The Distributor Evolution

by Frank Hurtte

Distribution is a strange industry. It is an industry to which I have been connected virtually my entire life. My father started his career as a salesperson for an oil distributor and later bought a distributorship in what was called the Tires, Batteries and Accessories side of oil distribution. I started going to work with my dad around age 10. Our chats in his truck were often lessons on the distributor business. My first job out of college was working for a manufacturer, but my role was to oversee the sales of a dozen or so distributor locations. Later, I ran branches, developed growth strategies and led a distributor of my own.

What’s the point of all this? Despite my long tenure in distribution, these experiences do not really account for much more than a historical perspective. The truth is there are many folks with equal work experience. I run into them every day. Most could be classified into four categories:

1) Folks who refuse to recognize changes and continue to operate under the same plans they had back in 1979, ’99, ’09 . . . just select their favorite year.

2) Those who hope the industry will change back to something like the “good ole days.”

3) People who see changes in other parts of the country but somehow believe their territory (or group of customers) is different.

4) Distributors who believe change is ever constant and continuously position themselves for the future.

I believe the distribution model has changed, shifted, morphed and expanded with each passing year. My father’s business model shifted from 6,000 to 7,000 small local independents to approximately a dozen mega-distributors. Many of the owners of these businesses simply rode the wave of change to retirement then closed the doors on whatever was left of the business. Since many owned the building that housed their business, their once thriving distributor location became a Class 3 bonded warehouse space. My father’s business had a decent location which now serves as a Subway sandwich shop. On the other hand, some of these people shifted their business model and survived in a different format.

The purpose of this long-winded story is simple: Distribution is an ever-changing model. And the winds of change are shifting for many smaller distributors. Case in point, recently we talked to a couple of smaller automation distributors. During the conversations, two of them used a new term to describe their business, a disintegrator.

What is a Disintegrator?

A disintegrator could be defined as a distributor that has discovered selling systems is more profitable than simply selling parts. In the space surrounding automation, which includes precision motion controls, vision systems, variable frequency drives, advanced sensors and industrial computers/communication products, the phenomenon is accelerating. These organizations combine products from several companies and provide their customer with either a turnkey solution or a subset of the total solution, engineered by the distributor.

These distributors outline a plan which increasingly puts their services front and center. A few reported reaching the point where their service business has eclipsed parts profitability, even though the top-line numbers are much smaller. From a strategic point of view, they see continued margin erosion on the distribution side of the business while the opposite is true for the service business. Further, many of these distributors are small- to mid-sized and feel the supply partner community has grown enamored with larger distributors that produce massive numbers but oftentimes do not provide the level of presale service capable from their company. In many ways, this creates an issue not only for the distributors but also for their supply partners.

"Super Specialized’ Distributors

During this same survey, we also ran into a group of distributors that have become “super specialized” in a single technology. While they continue to sell other products, they have carved out a very narrow niche around one or two product categories. In these instances, they have outperformed other distributors by an order of magnitude in a few highly technical categories.

By positioning themselves as the living and breathing experts, these distributors continue to expand into customers served by their competitors. While the competitors carry some of the same products (many times the same manufacturer), the specialized service is viewed as keenly valuable by their customers.

Exploring more deeply, we came away with the idea that this move was not part of a longer-ranging strategic plan developed in the late ’90s. Instead, it developed as a small and nimble distributor reacted to market changes and responded by capitalizing on expertise already in house. Either way, they have evolved into a super specialist in a specific field and produce results that totally eclipse the other distributors in a few products and technologies. Manufacturers selling the product groups enjoy massive benefits, yet often fail to recognize the extent of the value provided by this type of distributor.

Why the manufacturer/distributor disconnect?

One major issue facing both sides of the supply chain comes via a lack of understanding between the manufacturer and the distributor. A quick evaluation of the market reveals a three-decade push toward consolidation. Rarely does one find a manufacturer that provides a single technology. Instead, we find companies pushing for multiple products and technologies in their portfolio of products.

Single-technology providers are either acquired by a larger organization that uses the new company as a bolt-on addition to their products or search for new technologies to expand their own offerings.

In the case of acquisition by a larger organization, these distributors are often lost in the mix. Their numbers pale in comparison to distributors handling the full breadth of products. Nothing exemplifies this like the mega-manufacturers in the electrical and automation spaces. Pushing this example forward, we discover a mid-sized distributor specializing in the sale of motion control equipment. Its sales of a few technologies are exceptional; however, compared with the massive volume of business the manufacturer does in other categories, the number is minuscule.

