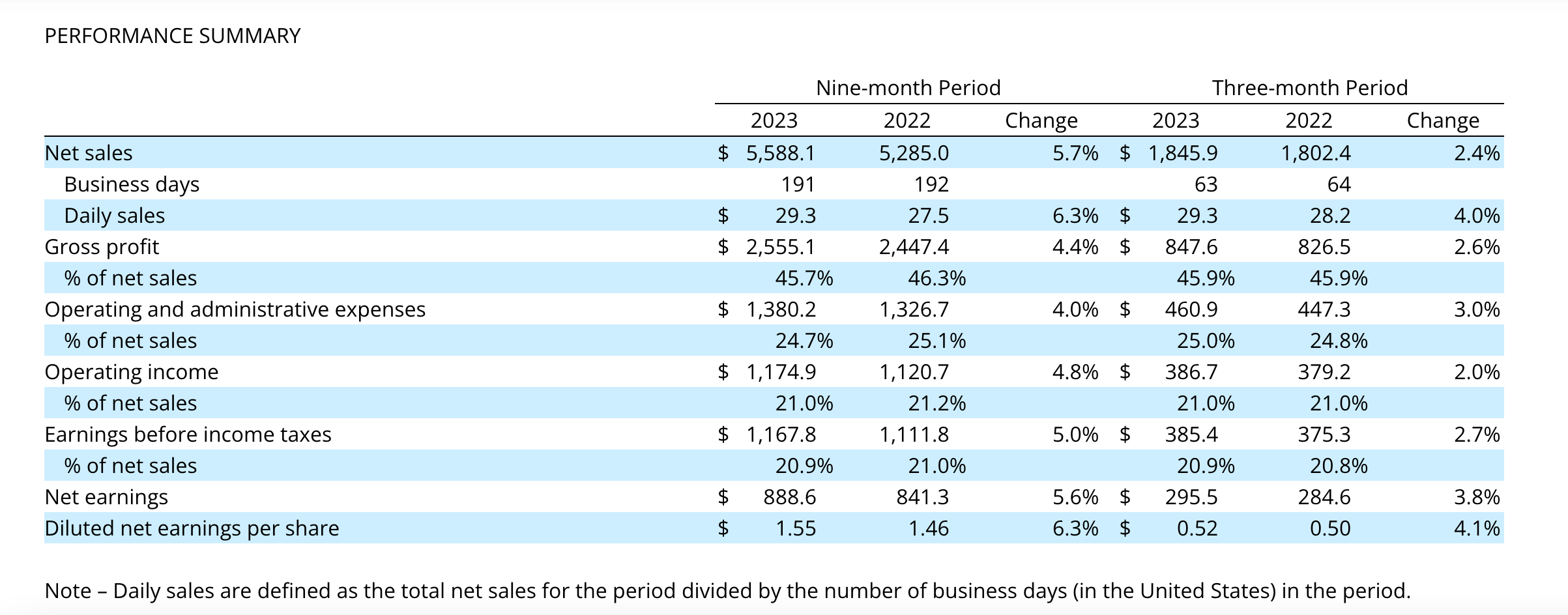

Fastenal Q3 net sales climb 2.4%

Fastenal Co. announced its financial results for the quarter ended September 30, noting that net sales increased $43.5 million, or 2.4%, when compared to the third quarter of 2022.

There was one fewer selling day in the quarter relative to the prior year period and, taking this into consideration, its net daily sales growth increased 4.0% in the third quarter compared to the third quarter of 2022. It experienced higher unit sales in the third quarter that was primarily due to growth at its Onsite locations, particularly those opened in the last two years. This more than offset the impact of softer end market demand on its manufacturing customers and lower revenues to construction and reseller customers. Foreign exchange negatively affected sales in the third quarter of 2023 by approximately 10 basis points.

The impact of product pricing on net sales in the third quarter of 2023 was modestly positive, consistent with historical trends, as compared to the impact of product pricing on net sales in the third quarter of 2022 of 550 to 580 basis points. Incremental pricing actions over the past twelve months have been of modest scope, resulting in mostly stable price levels through the third quarter of 2023.

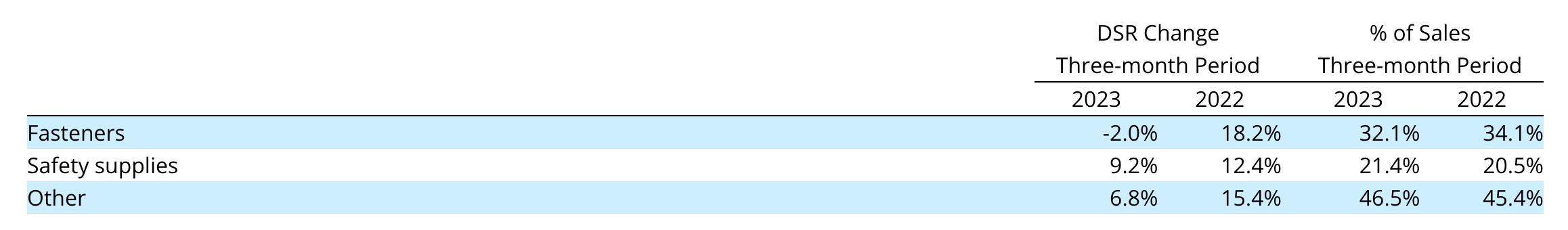

From a product standpoint, we have three categories: fasteners, safety supplies, and other products, the latter of which includes eight smaller product categories, such as tools, janitorial supplies, and cutting tools. We experienced increasing divergence in the performance of our fastener versus our non-fastener product lines in the third quarter of 2023, which we believe relates to two factors. First, fasteners are more heavily oriented toward production of final goods than maintenance, which results in greater susceptibility to weaker manufacturing end markets. Second, pricing for fasteners has decelerated at a faster pace than non-fastener products. The DSR change when compared to the same period in the prior year and the percent of sales in the period were as follows:

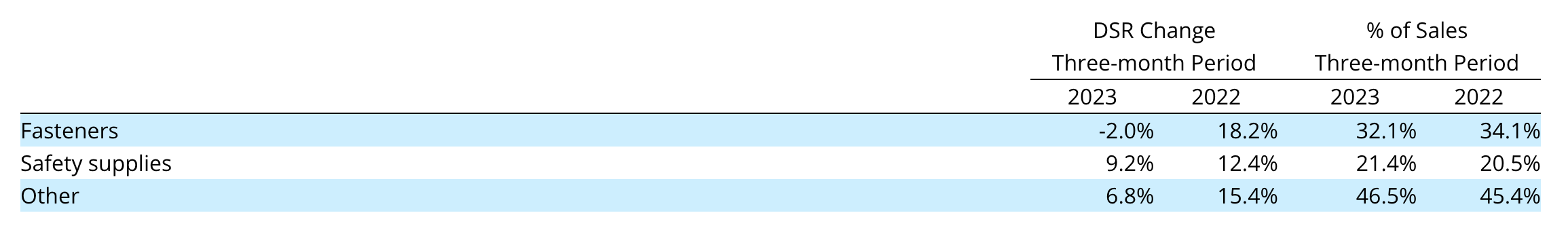

Fastenal's end markets consist of manufacturing, non-residential construction, reseller, and other, the latter of which includes government/education and transportation/warehousing. We continued to experience a significant divergence in the performance of our manufacturing end market versus our non-manufacturing end markets in the third quarter of 2023. We are growing relatively faster with key account customers, particularly Onsites, with significant managed spend where our service model and technology is particularly impactful, which disproportionately benefits manufacturing customers. The DSR change when compared to the same period in the prior year and the percent of sales in the period were as follows: