the end of inflation does not mean the era for price instability is over. In order to respond quickly and accurately in an ever-changing market, distributors need empowered organizations with the technology and skills that can secure information advantages as well as sales leadership capabilities. This demands new business practices and business transformation in pricing too!

Nelson Valderrama is Chief Executive Officer of Intuilize, a web-based application designed to work in tandem with your ERP (and other digital technologies) to provide price optimization for forward-thinking distributors. For over two decades, Valderrama has managed the exponential growth of large and midsize companies, including GE and private equity firms, to increase their profits by optimizing pricing and inventory systems without compromising their original model.

Nelson Valderrama is Chief Executive Officer of Intuilize, a web-based application designed to work in tandem with your ERP (and other digital technologies) to provide price optimization for forward-thinking distributors. For over two decades, Valderrama has managed the exponential growth of large and midsize companies, including GE and private equity firms, to increase their profits by optimizing pricing and inventory systems without compromising their original model.

This article originally appeared in the Nov./Dec. 2022 issue of Industrial Supply magazine. Copyright 2022, Direct Business Media.

Other factors that impact your margin is how your competition treats price increases. Distributors that use actual cost basis will have a short-term competitive advantage (at least until they burn through their stock) that may create a level of concern with your sales staff. Communcation (and patience) is key.