Products like residential load centers, combined with commercial circuit breakers, industrial switchgear and transformers, and other electrical needs, represent tens of millions of dollars in transactions at many distributors, while the distributor selling motion control pushes $500,000 in sales. However, this half-million is bigger than a distributor 20 times larger.

Compounding the issue, the larger distributor most likely lacks the technical expertise required to actively sell the products. Since the larger distributor is considered an important partner, the manufacturer dispatches extra resources to enable the “full-line” distributor to at least attempt to participate in the market. This effort impacts the bottom line of the manufacturer. More importantly, these actions push the specialized distributor to find other partners, often continuing the relationship with the first supplier while using the new partner for most new opportunities.

Evolution is a never-ending thing

Evolution is a never-ending thing

We have championed the cause for distributors charging for the services they provide. In the case of the “disintegrator” model outlined above, the addition of services may have influenced the strategic direction of the distributor. Others are following suit.

All of these distributors found that providing services is the business equivalent of building a moat around their most important business – a couple used this exact term. Ironically the term is typically utilized to describe protection against Amazon and other online vendors but, in this case, the moat provides protection against larger and less technical distributors.

Throughout the last five minutes or so, we have focused on small to mid-sized distributors. While it might be argued these changes happen more quickly and noticeably within this group, larger organizations are evolving, too. Case in point, a few mega distributors have purchased smaller distributors and have not folded them into their organization. To some, the reason is clear: they want to work on both sides of the evolutionary scale.

Other distributors have emulated the best practices of these distributors by structuring their organizations into smaller operating groups specializing in a few products to allow entrepreneurial evolution on the customer-facing side while still maintaining economies of scale in warehousing and back-office functions. As with all forms of evolution, it only works if it is successful.

Manufacturers, take note

Market share growth depends on the distributor that has morphed into something capable of driving the business of your product set forward. Further, if your line is broad, as in the example of the mega-electrical products companies, you can no longer think of your products as a whole but rather as individual parts and pieces.

While many manufacturers have designated “market maker” and “market server” distributors, the impact of the plans sometimes requires further granularity. A market maker for one technology may not be such for another, especially when your product offering is extensive. Further, a strategy of providing higher margins for the market making distributor might not work in today’s environment. Our world is awash in Special Pricing Agreements (SPAs). SPAs awarded to the wrong distributor will sink the best-laid discount schedule plan.

The question is are you evolving?

Environmental change drives the evolution of every species. Over the past few years, we have seen a lot of changes. No need for an expansively long list, the top three can be summarized as: 1) Skilled labor shortages, 2) Amazon and e-commerce, and 3) a measly little Global Pandemic. If you are operating fundamentally the same today as in 2015, you may be headed down the same path as our pal “Rex.” Tyrannosaurus Rex once ruled his domain – today he’s gone.

Finally . . .

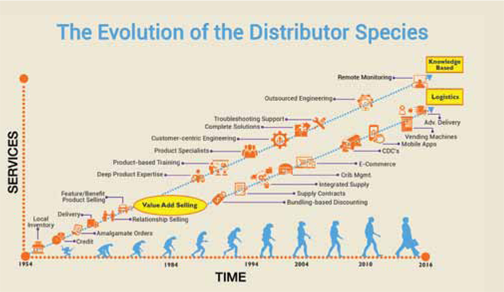

Long ago we published the info-graphic on the left demonstrating thoughts on the evolution of distributors in the Automation, Electrical, Fluid Power and maybe a couple of other segments. That was back in 2015. The question becomes are you walking upright?

Frank Hurtte is the founding partner of River Heights Consulting. He combines the battle scars of 28 years of front line “in the trenches” experience with over 13 years of service to knowledge-based distributors and their manufacturer partners. Email frank@riverheightsconsulting.com for more information.

Frank Hurtte is the founding partner of River Heights Consulting. He combines the battle scars of 28 years of front line “in the trenches” experience with over 13 years of service to knowledge-based distributors and their manufacturer partners. Email frank@riverheightsconsulting.com for more information.

This article originally appeared in the Sept./Oct. 2021 issue of Industrial Supply magazine. Copyright 2021, Direct Business Media.